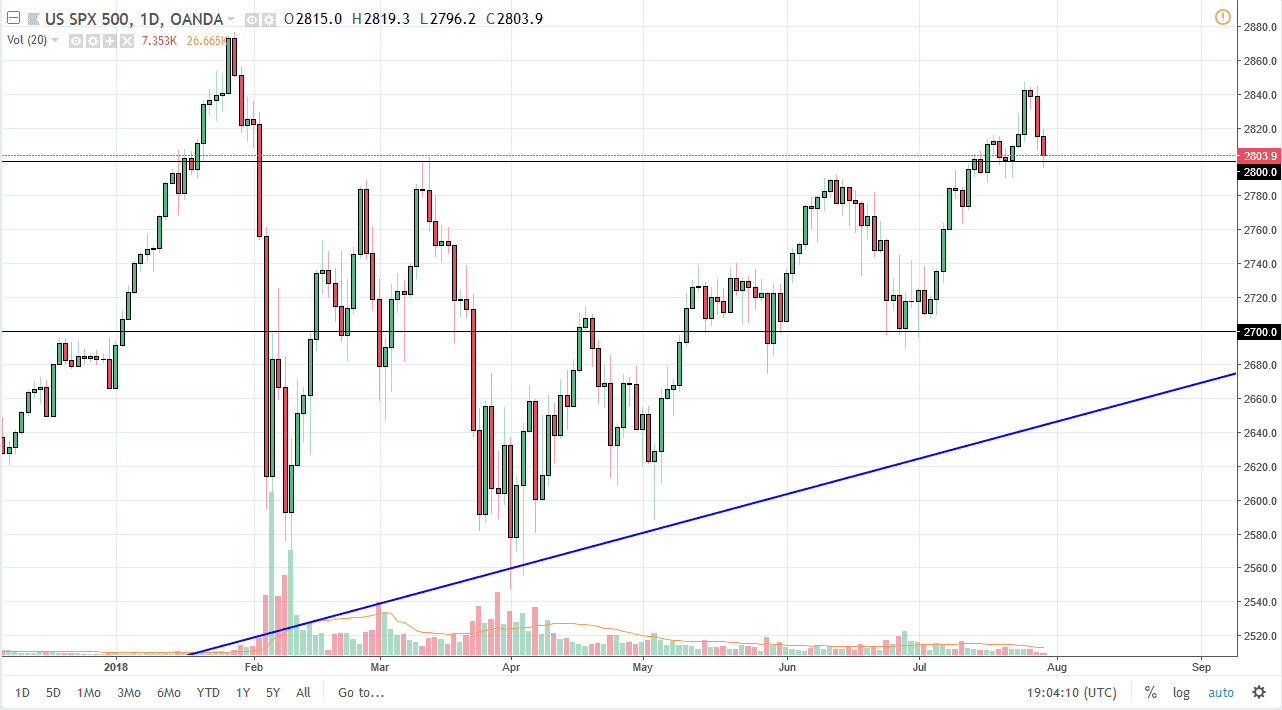

S&P 500

The S&P 500 fell during the trading session on Monday, reaching down to the 2800 level to find support. There is a lot of support extending down to the 2790 handle, and I think that a bounce from here makes sense. However, if we break down below the 2790 handle, then I think the market probably goes looking towards the 2740 level. We are in and uptrend, we have recently broken out so it would make sense that this is simply a retest of where we had seen resistance previously, and I think we will continue to go higher unless of course or some type of shock to the markets. Expect volatility, but I do think that the buyers are starting to come back around the 2800 level as it seems to attract a lot of attention.

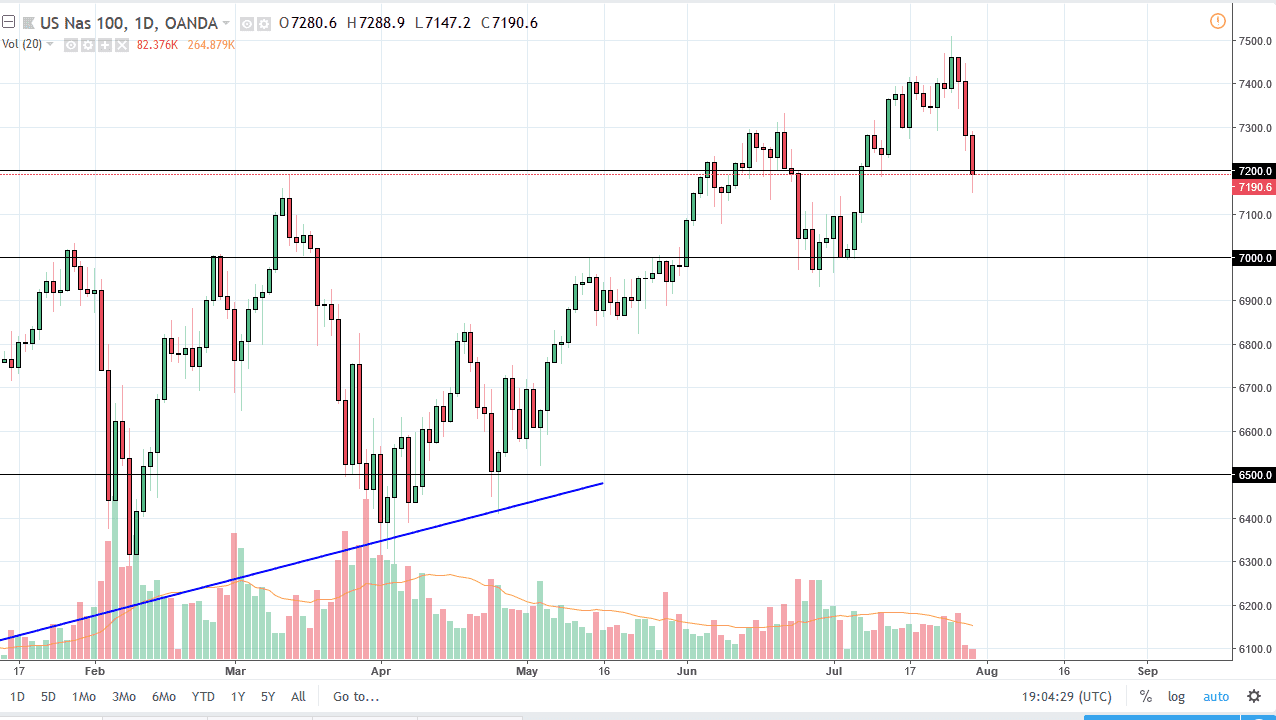

NASDAQ 100

The NASDAQ 100 has broken down during the day, slicing below the 7200 level before bouncing back towards it. I think that the market will probably try to rally from here as well, but we may even drop as low as 7100 before the buyers come back in force. Pay attention to the short-term charts, that’s probably going to give you an opportunity to pick up a better entry. If we do break down below here, then I think 7000 becomes even supportive, as it is a massive support barrier on the daily charts. The NASDAQ 100 has taken a bit of a bashing recently, mainly due to Facebook, but I think that it’s only a matter time before we rally significantly and continue towards the highs again. The 7500 level has offered a significant amount of resistance, so I think that we are probably looking at the market trying to build up the necessary momentum to break out.