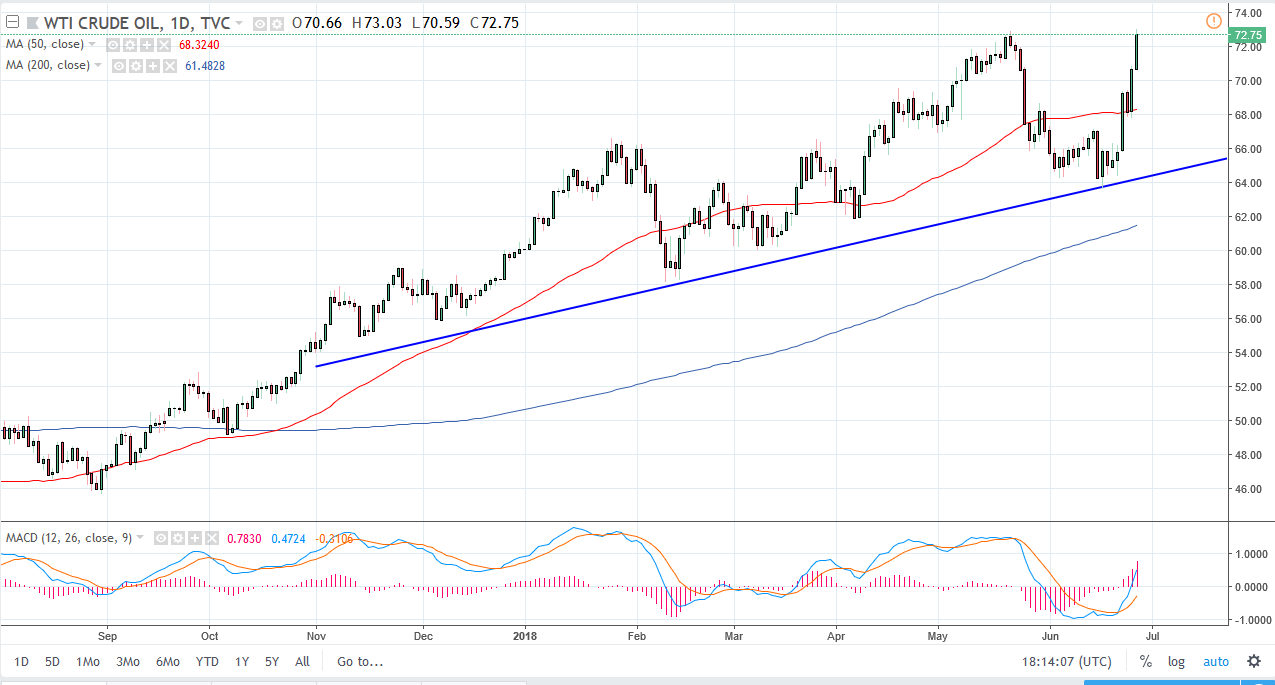

WTI Crude Oil

The WTI Crude Oil market rallied a bit during the day again on Wednesday, reaching towards the highs again. If we can break above to a fresh, new high, the market should continue to go higher. However, I think that we probably need to see a short-term pullback to at least pick up a bit of value that we can take advantage of and start buying again. I have no interest in shorting this market, it’s obviously very bullish, and it would be very difficult to go against this type of move. With that in mind, I think that the uptrend continues to push higher, and I think that it’s likely that we will continue to see value hunters into this market as the recent inventory numbers were extraordinarily bullish. At this point, I think that we are eventually reaching towards the $75 level.

Natural Gas

The natural gas markets were very noisy during the day on Wednesday, as we reached towards the $3.00 level, but found enough resistance air to pulled back slightly. On the short-term charts, it looks as if we are ready to roll over, so I don’t necessarily believe that we are going to break out to the upside. I think that we will probably drop towards the $2.90 level underneath, and I think that it’s likely that we continue to go back and forth. If we do break above the reason high, we could go to the $3.10 level after that. That’s an area that is even more resistive, so at this point it’s almost difficult to imagine how we can break out to the upside. I think that short-term trading in a back-and-forth manner probably continues to be what we see.