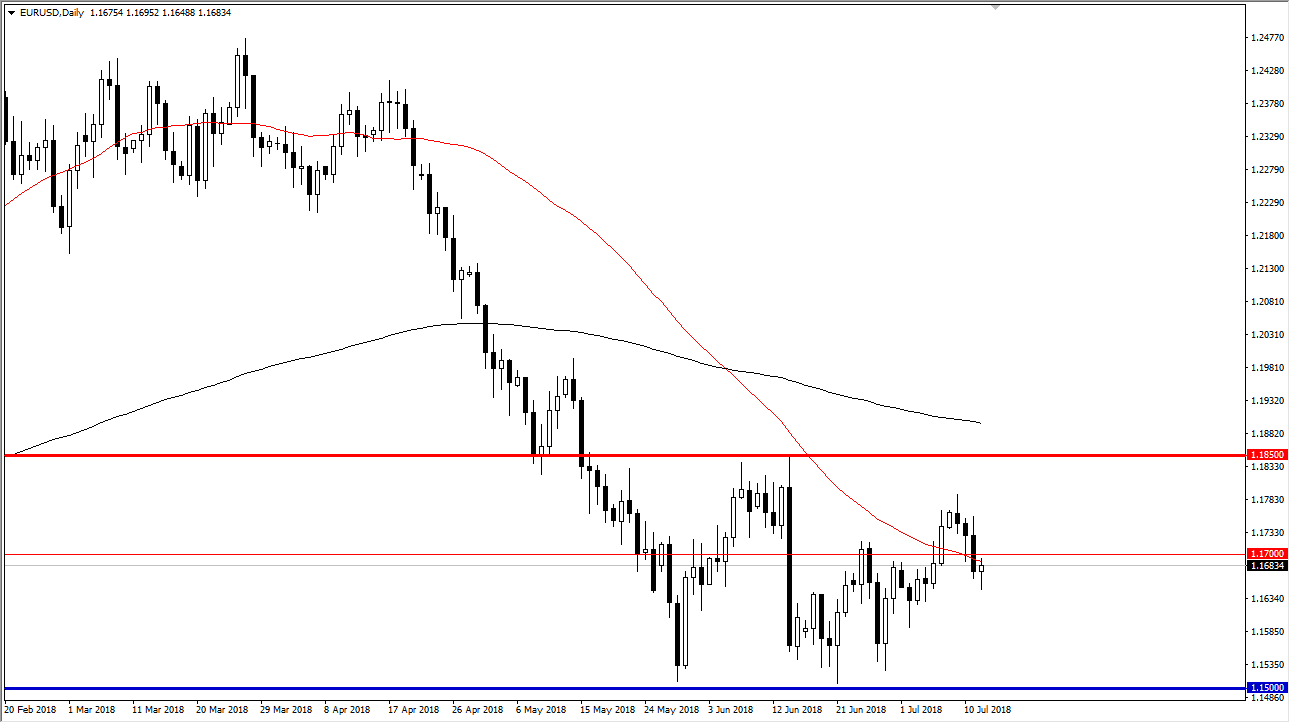

EUR/USD

The Euro initially fell during trading on Thursday but turned around to show the 1.1650 level to be supportive again. By forming a hammer like candle that we did at the 50 day EMA, it’s interesting to see that there is obviously some type of attraction to this market. If we can break above the 1.17 handle, I think at that point the market will probably go looking towards the top of the overall consolidation area, which is the 1.1850 level. This market continues to be very noisy, and I think at this point it’s likely that we will see a lot of back-and-forth over the next several weeks. I believe that headlines will continue to move these markets in the form of the trade war concerns between Germany and the United States, and of course the political situation and tensions between the EU and UK.

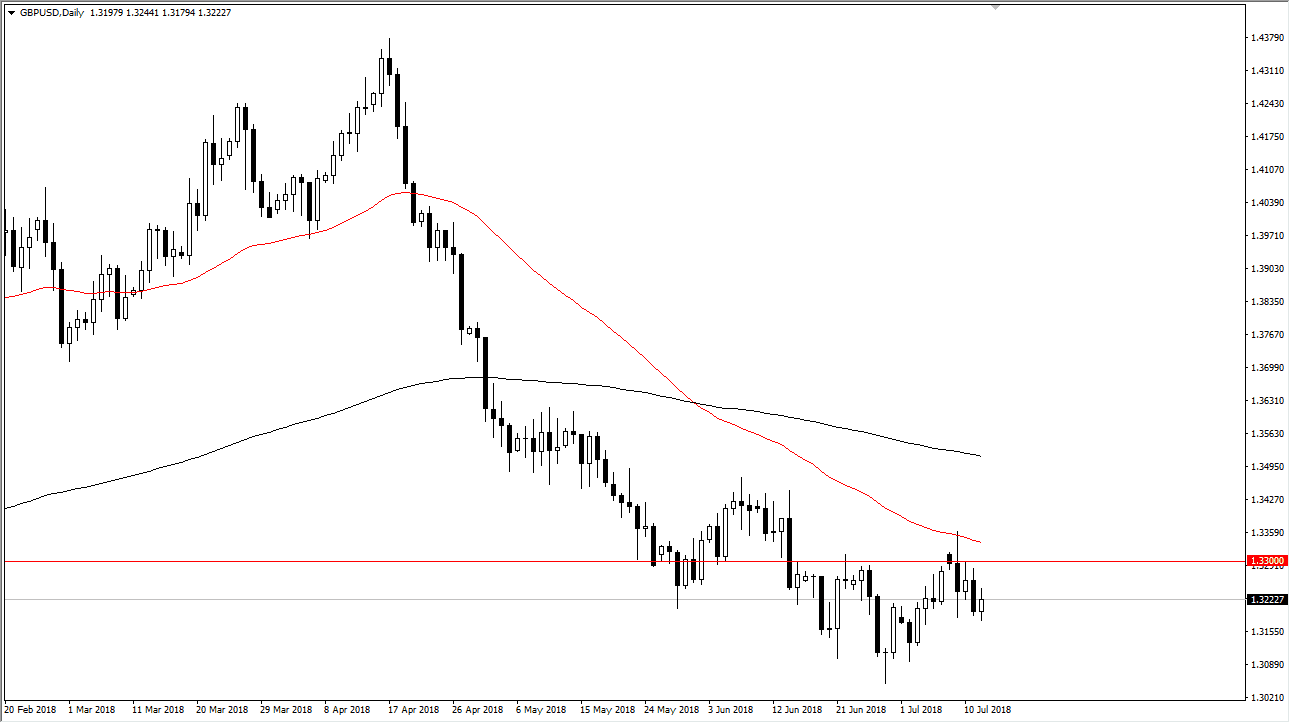

GBP/USD

The British pound had a slightly positive session, but as you can see we are in a slow and gentle selloff. I think that the market continues to find sellers above, especially near the 1.33 level. The 50 day EMA has started to act as dynamic resistance again, and at this point in time it’s likely that we will sell off again at the first signs of trouble. I believe that the British pound is going to continue to be a bit soft in relation to the EUR, so it’s likely that the EUR/GBP pair might even be a good way to play these currencies.

If we were to turn around and break above the 50 day EMA, then I think the market could go to the 1.35 handle above. The 1.35 level of course is a large come around, psychologically significant number, so keep that in mind as well.