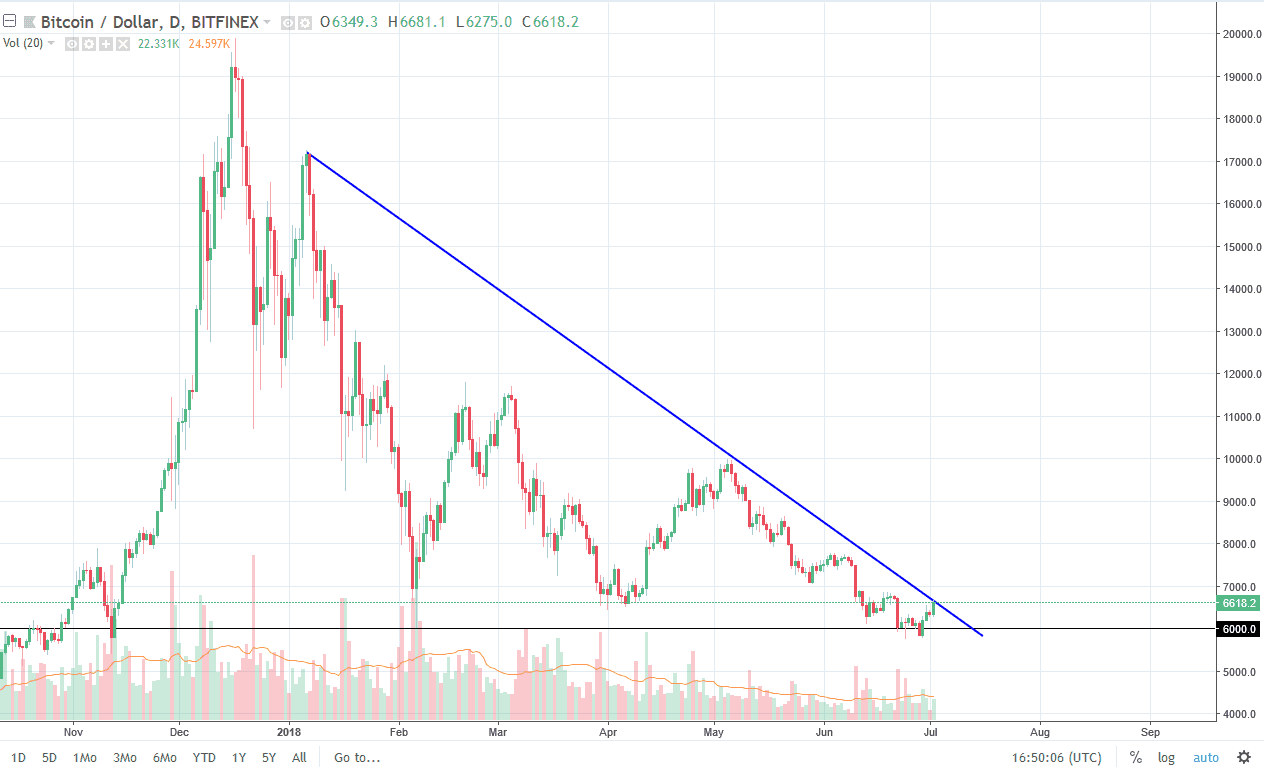

BTC/USD

The bitcoin markets rallied against the US dollar during trading on Monday, gaining over 4%. While I have been extraordinarily bearish of this market, one thing that can be pointed out is that we are testing a longer-term downtrend line, and it looks like if we can break above there, we may have room to go further. This is one of the first times that I’ve seen positive momentum in this market, so it could very well be the beginning of a short-term rally. However, if we roll over from here I would anticipate that we go towards the $6000 level again. A break above the top of the downtrend line probably sends this market looking to the $7000.

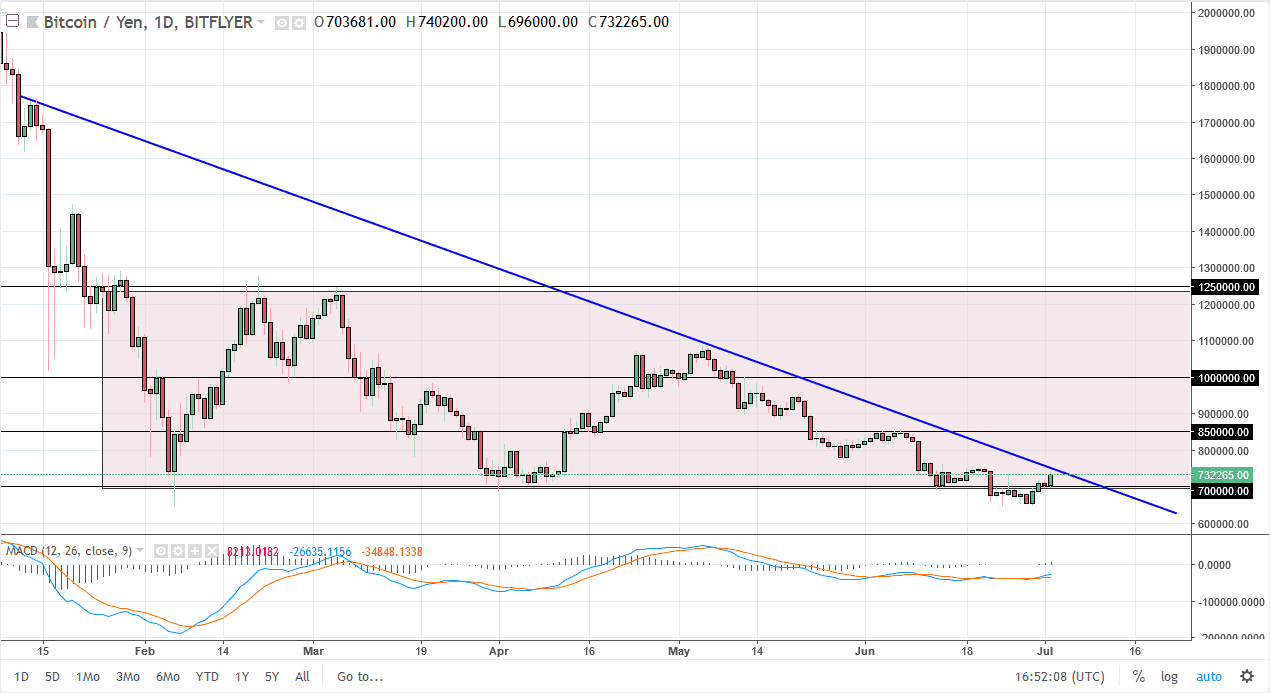

BTC/JPY

The bitcoin markets also rallied against the Japanese yen, looking towards the longer-term downtrend line, and I think at this point we probably going to go looking towards that area, in the region of ¥750,000. I think that if we can break above that level, it could open the door to the ¥800,000 level, and then possibly the ¥850,000 level. This would of course be a bullish sign, but if we roll over from here I anticipate that we will go right back towards the lows, so at this point the question now is whether this is a significant support level, or is it simply a “dead cat bounce?”

Remember that the bitcoin markets are extraordinarily volatile, and in the situation that we find ourselves in right now, namely the intensifying trade war situation that we have going on between the United States and China. I believe that a major “risk off” type situation should send this market lower, as many people will often use the Japanese yen as a safety currency.