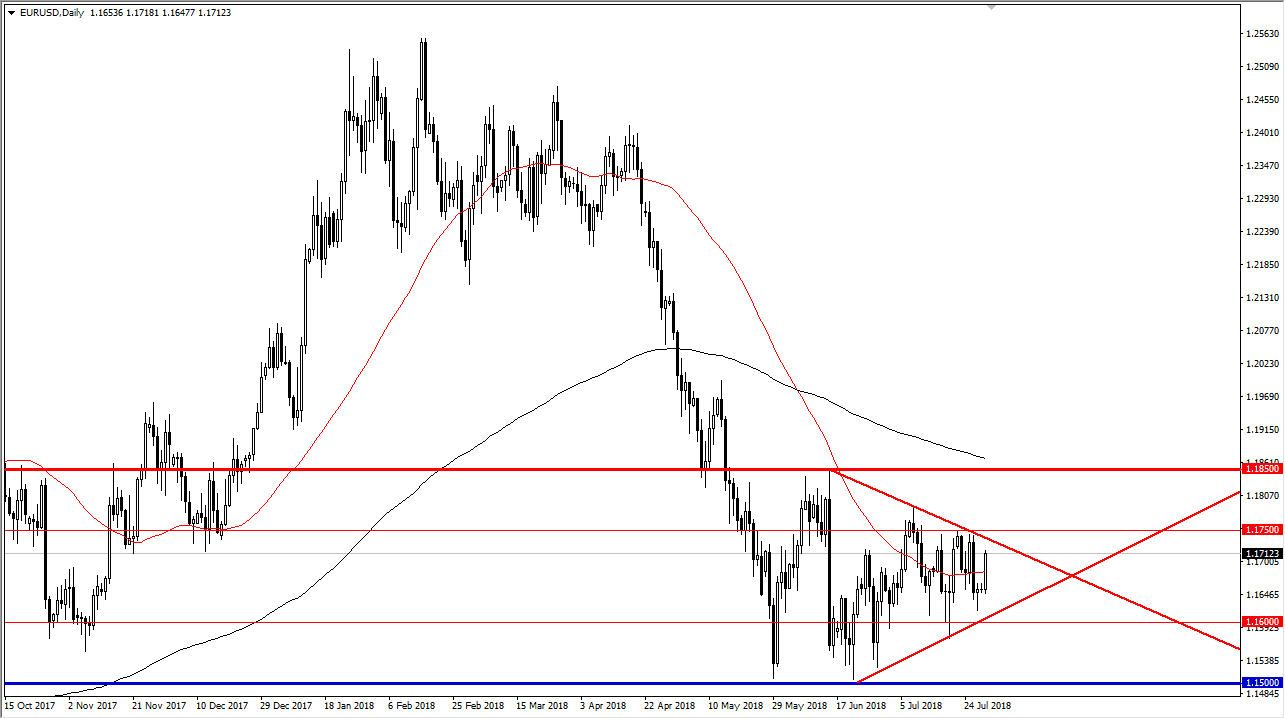

EUR/USD

The Euro rallied rather significantly during the Monday session, reaching towards the top of the symmetrical triangle that we have been in. However, I think that we won’t break out of this triangle, mainly because we have the jobs number coming on Friday, the Federal Reserve this week, the Bank of Japan on Tuesday, and of course the Bank of England on Thursday. In other words, we have a slew of central bank announcements and major news flow to move the markets. Because of this, I think that we will struggle to break out of this consolidation in the short term, but I think by the end of the week we will have cleared. If we can break above the 1.1750 level, the market probably goes to the 1.1850 level. Otherwise, if we break down below the 1.16 level, then we go down to the 1.50 level.

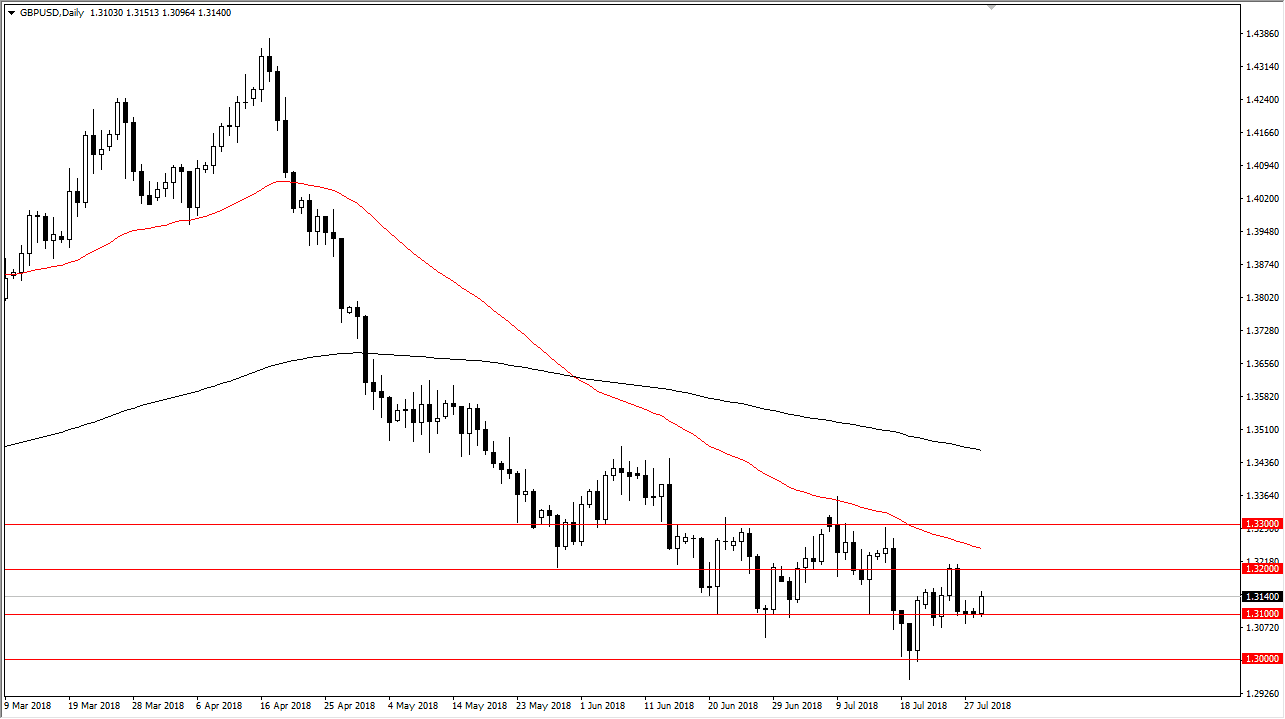

GBP/USD

The British pound had a positive session as well, but with the Bank of England having an announcement on Thursday, I think the market is probably going to be a bit cautious about putting too much money to work. I see the 1.32 level as an area of resistance, and I think that we probably will struggle to break above there. Even if we do, I think there’s even more resistance at the 50 EMA, and of course the 1.33 handle as well. I believe that we see choppy conditions between now and Thursday, in a very tight range. Short-term traders will love this pair though, because you should have some fairly clearly defined levels to work off of. I believe this point it’s likely to be choppy, and that dictates two things in my trading experience: range bound systems, and small positions.