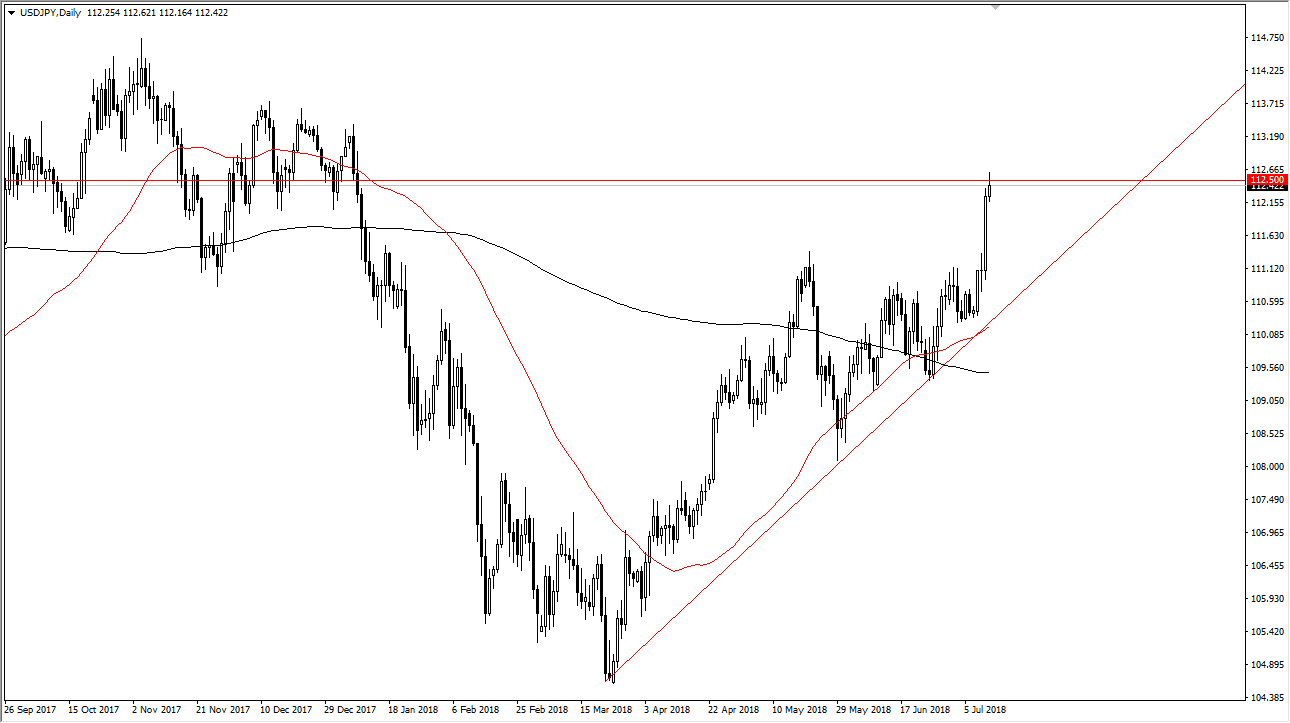

USD/JPY

The US dollar has rallied again during the trading session on Thursday, breaking through the ¥112.50 level. However, we did pull back a little bit from there to show a bit of a resistance barrier, and this is an area that I have been looking at for some time. Now that we have reached here, I would anticipate that we could pull back, perhaps looking towards support closer to the ¥111.25 level. I would be a buyer of these pullbacks, because we have not only recently seen a “golden cross” as far as moving averages are concerned, but I also see a major uptrend line that could offer buying opportunities. Beyond all of that, the fundamental situation is that the United States is going to continue to raise interest rates while the Bank of Japan simply cannot.

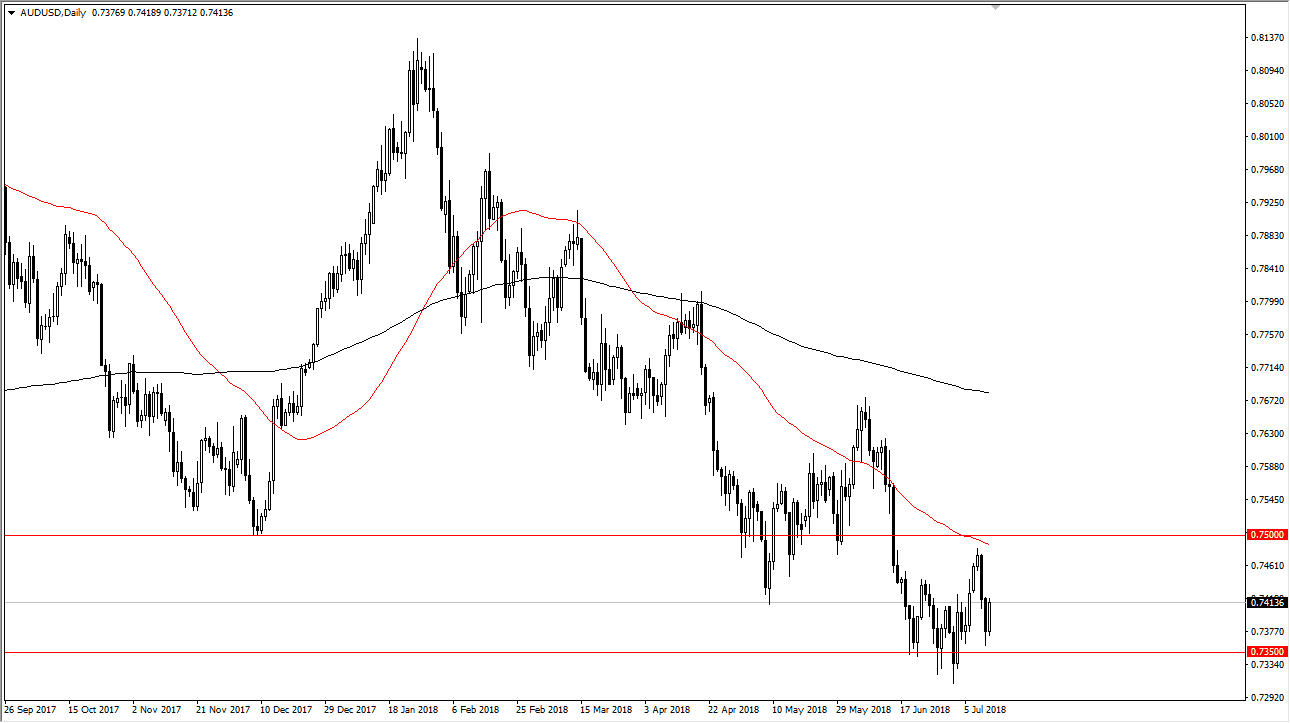

AUD/USD

The Australian dollar has rallied during the day on Thursday, showing signs of support again near the 0.7350 level. It looks as if there is plenty of interest in this market down in this area, but there’s obviously a lot of resistance above. I think the 0.75 level above is massive resistance, but if we can break above the 50 EMA and that level, then the Australian dollar could turn around. I believe that the market will continue to be very choppy and volatile, but at this point I think if we were to break down to make a fresh, new low again, that could drop this market down to the 0.70 level over the longer-term. The Australian dollar is highly sensitive to the trade war problems coming out between the United States and China, as Australia is a major supplier of raw materials to the Chinese industrial output.