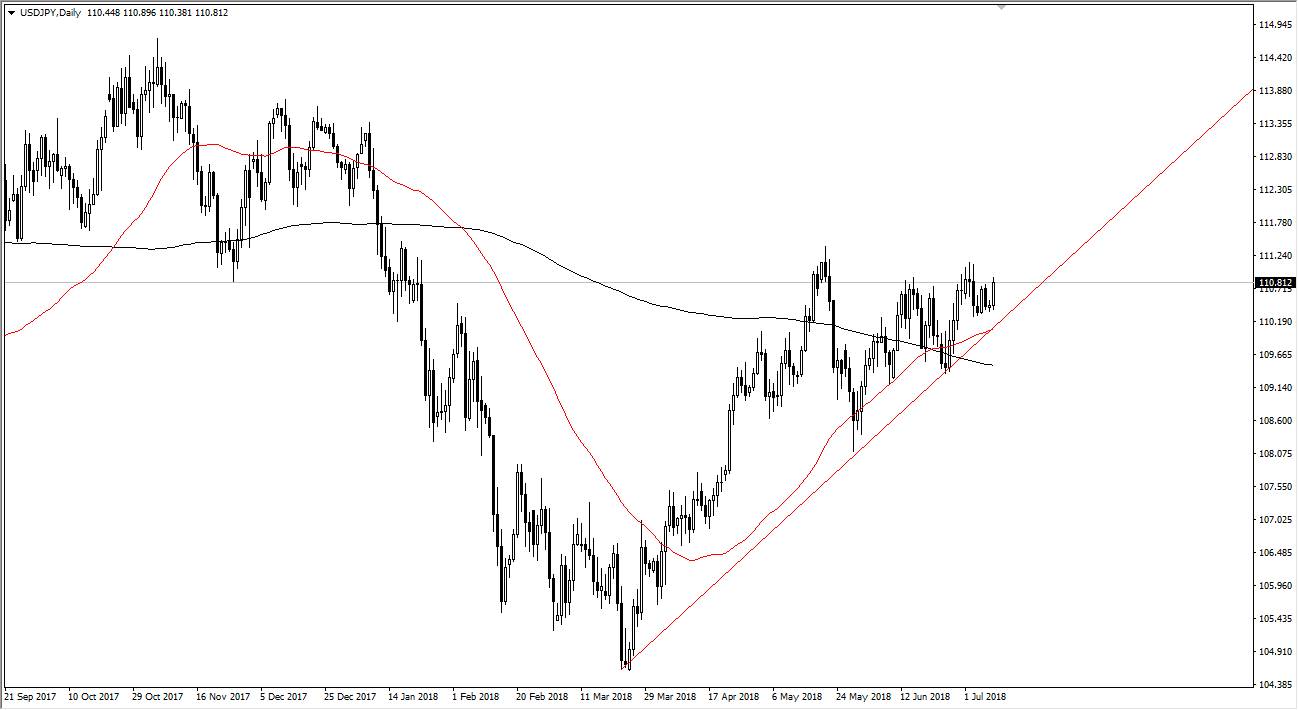

USD/JPY

The US dollar has rallied quite nicely against the Japanese yen during trading on Monday, reaching towards the 111 level. That’s an area that has caused resistance more than once, and quite recently. Because of this, I think that a short-term pullback could be coming, but at that point I would expect buyers to come back in and pick up this market based upon value. I believe that the uptrend line underneath should continue to offer support, and until that gets broken I would be a buyer on dips overall. I have no interest in shorting this market currently, but I do recognize that a pullback may come back into the marketplace to get value hunters into the market as the “risk on” attitude returns as fears of a trade war exploding have abated a bit.

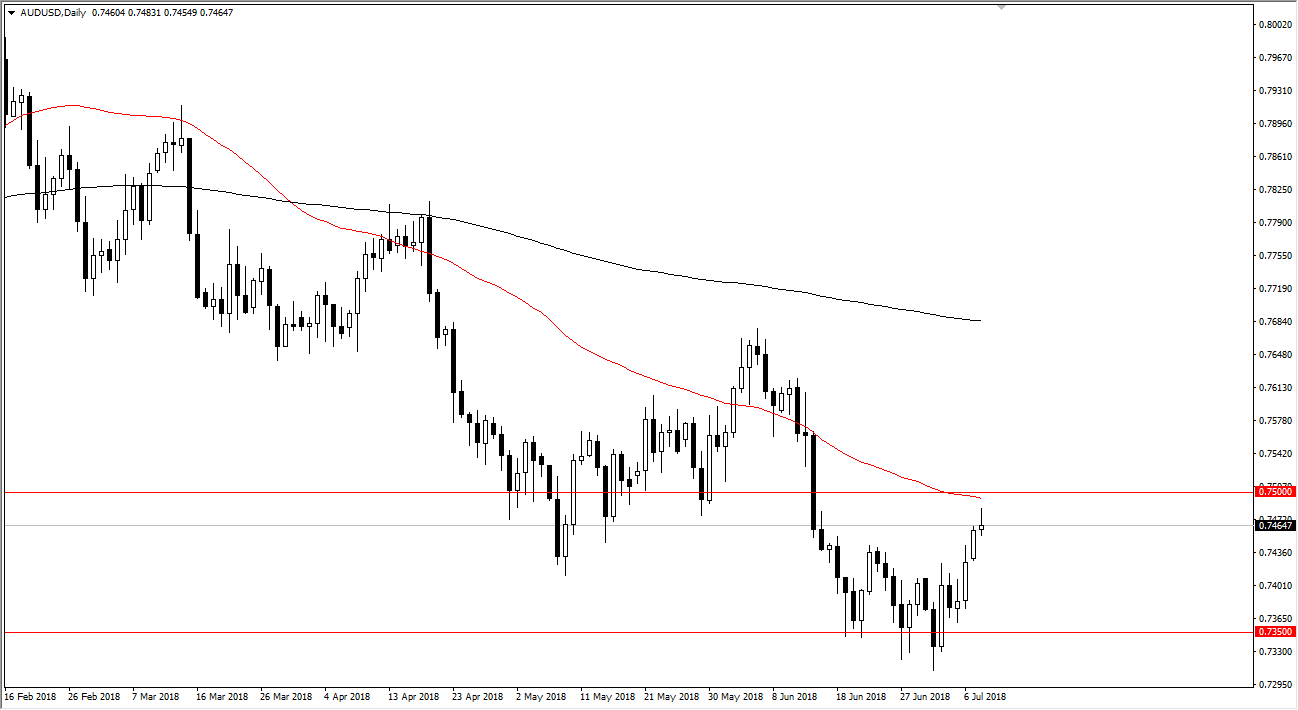

AUD/USD

The Australian dollar has gone back and forth in the trading session on Monday, reaching towards the 50 day EMA again. We turned around of form a shooting star, just below the 0.75 level. Because of this, I think that we are going to roll over and go looking for support underneath. The Australian dollar of course is highly sensitive to the gold market, so pay attention to those as well. I think that the markets are starting to run into some significant technical resistance above, so I would anticipate that we are going to drop, at least in the next couple of days. However, if we can break above the 0.75 level, that’s an extraordinarily bullish sign and should send this market much higher. Overall, I think that we are looking at a short-term pullback regardless of the longer-term outlook.