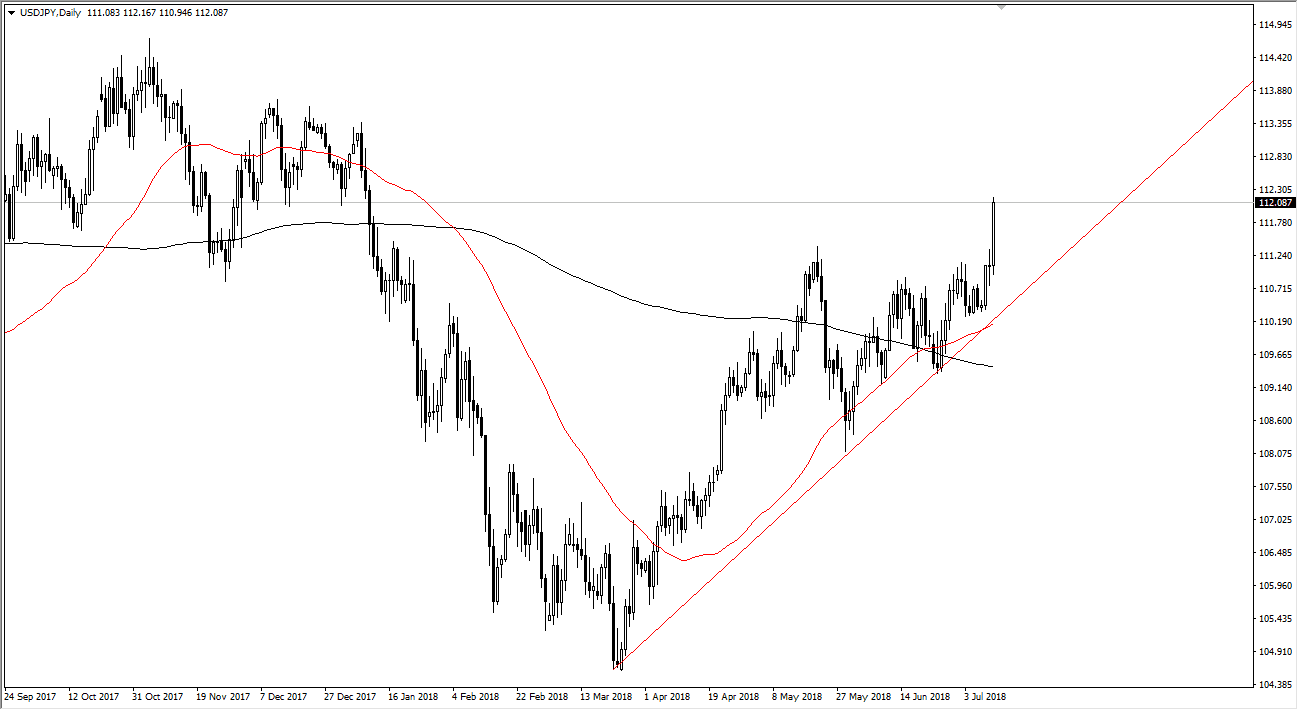

USD/JPY

The US dollar has rallied rather explosively against the Japanese yen during trading on Wednesday, breaking towards the ¥112 level. I think that this market will eventually find more bullish pressure, but we may need to pull back just a bit to find and of value as we may have gotten ahead of ourselves. I believe that a pull back towards the ¥111.25 level is a nice buying opportunity, and I believe that we will eventually go looking towards the ¥114 level based upon the US central bank looking to raise interest rates while the Japanese yield curve has inverted. Because of that, it’s likely that we will continue to see a lot of softness in the Japanese yen overall. The fundamentals as far as interest rates are concerned certainly favor the pair going higher. Look for value though.

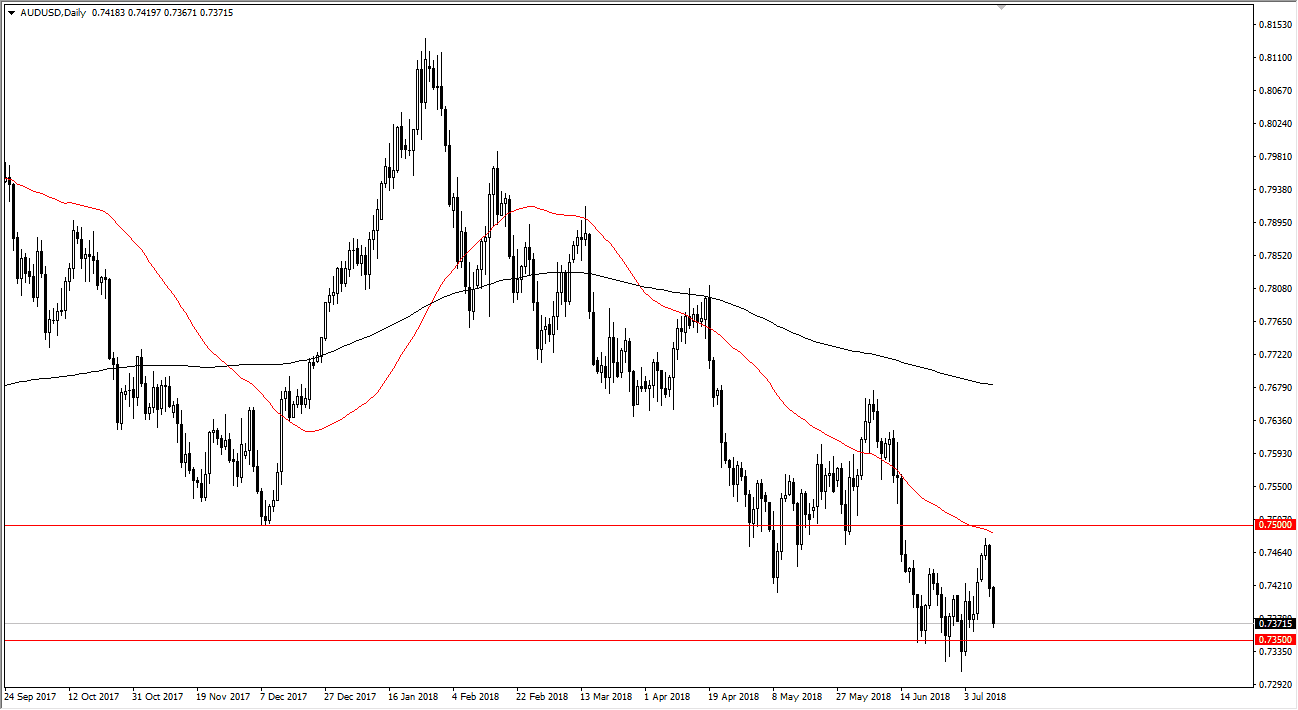

AUD/USD

The Australian dollar has fallen rather hard against the US dollar during trading on Wednesday, reaching towards the 0.7350 level. The market will probably continue to be noisy, but I think the 0.7350 level is crucial, so if we can stay above there, it’s likely that the market will eventually find buyers. Based upon the weekly chart, you can make an argument for bullish pressure as we have seen several hammers. That of course is a bullish sign as well, so I think that if things can calm down as far as the trade war fears are concerned, this market may be offering a buying opportunity. However, if we break down below the 0.73 level, the market probably breaks down below there to go looking towards the 0.72 level after that. If we can turn around, I suspect that we will go looking towards the 0.75 level above.