USD/CAD

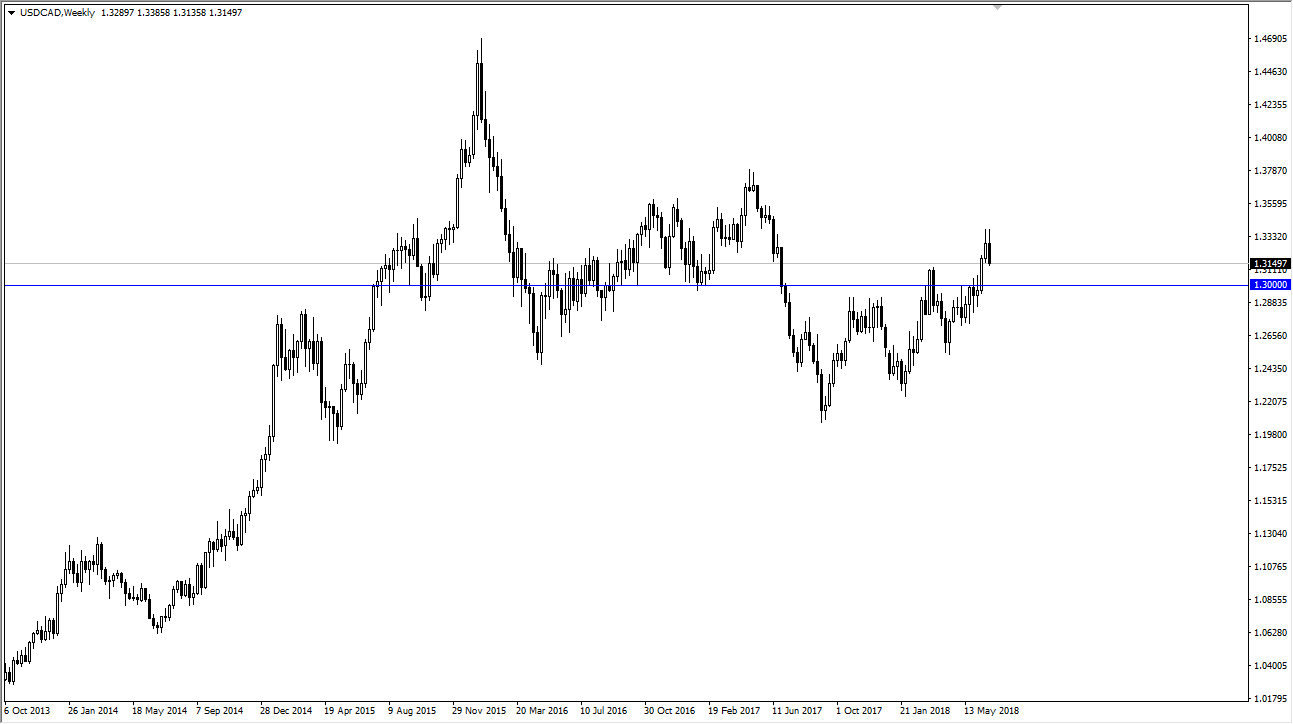

The US dollar has been bullish against the Canadian dollar during most of the month of June, but the last week ended up being somewhat bearish. It is because of this that I think we are going to continue to see a significant amount of noise, but more than likely I do believe that the buyers will return at the psychologically significant figure just below, the 1.30 level. As you can see on the chart, we have seen several turnarounds in both directions at this level, and I believe it is essentially “fair value” for the Canadian dollar overall.

Oil markets of course will have their influence as per usual, as the Canadian dollar is typically used as a proxy for buying oil. The US dollar course is a safety currency, so if we get some type of concern about the trade wars escalating, I suspect that this market will probably fall, not only because the US dollar is considered to be safer, but oil would probably take a bit of a head as people are going to suddenly concern themselves as to whether there are going to be enough buyers out there demanding energy. In a slower economic situation, obviously energy isn’t as necessary.

I believe that we are going to have a month that is initially bearish, but I would expect the buyers to return. I think value hunters will come in somewhere just below the 1.30 level, extending down to at least the 1.29 level. If we were to break down below the 1.29 level, then we can start to think about even lower pricing. All things being equal, I suspect short-term bearishness, followed by buyers towards the end of the month again.