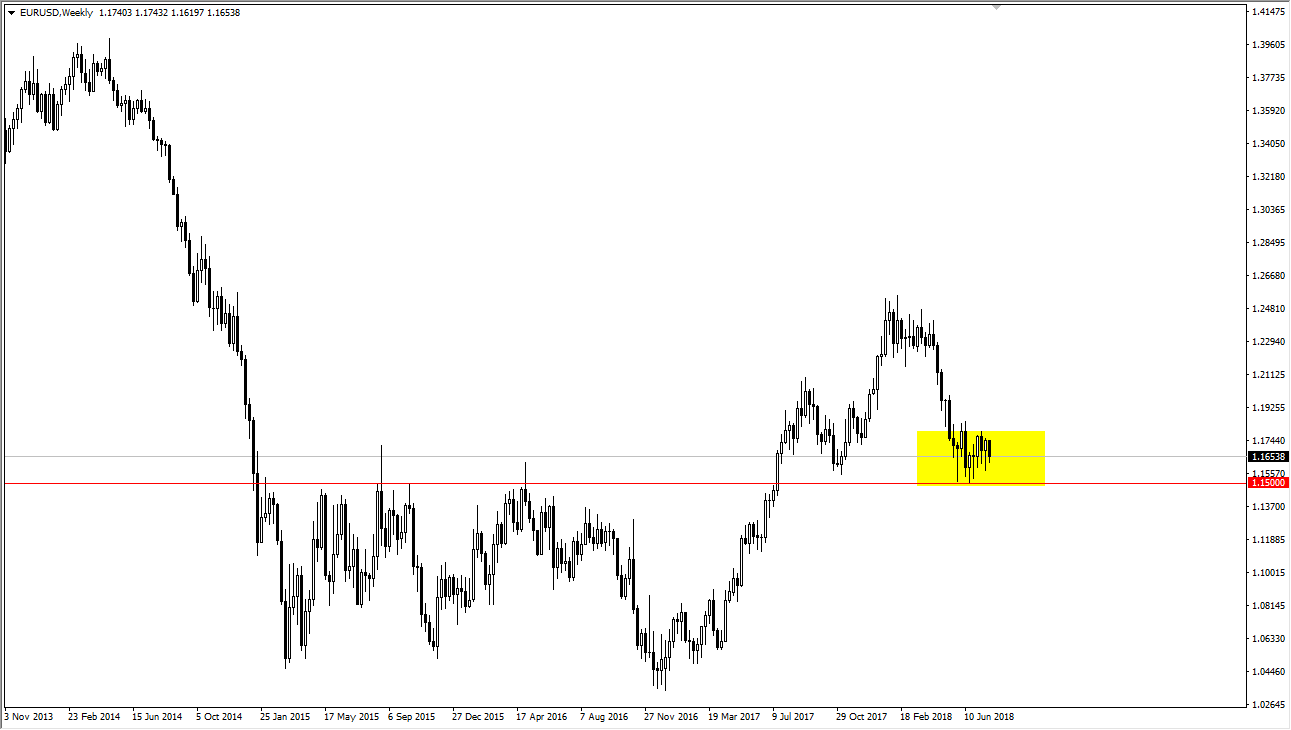

The EUR/USD pair has gone back and forth over the last couple of months, as we continue to test the 1.15 level underneath, an area that I think is crucial for support. I believe that it is only a matter of time before we bounce from here, as it looks like the 1.15 level is offering a bit of a “floor” in the market. It is because of this that I am a buyer of dips, and if you squint, you can see that there’s a bit of a symmetrical triangle. I believe that the market is trying to break out to the upside, but obviously we need some type of good news.

Because of this, I see three possibilities:

Bullish:

All things being equal, I believe that the bullish scenario is that we start to see US dollar weakness, which I think is a real possibility at this point, and then we break above the 1.1850 level. If and when we do, that is a major breach of resistance, and then I think the market goes to the 1.20 level, perhaps even followed by the 1.23 level.

Neutral:

The neutral scenario is that we continue to bounce around in the rectangle that I have drawn on the chart, or perhaps even drift through the end of what could be a symmetrical triangle and stay between the 1.15 level on the bottom, and the 1.1850 level on the top. I think this would be indicative of the Brexit not being resolved, and perhaps at the same time we could have a bit of confusion when it comes to the trade war, therefore seeing a bit of weakness when it comes to the US dollar.

Bearish:

The bearish scenario of course is a break down, which would be defined in my mind as a weekly close below the 1.15 level. If we get that, then I think the market breaks down to the 1.12 level over the longer-term.

At this point, it’s very difficult to call where the market can go over the next 30 days, but I have three clear-cut possibilities, and I will only place trades based upon which one happens. The neutral one is simple, we would just simply trade back and forth between the two levels. Obviously, the bullish and bearish scenarios need a break out to take advantage of, and perhaps place a longer-term trade.