GBP/USD

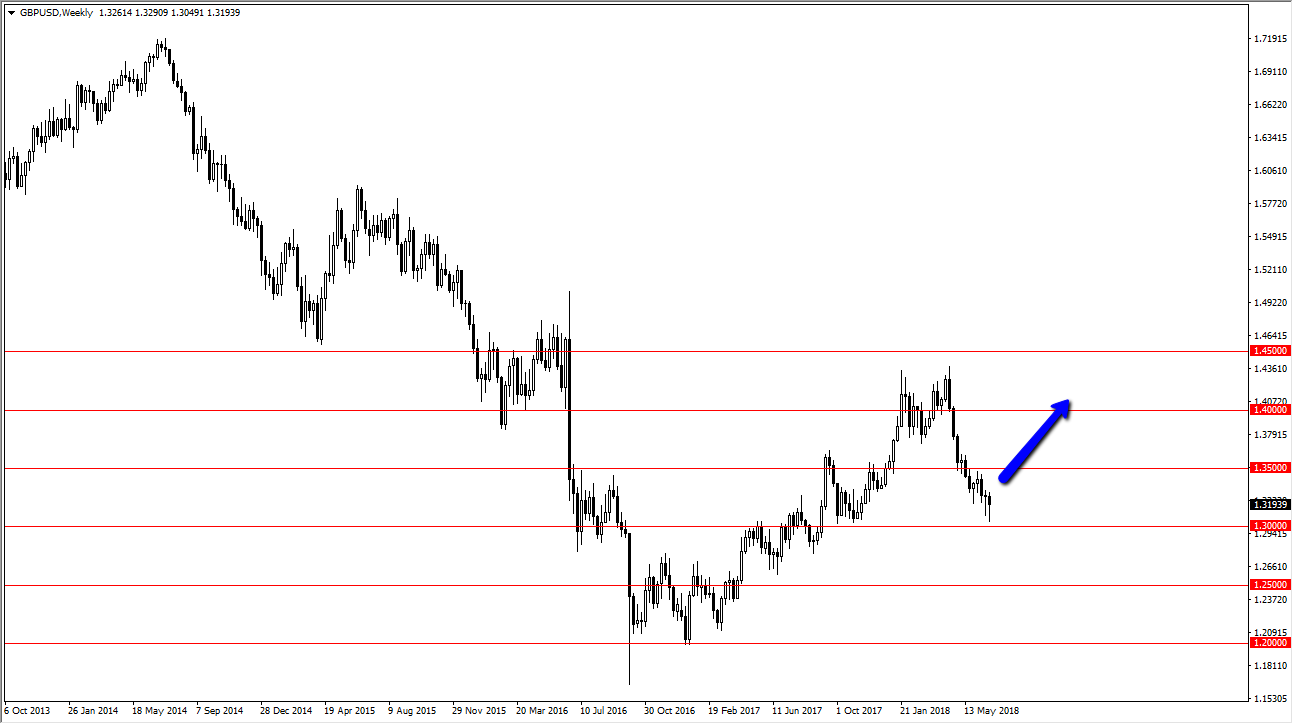

The British pound has been a bit negative during the month of June but has found support at the all-important 1.30 level to turn around of form a massive hammer for the last week. Because of this, I think that we are likely to see a bit of a bounce for the month, but I don’t know how strong it’ll be. There are far too many questions about the potential damage to the British economy upon leaving the European Union, so it’s likely that we will continue to see a lot of volatility. However, we have obviously gotten a bit oversold, and when you look at this chart from an Elliott Wave aspect, you could make an argument for the end of Wave Two.

If that’s the case, the most impulsive wave should be coming and that would be confirmed, at least in my eyes, by a break above the 1.36 handle. At this point, I suspect that we could make another run towards the highs, but we need to see some type of calming down of trade tensions to say the least. This has driven a lot of money into the US dollar as people go looking towards treasuries. Overall, the Bank of England looks to be a bit more hawkish than originally thought, and that of course has helped the support as well. I suspect that we will have a positive month of July, but I don’t necessarily believe that it’s going to be an easy month, after all those are two totally different things. All things being equal, I am a net buyer of this market, with hard stops just below the 1.30 level, recognizing that a break down below that level would be very negative indeed.