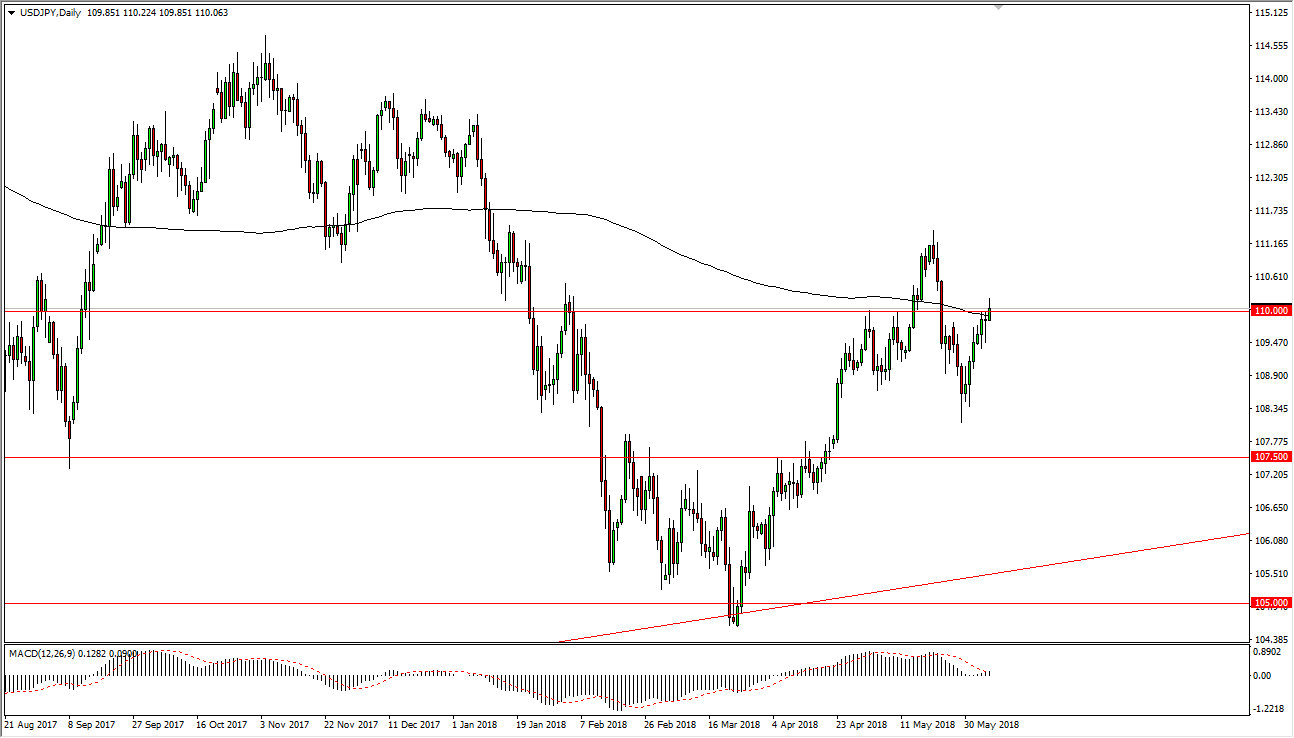

USD/JPY

The US dollar has rallied a bit during the trading session on Wednesday, breaking above the vital ¥110 level. The fact that we have done this is a bullish sign, and we have broken above the top of a hammer from the previous session as well as the 200 simple moving average. That’s a very strong sign, and I think we are going to continue to see buyers jump into this market and perhaps try to push it towards the ¥111 level next, and then beyond that the ¥112.50 level. Short-term pullbacks continue to be buying opportunities, unless of course we break down below the ¥109 level which is very negative to say the least. Overall, I do like this pair, and if we can stay out of geopolitical trouble and of course a trade war, it should continue to strengthen overall.

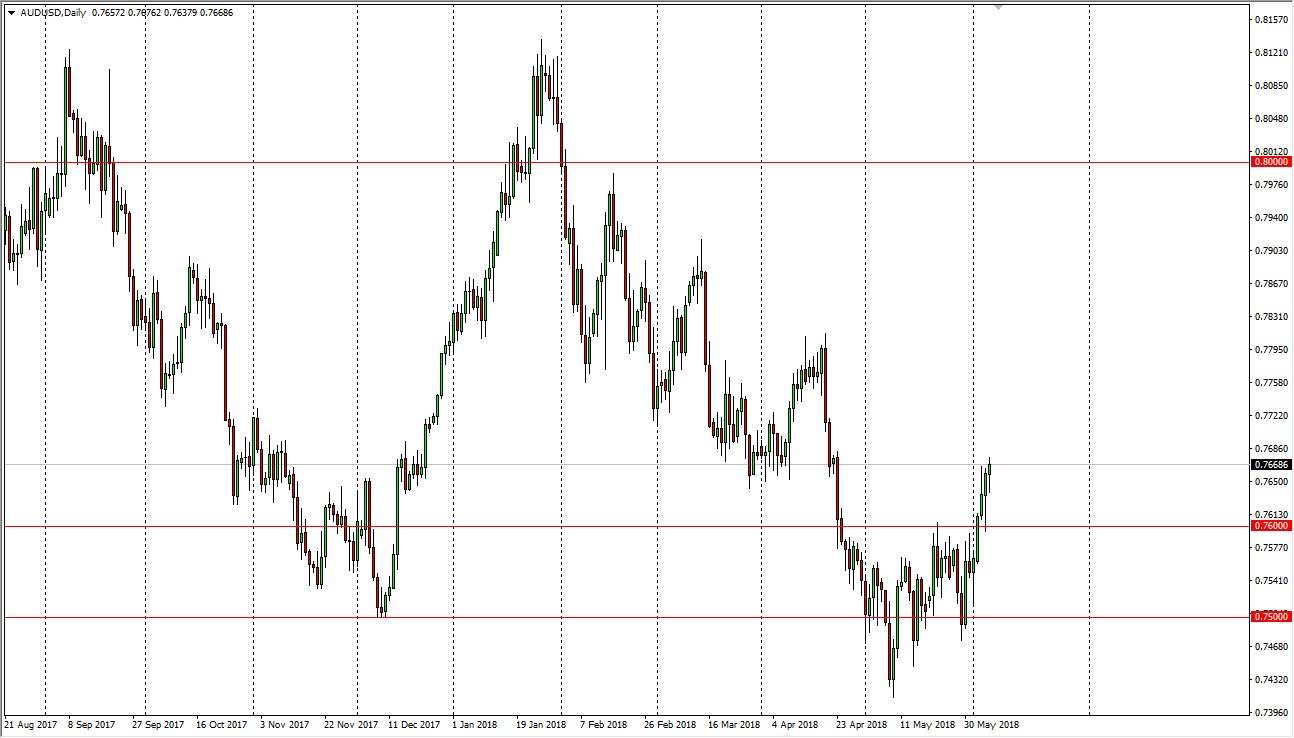

AUD/USD

The Australian dollar pulled back a bit during the trading session on Wednesday, but then turned around of form a bit of a hammer. The market looks as if it is trying to break above the resistance, and I think that the market should continue to go to the 0.78 handle. The level continues to be attractive for buyers, and I think that the 0.76 level underneath should end up being supportive. If we break down below that level, then I think the market find plenty of buyers underneath at the 0.75 handle, based upon the longer-term charts, specifically the hammers that we have seen on the weekly chart. Overall, I am a buyer of dips, if we can stay out of some type of geopolitical trade war or crisis. Pay attention to the Gold markets, if they rally that should also help this market as well.