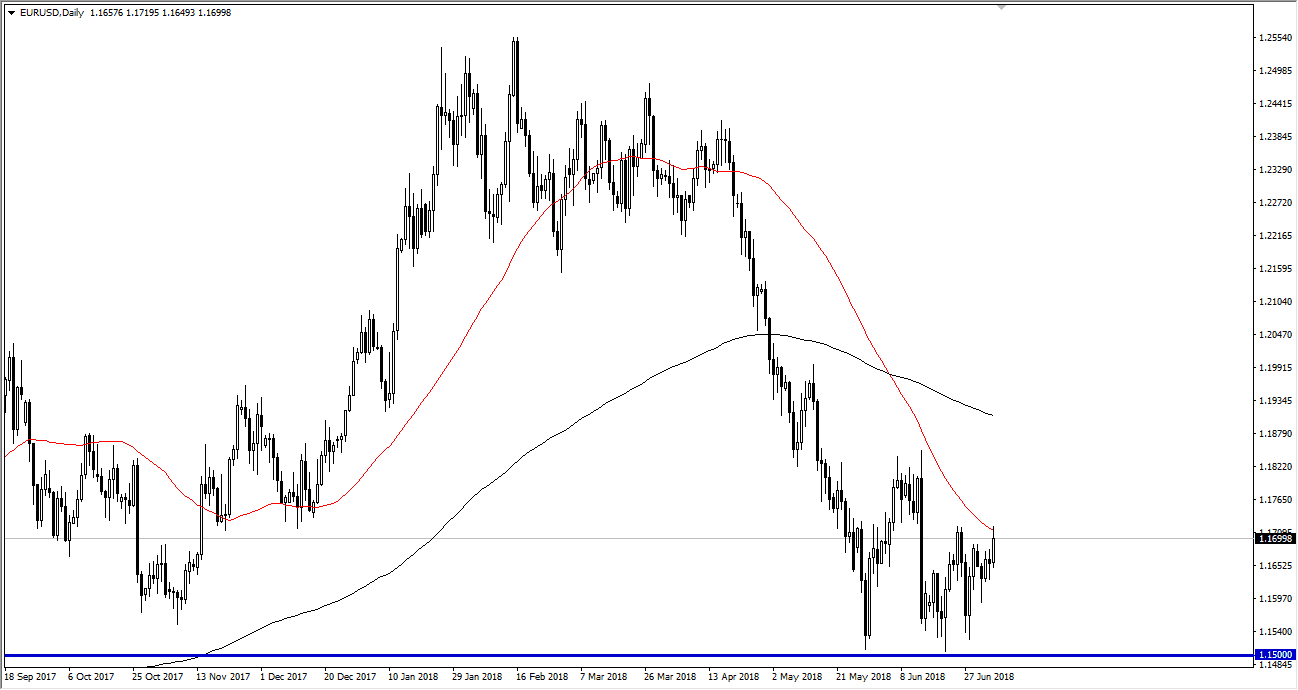

EUR/USD

The EUR/USD pair rallied significantly during trading on Thursday, reaching towards the 1.17 level and even the 1.1725 level after that. The 50 day EMA seems to be offering a bit of dynamic resistance, and as we head into the Friday session, we will then start to focus on the jobs number in the United States. That will have a significant influence on this market, and quite frankly most the time this pair is not worth trading on those sessions. It tends to go back and forth and essentially suddenly nothing at the end of the day. However, I believe that what we are looking at more than anything else is longer-term consolidation between the 1.1850 level at the top, and the 1.15 level underneath. We are roughly in the center of this, so expect a lot of volatility, and dangerous trading.

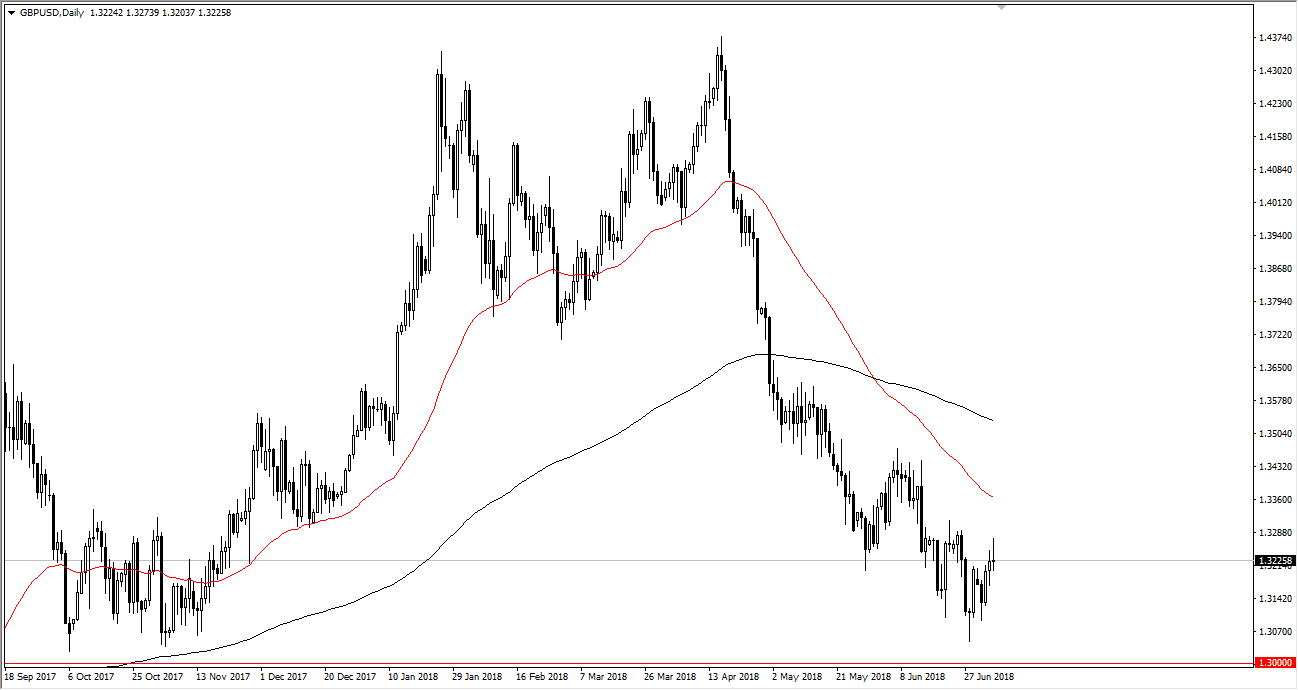

GBP/USD

The British pound was volatile on Thursday as it was suggested that perhaps the Germans were not happy with the customs agreement that the British put forward, but I think that doesn’t matter in the longer-term. What does matter is that we have been in a downtrend, and we are struggling to go higher. I believe that the 1.33 level was an area that was always going to be difficult to break above, so pulling back from there was something that I had somewhat anticipated anyway. The 1.30 level below is supportive, and extraordinarily so. At this point, I am looking to trade this market based upon the daily close, and not the noise that will come out today. If we close above the 1.3350 level on the daily chart, then I’m willing to buy and aim for the 1.35 handle. However, if we close below the bottom of the candle stick from the Thursday session, I believe we will go down to the 1.3050 level.