WTI Crude Oil

The WTI Crude Oil market initially dropped at the open on Monday but turned around to shoot straight up in the air. We gained 2.65% by the time the futures markets closed, but we are still below the massive selloff that started on Friday. It is because of this that I think the market is still very likely to be choppy as we await the results of the Friday meeting of the OPEC ministers. This could lead to higher production levels, which would drive down the value of crude oil. If they do not increase production, that should be very bullish for oil. Between now and then, I would expect a lot of noise, but we are still technically bullish at this point, as the buyers have recovered the momentum at the significant uptrend line.

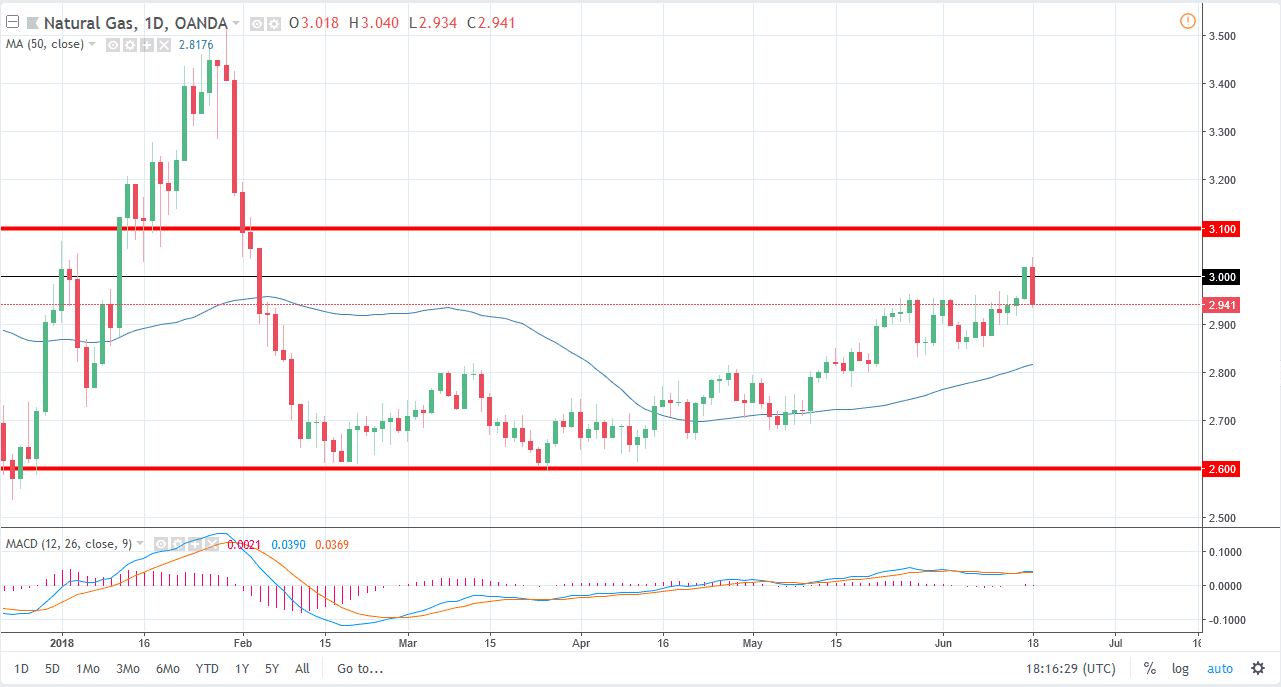

Natural Gas

Natural gas markets initially tried to rally on Monday but turned around to form a very negative candle. The outside candle suggests that we could have more selling pressure, but we also have a lot of noise just below. I believe that a break down below the bottom of the range for the session on Monday would have more selling coming into the market, perhaps reaching towards the $2.85 level. Rallies at this point will continue to find selling pressure, extending all the way to the $3.10 level. We are getting a bit “long in the tooth” when it comes to the consolidation rally, so I think that it’s very likely that the sellers will return relatively soon. There is a lot of noise associated with this market as it tends to focus on short-term moves and short-term weather forecasts in North America. Because of this, make sure your position size is relatively small on that breakdown.

.png)