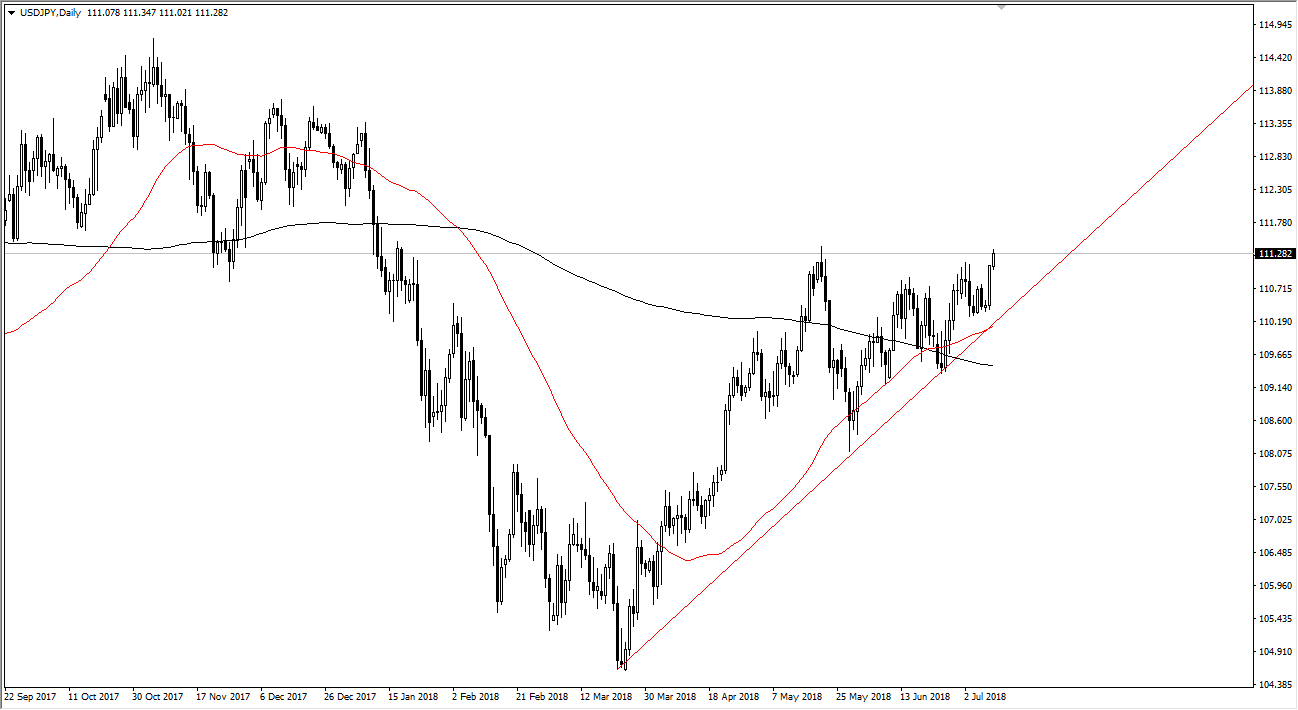

USD/JPY

The US dollar rallied against the Japanese yen during the trading session on Tuesday, breaking above the ¥111 level. By doing so, the market looks ready to attempt the uptrend, and the recent “golden cross” on the daily chart won’t hurt either. The uptrend line continues to offer support in this market. I believe that the US dollar will continue to see a lot of volatility, but after the most recent move I think that short-term pullbacks will be thought of as buying opportunities. Longer-term, I think we will probably go looking towards the ¥112.50 level. It’s not until we break down below the uptrend line that I would be a seller, and at that point I think that we would probably find buyers again near the ¥109 level. There is a lot of noise in this market, and of course it has a certain amount of risk appetite built into it, so I think that the market will continue to pay attention to stock markets around the world, following them and the same direction.

AUD/USD

The Australian dollar initially fell during the day on Tuesday, reaching towards the 0.74 level. By turning around the way it has, the market ended up forming a nice hammer, looking for the 0.75 level above as a target. There is the 50 EMA just above, and if we can get above that level it’s likely that the market should then go to the 0.7050 level after that. I believe that if we turn around and break down below the hammer, the market should go much lower, reaching towards the 0.7350 level. We continue to see a lot of volatility, mainly because the Australian dollar is so highly sensitive to trade restrictions in Asia. Longer-term though, on the weekly charts we have formed several hammers, so it looks like we are trying to turn things around.