BTC/USD

Bitcoin rallied again during the trading session on Tuesday, as we have broken above the $8000 level, and more importantly, the 200 day EMA. Beyond that, you should pay attention to the fact that money is flowing out of China again, and a lot of times they will find ways to get involved in bitcoin. Also, there is talk of a bitcoin ETF now, and it looks as if it is going to be able to clear regulatory hurdles in the United States. At this point, I think that the next target is the $9000 level, and I also believe that there is plenty of support from two days ago. However, I find this kind of ironic considering that the idea of an ETF trading bitcoin futures goes counter to the whole reason for bitcoin in the first place. I think that we will enter a new bull market, but longer-term, unless Main Street adopts bitcoin, there isn’t going to be any real demand, and I think that ultimately we are going to see a surge as the ETF markets start, but eventually people will notice that nobody’s using it. At that point, the ETF’s will then become a weapon of mass destruction for crypto currencies, as it will be easier to short bitcoin, even for the average stock trader. I could be wrong, but this is certainly a longer-term danger. In the short term, we should go to $9000.

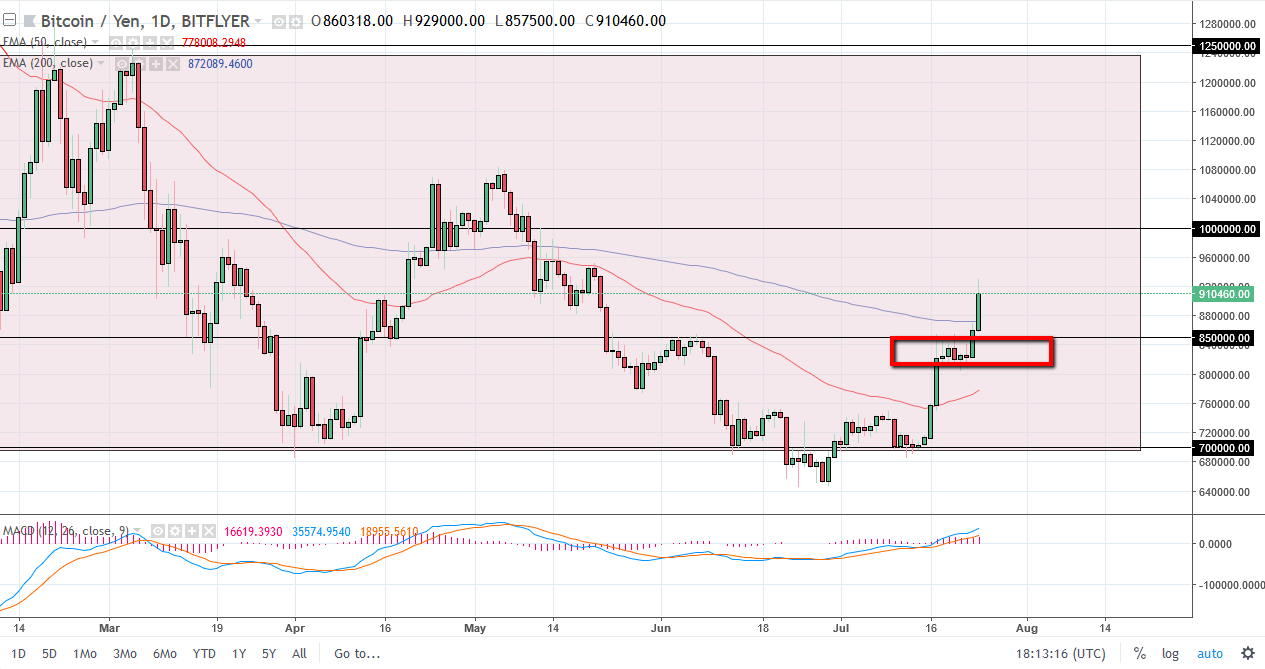

BTC/JPY

Bitcoin also rallied against the Japanese yen as you would expect, as we are piling into a bit of supply near the ¥925,000 level. I think we will probably continue to go higher, we may get a short-term pullback before we do so though. Longer-term, I believe that the ¥1 million level is a decent target, and I think there is plenty of support below at the ¥850,000 level.