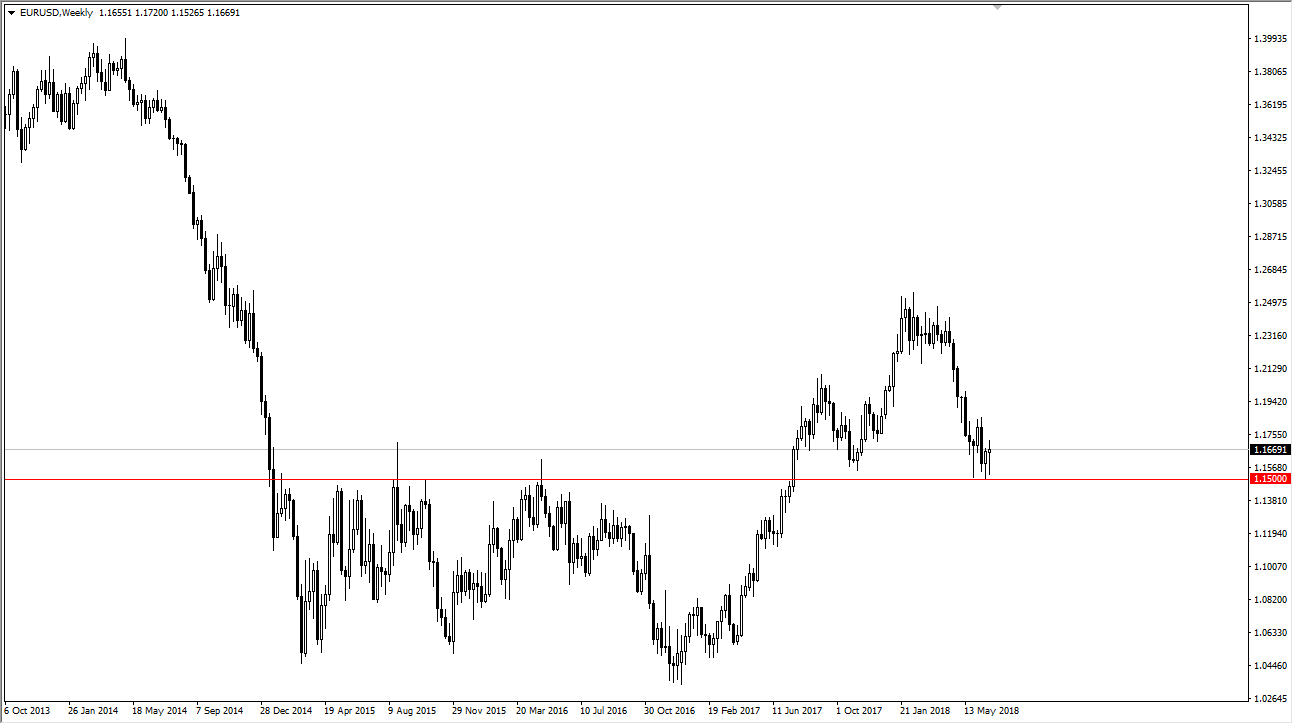

EUR/USD

The Euro has been grinding sideways during most of the month of June, as may was absolutely atrocious for the common currency. However, I think what we are looking at is a situation where we are trying to form a bit of a base, and towards the end of the month we had a bit of a bounce do not only to the structural support at the 1.15 level, but also the announcement that the Europeans may have come up with a basic framework to deal with the waves of migrants. If that’s the case, that could calm down many of the tensions between the neighboring countries, and that could be a boost for the economy.

However, and working against the European Union, is the fact that there could be an upcoming trade war. Europe is especially vulnerable, and I think that if trade war rhetoric steps up, that could put a bit of a cap on gains. I anticipate that most of this month will probably be spent between 1.15 and 1.1850 above. Short-term trading in a back-and-forth manner would make a lot of sense, but if we can clear the 1.1850 level, I think that the Euro is free to go towards the highs again. This would probably take some type of major fundamental shift in thinking, not the least of which would be attitudes. That being said, if we were to break down below the 1.15 level it would be very negative, especially if it was on a weekly close. At that point, we would probably go looking towards the 1.1250 level initially, and then the 1.10 level after that. Either way, I think it’s going to be volatile, so this could be a difficult market to work with.