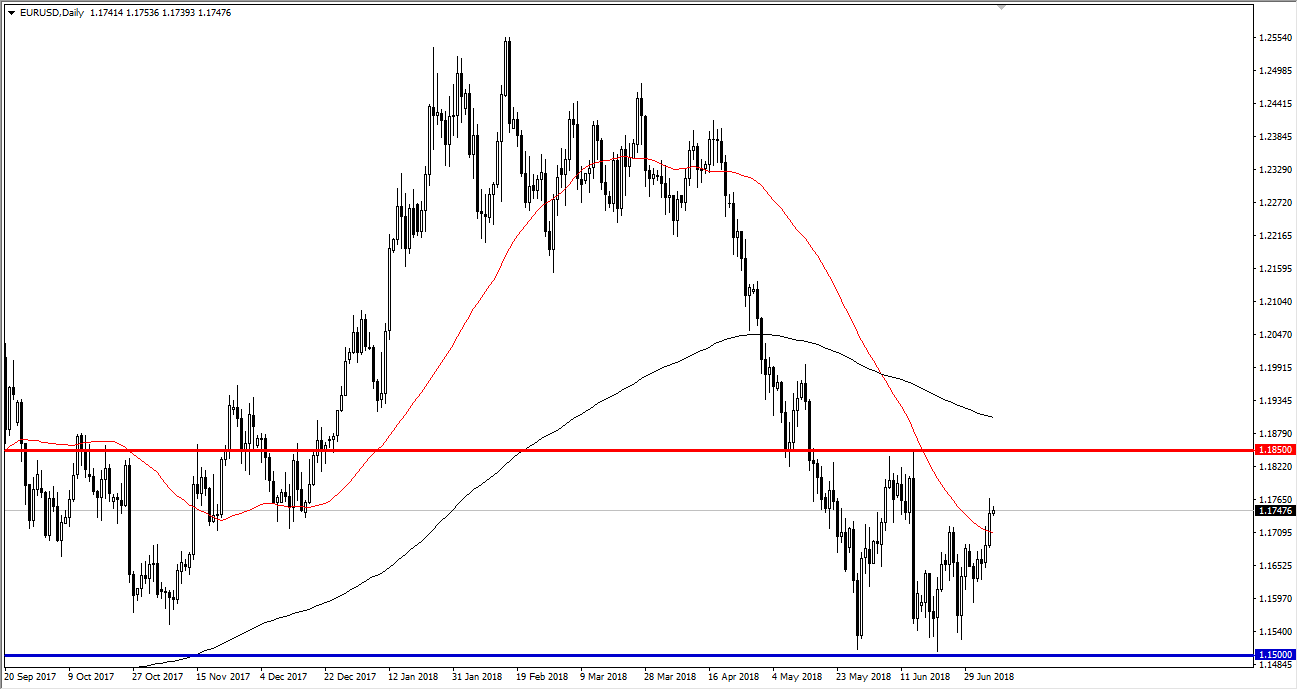

EUR/USD

The Euro rose slightly in early Asian trading on Monday, as it looks like we are ready to continue going higher. If we can break above the highs from the Friday session, I think at that point it would make sense that the Euro would go looking towards 1.1850 level above that has been significant resistance. We have cleared the 50 EMA during the Friday trading session, and it looks as if it is trying to turn back to the upside. However, there are a lot of concerns around the world, and that could have an effect on this market. I believe that the market will stay in this consolidation area, but if we do break above the 1.1850 level on the daily chart, that would be a very bullish sign and could send this market to the 1.20 level next. Otherwise, I anticipate that we will touch the red line on the chart and then turned around.

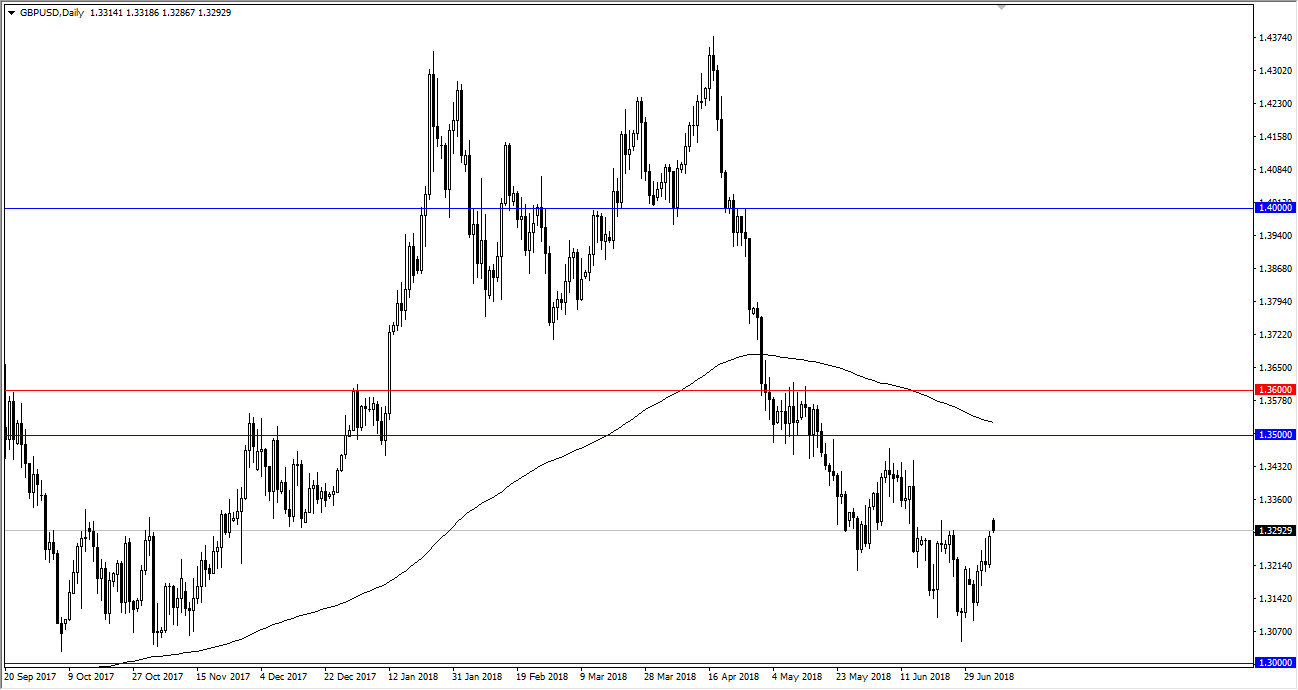

GBP/USD

The British pound has gapped higher at the open on Monday, showing signs of life as we reached above the important 1.33 level. It looks as if we will probably pull back to find buyers at lower levels, but if we can turn around and break above the 1.33 handle again, something that I follow anticipate, I think that the market will rally towards the 1.3450 level above which was the most recent short-term high. However, if we turn around to break towards the 1.32 level, and more importantly break below it, then the market probably test the lows again. I would expect a lot of noise, and therefore I would be cautious about putting too much money into this market, although on the longer-term charts it looks as if both of these markets as support just waiting to happen.