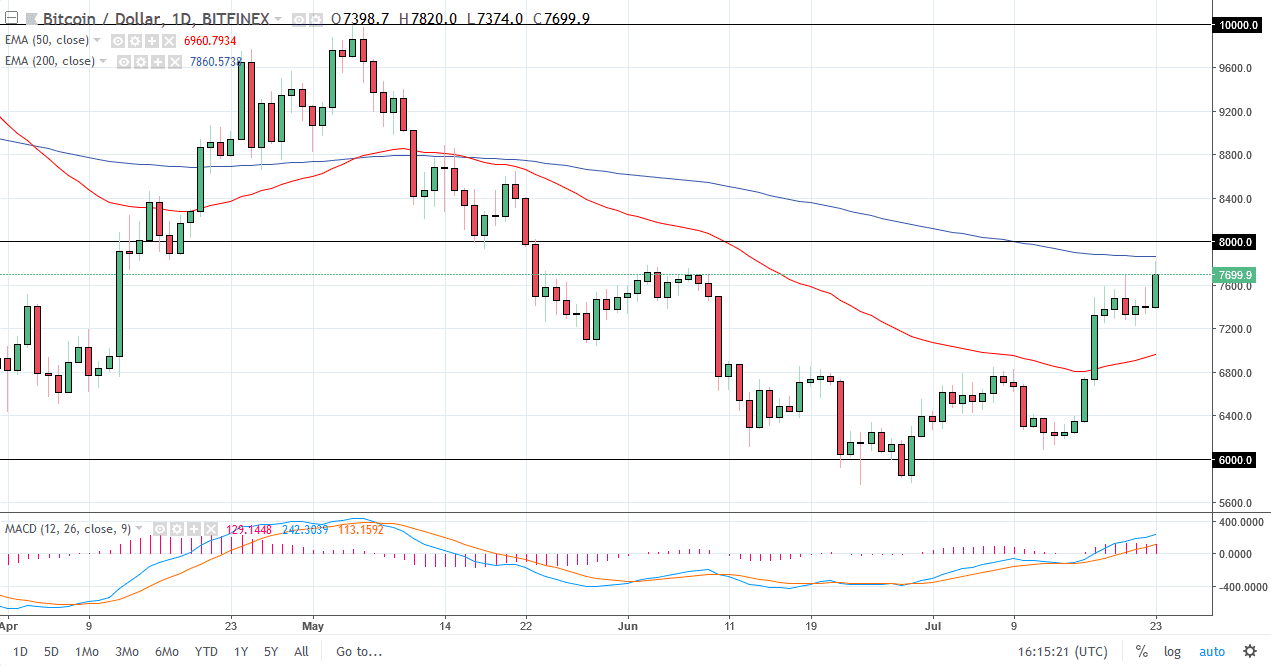

BTC/USD

Bitcoin rallied significantly to kick off the week, reaching towards the 200 day EMA on the daily chart. It should also be pointed out that we still have a bit of selling pressure just above, so I think that we need to see some type of pullback to continue the upward momentum. Recently, I have been watching capital flows out of China, which quite often find their way through the cryptocurrency markets. As they are starting to pick up, shown by the devaluation of the Chinese yuan, it’s possible that this has more to do with Chinese citizens trying to get their money out of the country than anything else. Nonetheless, price is price and we need to pay attention to how it acts. At this point, I would anticipate a lot of resistance just above, but it certainly looks as if the $7200 level is trying to offer a bit of a “floor” for a move higher. Clearing the $8000 level would be rather significant as well.

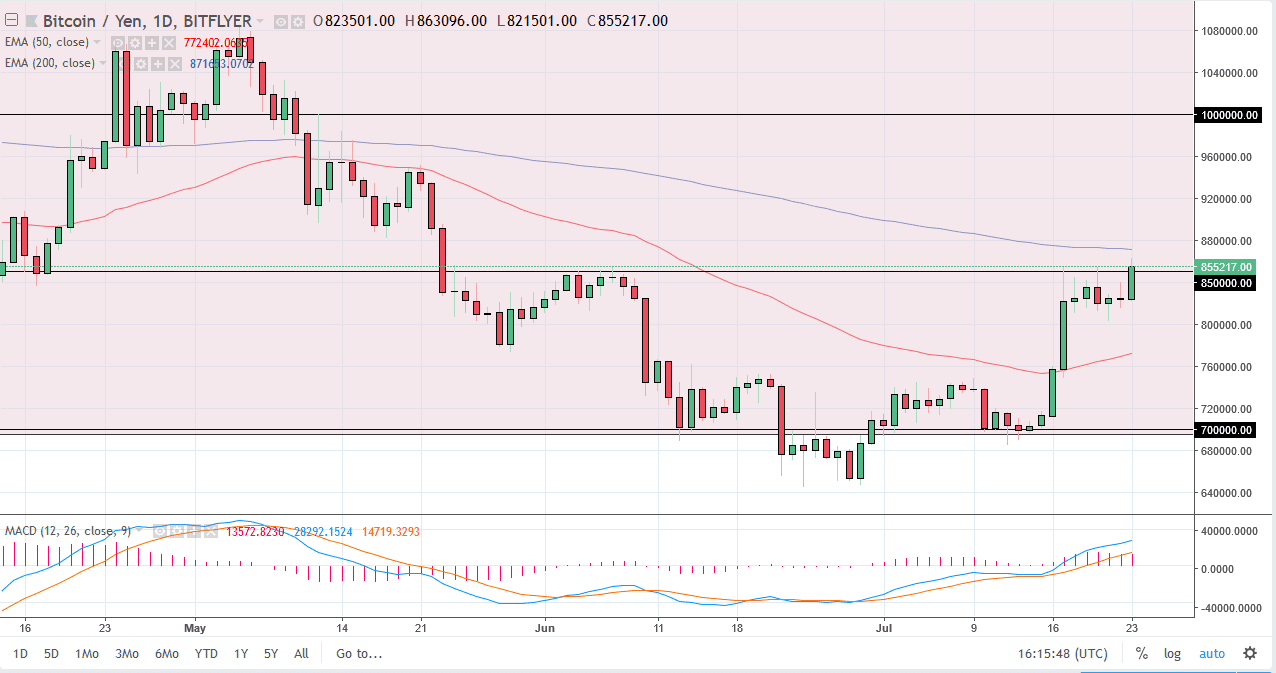

BTC/JPY

Bitcoin also rallied against the Japanese yen as you would imagine, breaking above the ¥250,000 level. This is a good sign, but I believe that we need to clear the 200 day EMA as well to be a bit more confident. I think that the ¥800,000 level right now is going to offer a bit of a “floor” in this market, and I think it’s only a matter of time before buyers would step in. If we turned around to break down below the ¥800,000 level, then the market could unwind back to the ¥700,000 level. It certainly looks as if the momentum is with the buyers at this point, and I think we are starting to see a move towards the upside. I don’t think it’s going to be easy, but if you are a longer-term trader, this volatility shouldn’t concern you.