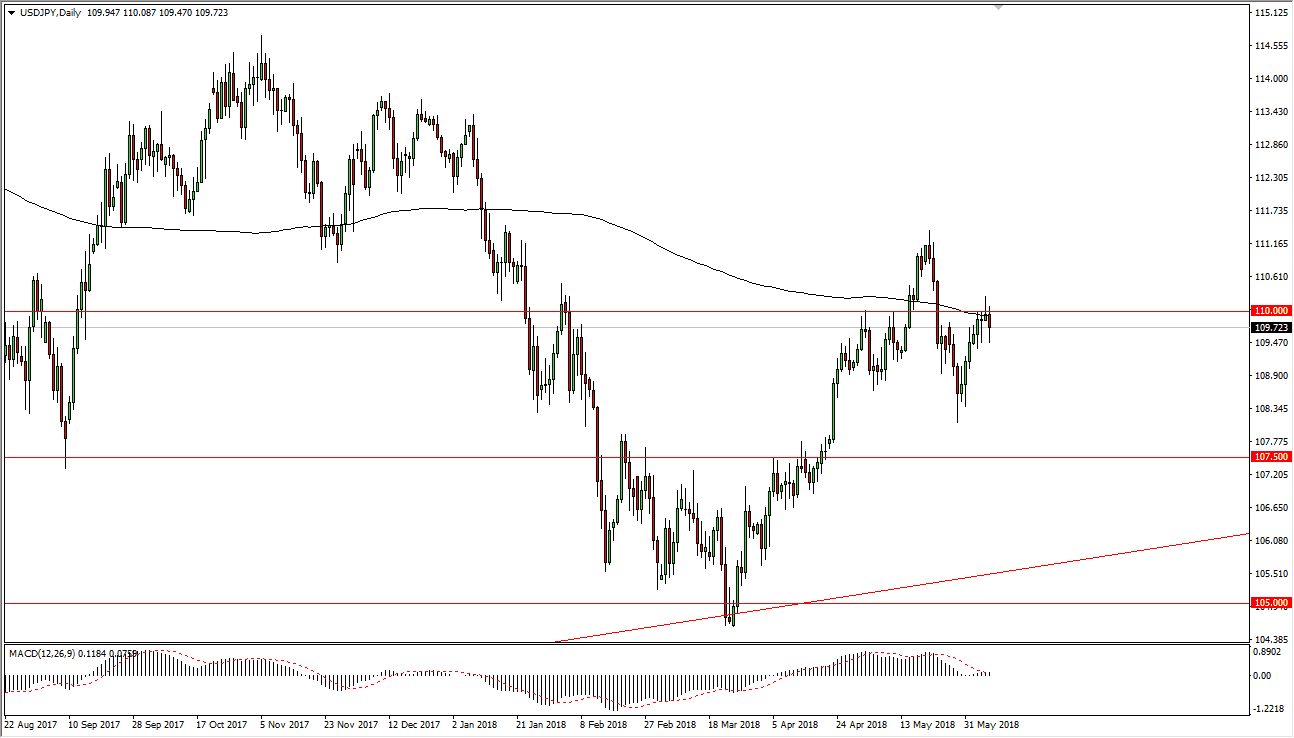

USD/JPY

The US dollar fell against the Japanese yen during the trading session on Thursday, as the 200 day simple moving average continues to cause issues. Beyond that, the ¥110 level has been resistance more than once, and it will of course continue to cause a reaction occasionally. If we can break above the top of the shooting star from the trading session on Wednesday, the market should continue to go higher, perhaps reaching towards the ¥111 level rather quickly. If we break down below the lows of the session on Thursday, then I think the market probably fall and go looking towards ¥109 level. Remember, this pair is highly sensitive to the headlines around the world, and of course stock markets. I think that stock markets are going to pulled back slightly but should end up offering value. That should give this market a bit of a lift down the road. However, expect a lot of sideways action in the short term.

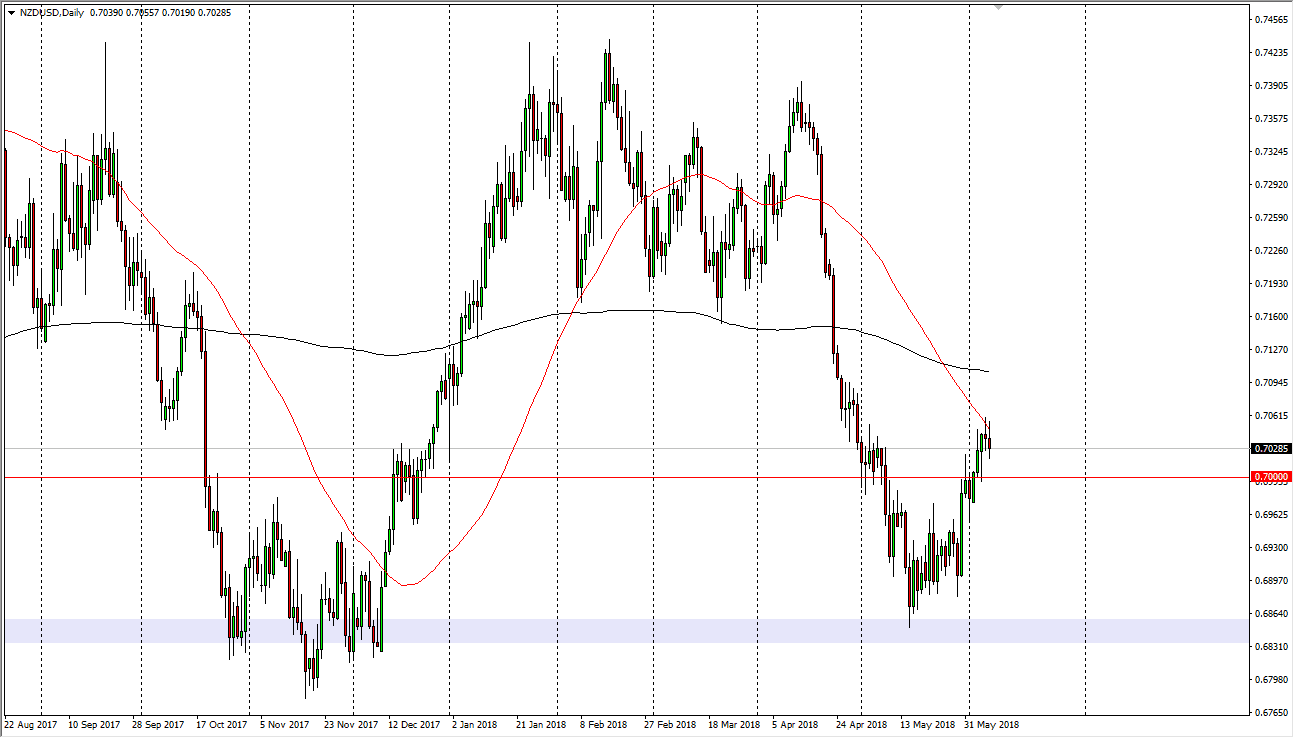

NZD/USD

The New Zealand dollar initially tried to rally during the day on Thursday, but fell again to form a shooting star, just as it did during the day on Wednesday. The 50 day SMA has offered significant resistance, and at this point I think we could very well pull back a bit. If we do, I think the market probably goes down to the 0.70 level, which of course will attract a lot of attention. That should be a very supportive area, but if we break down below there I think the market should continue to go lower, perhaps reaching towards the 0.69 level. Alternately, if we can break above the Wednesday eyes, then the market should go to the 0.72 level over the longer-term. Remember, this pair is also highly sensitive to risk appetite.