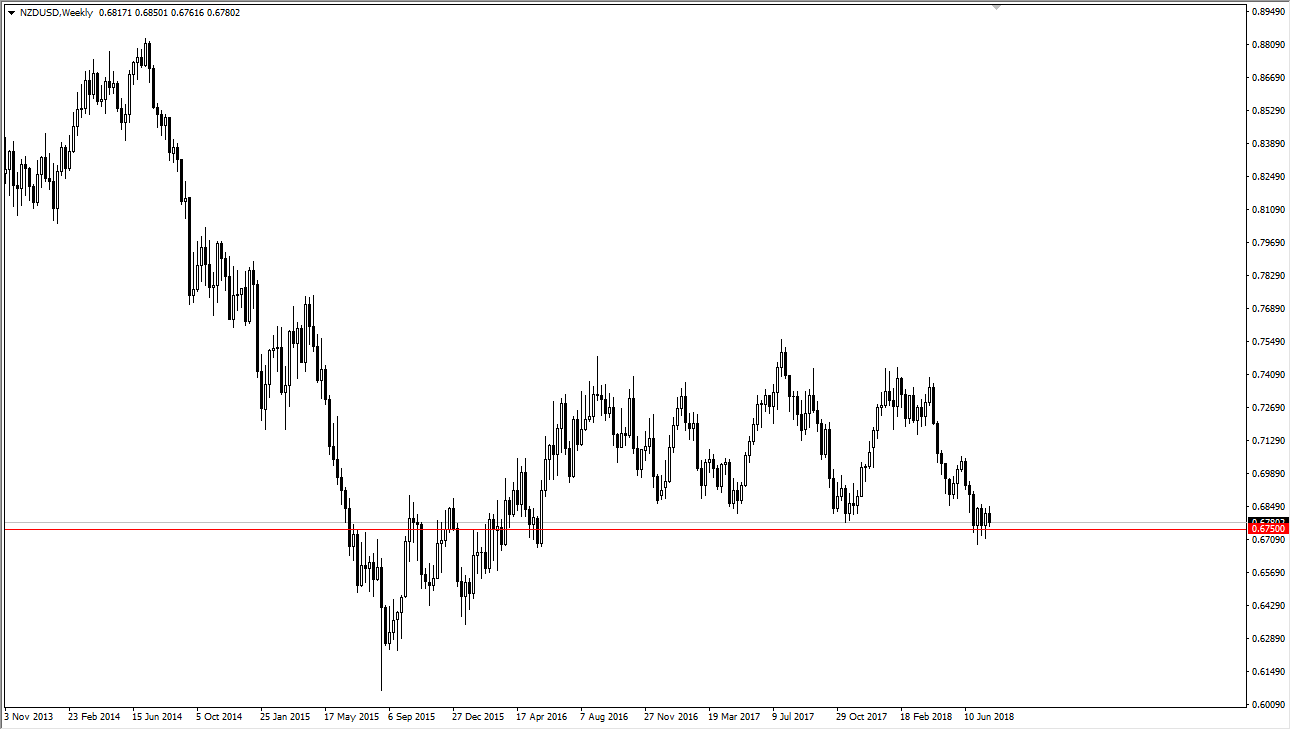

The New Zealand dollar has been hanging about and a sideways consolidation area over the last 30 days, showing the 0.6750 level to be supported. I think that we will continue to see buyers come in down to at least the 0.67 handle, and it’s likely that we could get a little bit of a bounce. If we do break down below the 0.67 handle for a daily close, then I think the market will unwind. If it does unwind that way, I would anticipate that the 0.65 level would be the next target.

A lot of what we are going to see in August will come down to the trade war rhetoric, as the New Zealand dollar is highly sensitive to global trade being a commodity currency. The market participants will continue to look at this market from a longer-term perspective when it comes to the trade war, and I think if we can get some type of certainty, that should help lift the NZD. However, if things get worse between the United States and China, it’s likely that the New Zealand dollar will be hit.

Beyond that, we should be paying attention to the New Zealand economy as per usual, which has been cooling-off as of late. If we can find the momentum to break above the 0.69 handle, I think at that point we will go looking towards the 0.70 level, and then eventually the 0.74 level. I don’t know that we can get there in the month of August, but certainly we could make a move in that general direction. All we need at this point is some good news globally to have risktakers come back into this market place and take advantage of what looks to be a relatively “cheap” Kiwi dollar.