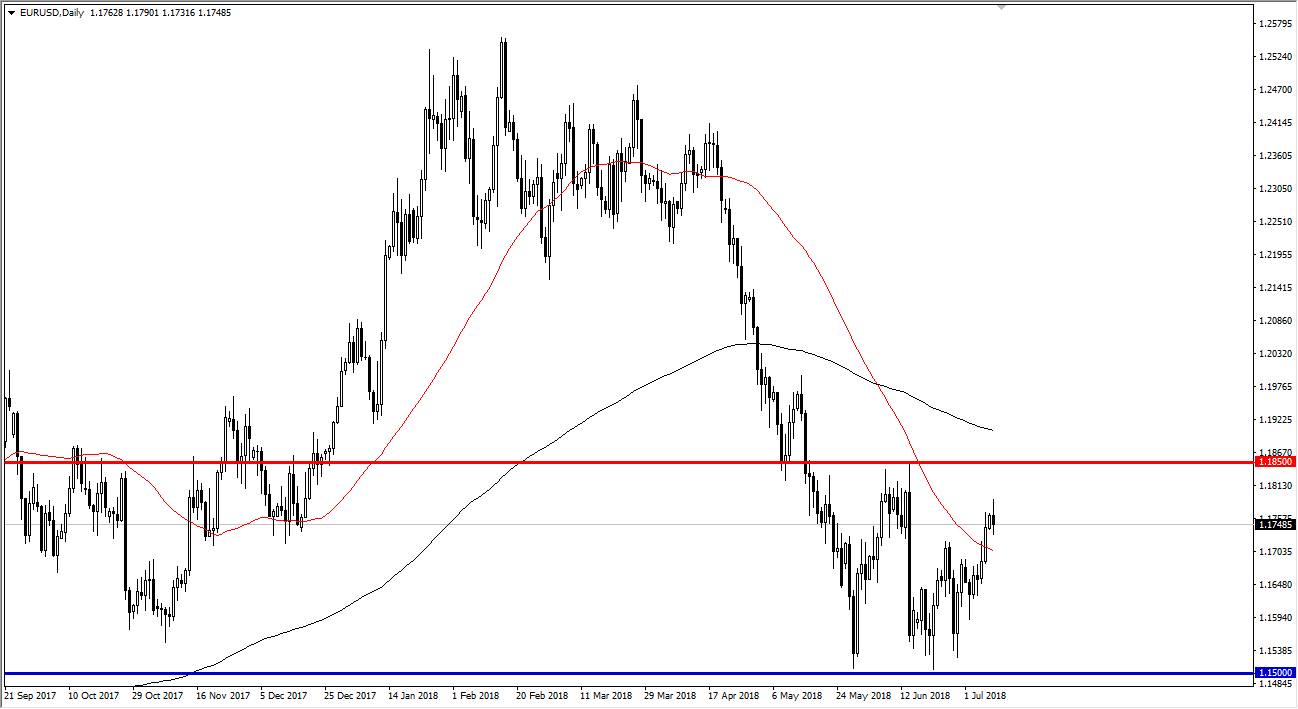

EUR/USD

The EUR/USD pair has gone back and forth during the trading session on Monday, showing signs of volatility around the 1.1750 level. However, we are not at the top of the consolidation range, so I think that we could still turn around and rally towards it. I see that as the 1.1850 level, and that’s an area that has proven itself more than once. A lot of this comes down to the Germans coming together a bit tighter, and of course the Italians starting to step back into line. However, if we were to break above the 1.1850 level, the market should then go looking towards 1.20 level above. Otherwise, we could pull back from here, but I suspect that there is probably still some value hunters down at the 1.17 level.

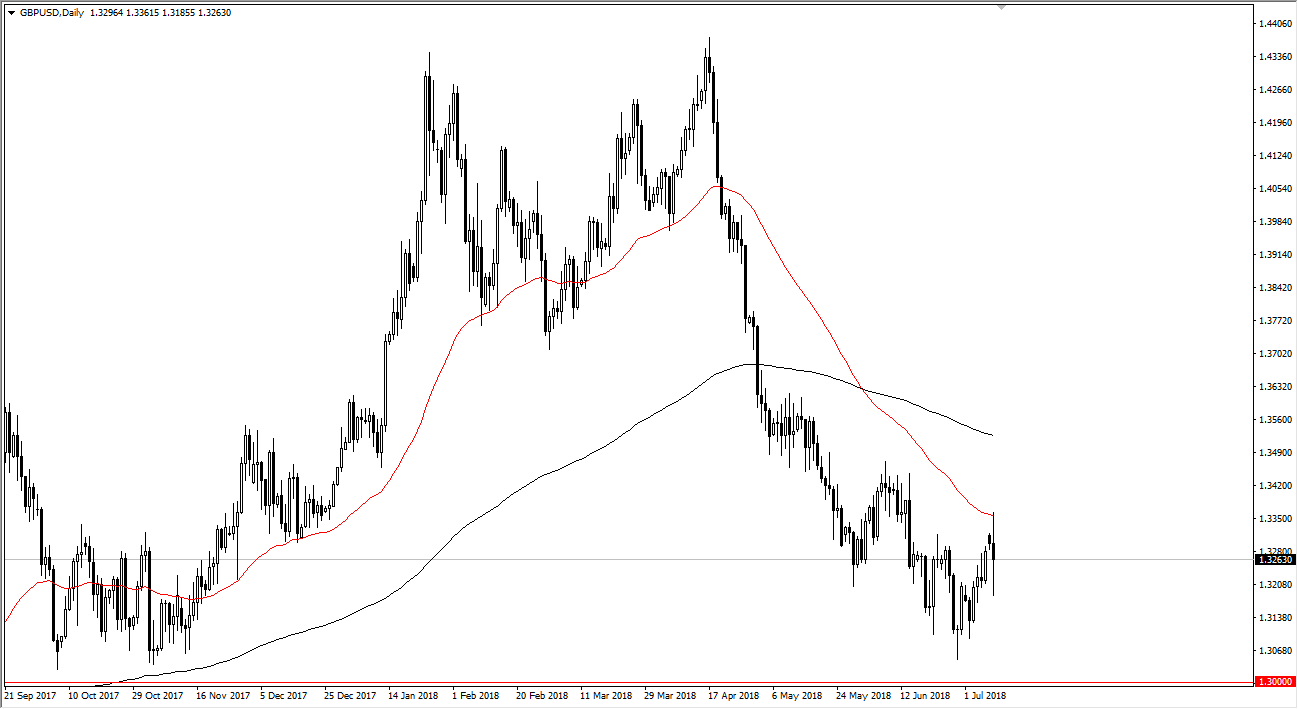

GBP/USD

The British pound has been ridiculously volatile during the trading session on Monday, as there are fears of Teresa May getting some type of no-confidence vote. At this point, I think there is still a lot of fear when it comes to whether there is going to be a hardware is soft “Brexit”, so I think it’s probably best to stay out of this pair although I would point out that late in the day we did see a lot of buyers come back in and push higher. Because of this, I think there is going to be a certain amount of resiliency, but I also recognize that this market will be driven more on headlines than anything else, so it’s going to be very difficult to trade this market. All things being equal, I’d be a buyer but at this point I think it’s going to be very noisy regardless of what happens.