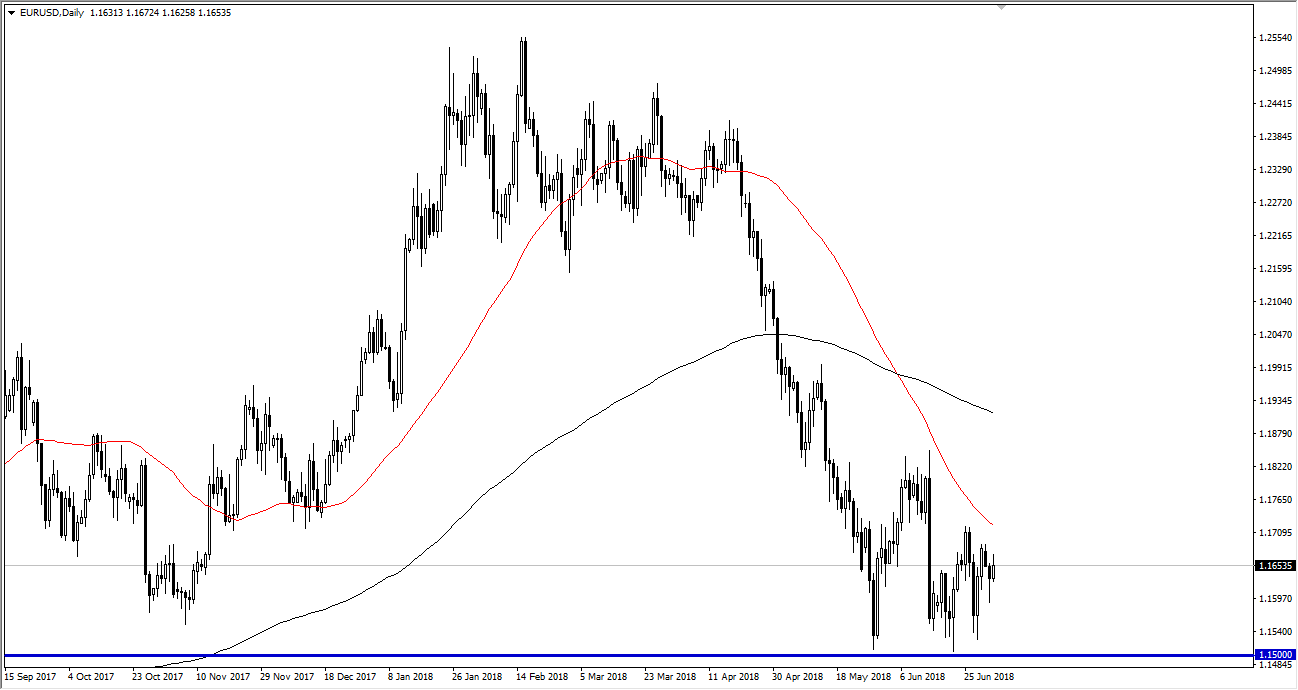

EUR/USD

The Euro rallied a bit during the trading session on Tuesday but gave back about half of the gains as we continue to see a lot of noise. The 1.17 level has offered a significant amount of bearish pressure, and we ended up forming a bit of a shooting star looking candle as we continue to be rocked back and forth in the currency markets due to uncertainty with trade wars and the like. Beyond that, I think that some of the relief rally was a little overdone as although Angela Merkel seems to be safe and a continuity of German leadership is assured, the reality is that she caved on a lot of her principles, and now people are starting to focus on the future outlook for the European Union, which of course is next to say the least. The 1.15 level underneath continues to be massive support, but if we break down below there this market unwinds rather drastically. In the short term, I believe that selling short-term rallies continues to work.

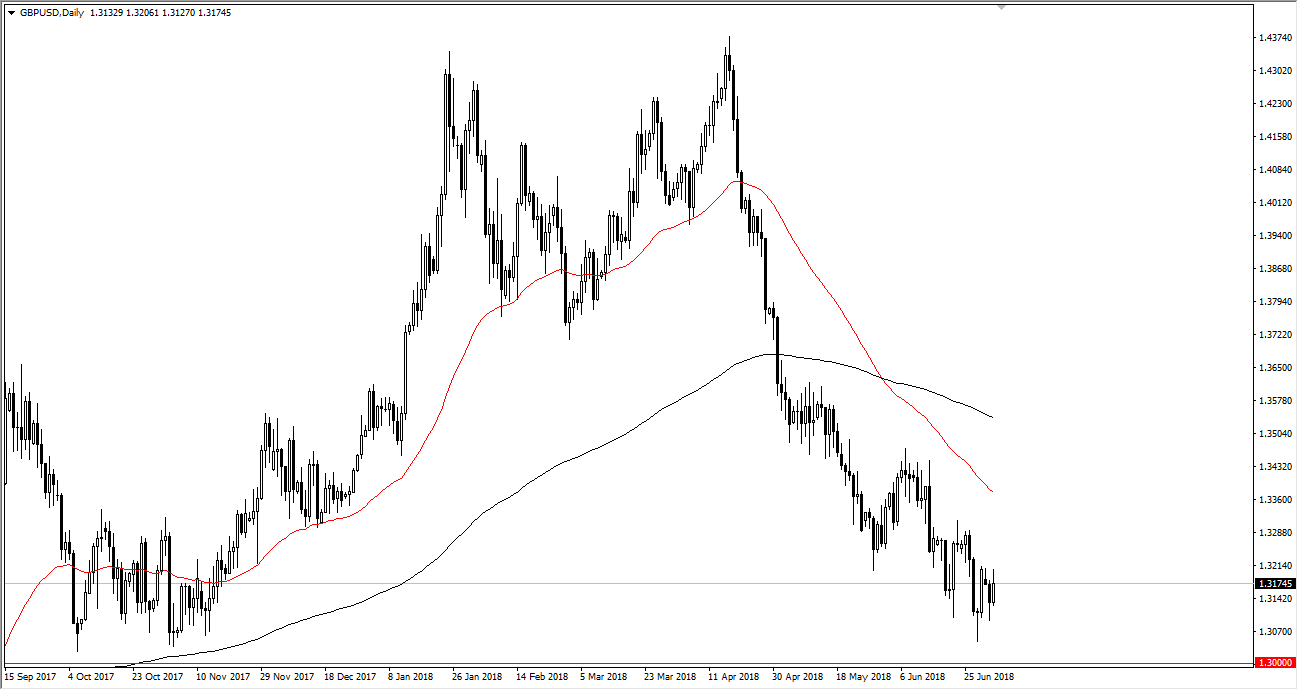

GBP/USD

The British pound tried to rally during the trading session on Tuesday but gave back quite a bit of the gains just as the Euro did. I believe that there is still plenty of fear out there when it comes to trade wars and tariffs, and because of this it’s likely that the US dollar will continue to be favorable as you can trade US treasuries with it. That is the first place that many hedge funds will run to when there’s a lot of fear, because it’s one of the few markets that are big enough to absorb all of the liquidity necessary. Because of this, and the shifting headlines, I anticipate that rallies will continue to be sold with 1.30 underneath being a massive “floor.”