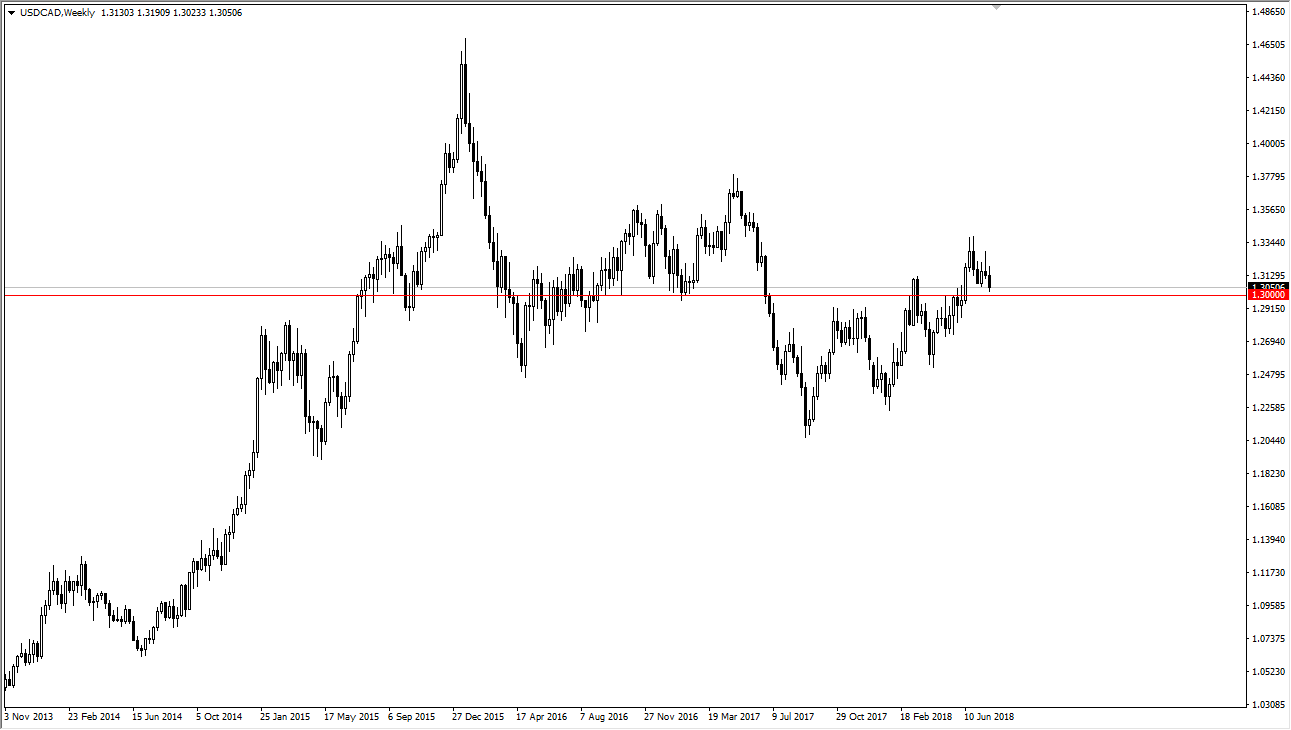

The US dollar fell a bit against the Canadian dollar during the month of July, approaching the 1.30 level. The 1.30 level underneath has been important obviously, mainly because the round number always sends a certain amount of order flow into the market. Keep in mind that the oil markets will drive where this pair goes next, and I think that is a bit difficult to quantify currently.

As we close out July, it looks as if the crude oil market is trying to turn things around and go higher again. But it’s difficult to tell where were going good on the short-term, because there is the possibility of a global slowdown, but at the same time the US GDP printed 4.1% at the end of the month. Beyond that, we have US dollar strength which weighs upon the value of crude oil, but at the same time we have tensions with the Iranians. In other words, I would expect very erratic trading in the crude oil markets.

So, by extension it should follow that the Canadian dollar will be all over the place. I believe that we will break below the 1.30 level initially during the month, but I fully anticipate that a drop from there will probably find buyers near the 1.29 level, only to consolidate overall. However, the usual rule applies here: if crude oil takes off to the upside, that should be good for the Canadian dollar, and by extension bad for this pair. Obviously, the exact opposite is true as well, so if oil starts to fall apart, that could send this market much higher. I believe that oil continues to be noisy, and therefore the USD/CAD pair will be very choppy during the month of August, not to mention the lack of volume that we can have at times during vacation season.