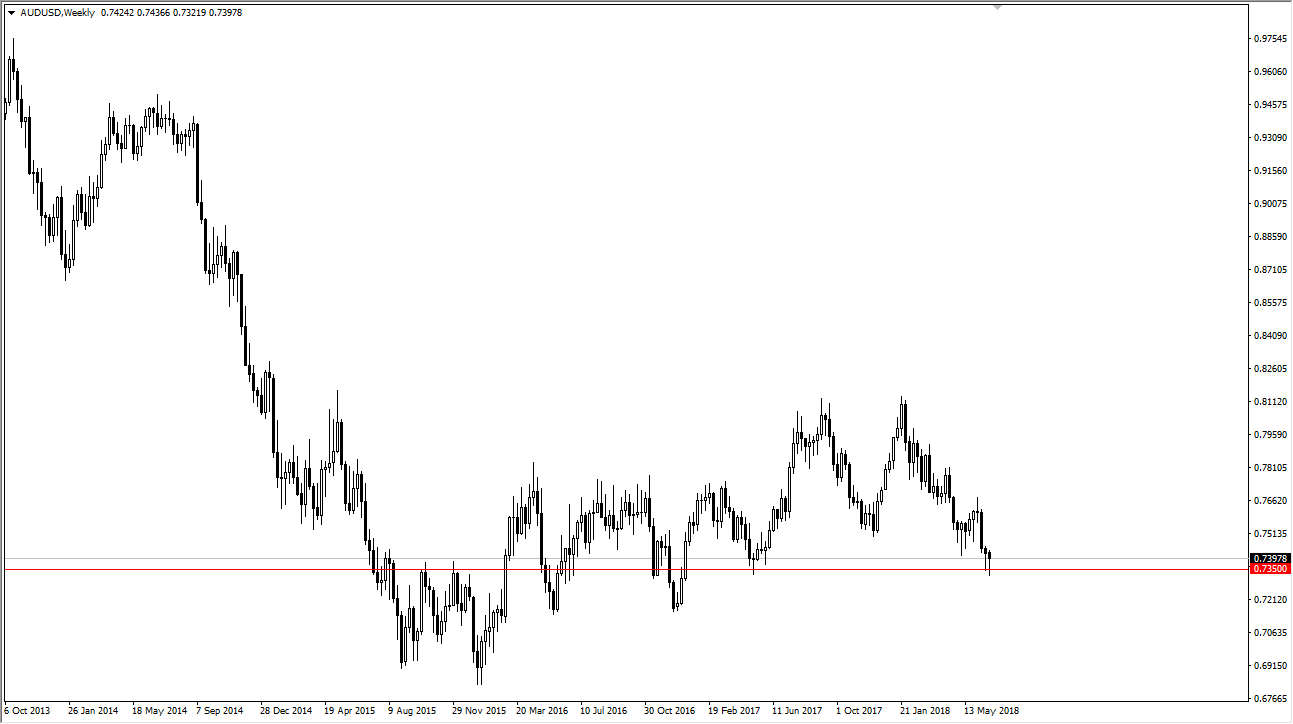

AUD/USD

The Australian dollar has been very noisy during the trading for the month of June. However, the most important thing on this chart is the fact that weeks three and four both found plenty of support near the 0.7350 level, and have even formed hammers, which of course are bullish candlesticks. I think at this point, the market is simply waiting to see whether the trade war kicks off, or cooler heads prevail. If they do, the Australian dollar is probably one of the first places that money will go looking to. Australia is heavily influenced by trade between Asia and the United States, as it provides plenty of raw materials to places like China and Indonesia. In the midst of a trade war, that’s not necessarily a good thing to base your economy on. However, if things calm down and trade resumes, it’s likely that we will continue to see upward pressure as traders search for yield.

The alternate scenario of course is that we break down below the bottom of the hammer from the fourth week of the month, meaning essentially the 0.73 level. If we were to break down below that level, the market will probably unwind towards the 0.72 level, and then possibly even the 0.70 level. This would almost undoubtedly be accompanied by some type of escalation in the trade war argument, as it would have people running for cover. Remember, a lot of the tweets that Donald Trump sends over the wires are basically a negotiating tactic. I believe the market is starting to figure this out, and therefore the so-called “smart money” is starting to look for yield again. That’s not to say that it’s going to be easy, and that things couldn’t change, but right now it looks like the buyers are starting to accumulate Aussie dollars.