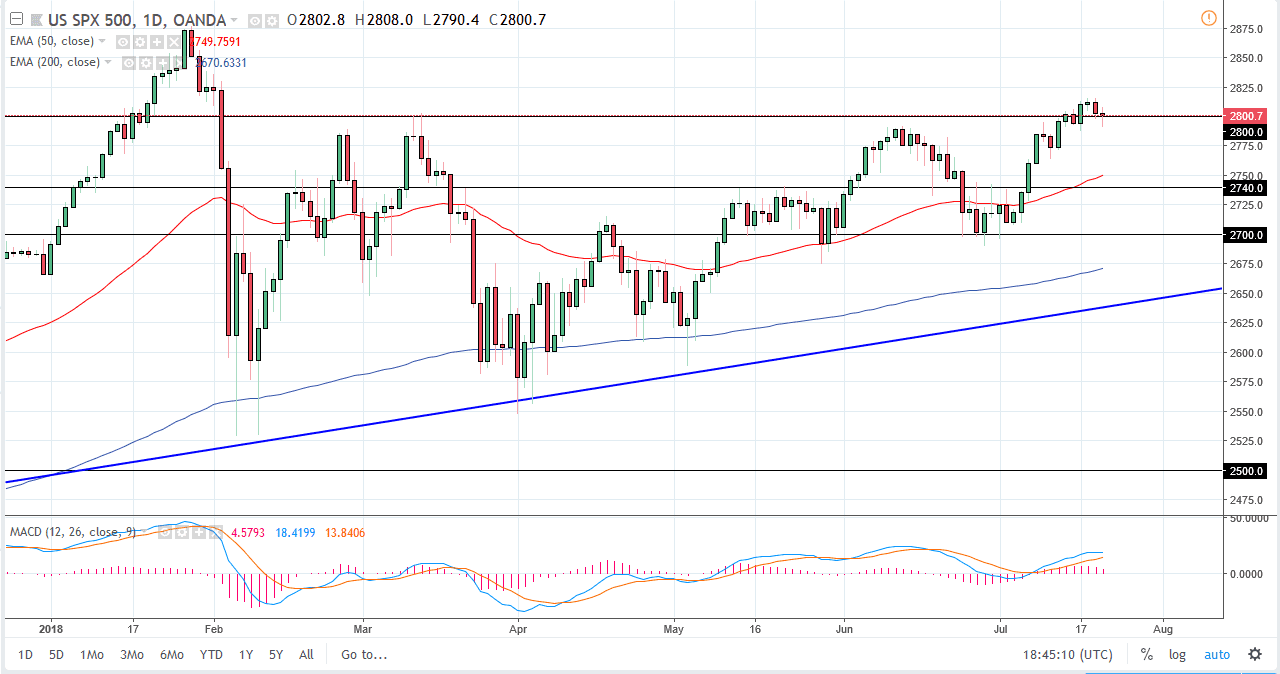

S&P 500

The S&P 500 has been very volatile during the trading session on Friday, mainly in reaction to Donald Trump tweeting that he believes that the Federal Reserve should keep interest rates lower, and then suggested that perhaps he would slap tariffs on all Chinese goods coming into the United States. Beyond that, we are sitting in an area that has a significant amount of supply, so it would not surprise me at all to see this market pull back a little. However, I think that it’s only a matter time before buyers get involved and start pushing higher. I believe the market will eventually break out but it's going to take a certain amount of momentum building to get above there and continue to grind to the upside.

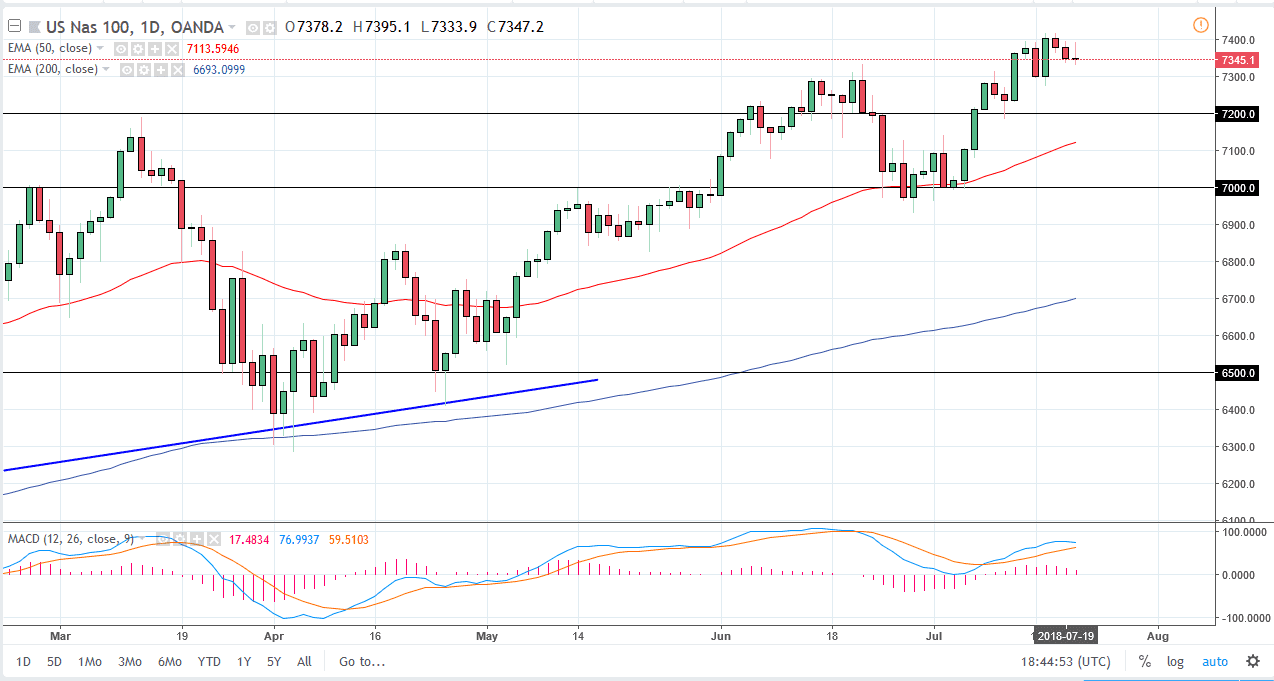

NASDAQ 100

The NASDAQ 100 tried to rally but found the 7400 level to be far too resistive to continue going higher. If we can break above the top of the range for the day, that would be a very bullish sign and I think at that point we would be ready to go to the 7500 level. However, with the bearish attitude of the markets, I think that we could continue to grind a bit lower, perhaps reaching down towards the 7300 level, followed by the 7200 level which should be massively supportive. I think it’s only a matter of time before the buyers return, so I’m not looking to short this market, I’m looking to buy a value when it appears on a pullback. I think that the markets have shown just how resilient they are in general, and it’s likely that we will see buyers come into take advantage of dips as they occur. The 7200 level underneath should be rather supportive and a short-term “floor” in this market.