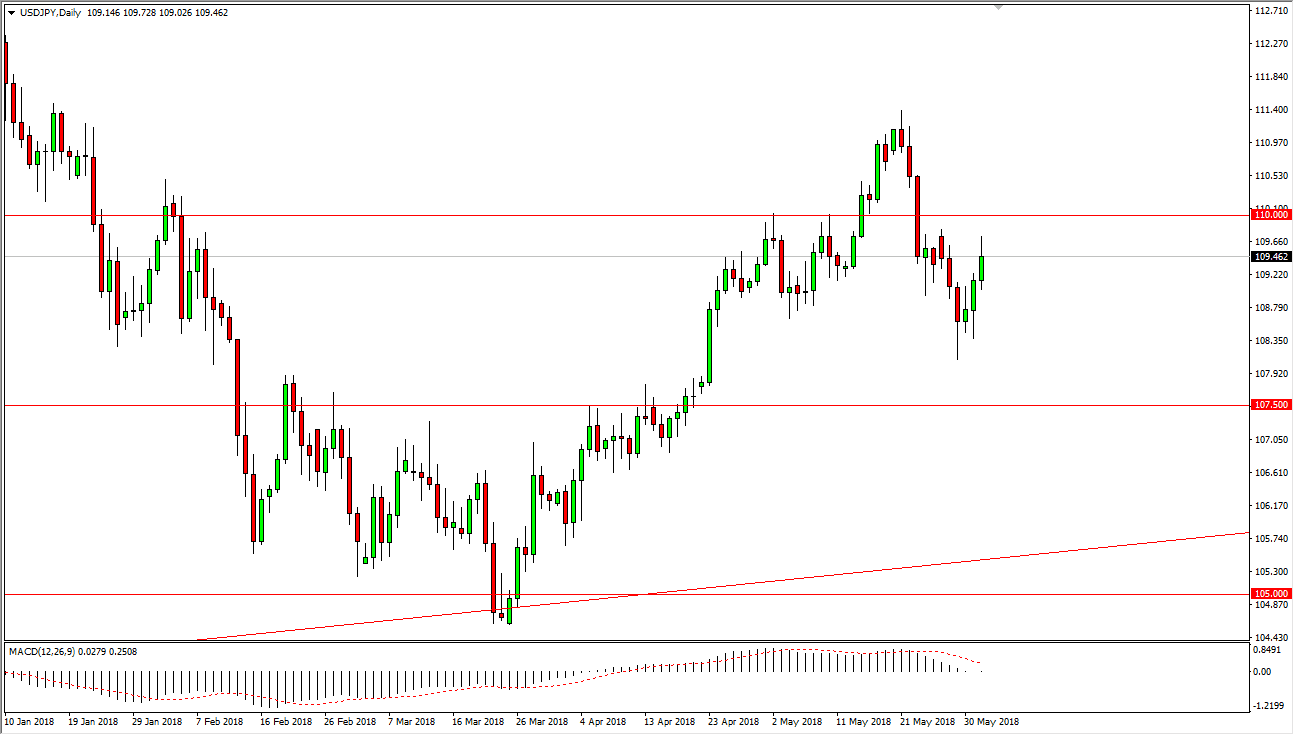

USD/JPY

The US dollar has rallied during the trading session on Friday, reaching towards the ¥110 level. We pulled back a little bit, so it looks likely that it might be a bit noisy going into the weekend. However, it looks as if the going to continue to show volatility, and the weekly candle forming a hammer suggests that there is more bullish pressure than originally thought. If we can break above the ¥110 level, the market should then go higher, perhaps reaching towards the recent highs. I think that the ¥107.50 level underneath is massive support, as it was previous resistance. I think that if we do break above the ¥110 level, the market should start to pick up momentum, perhaps based upon the fact that the Americans and the North Koreans are in fact the meeting June 12 in Singapore. Higher interest rates and good geopolitical news is a nice catalyst for this market to finally break out to the upside.

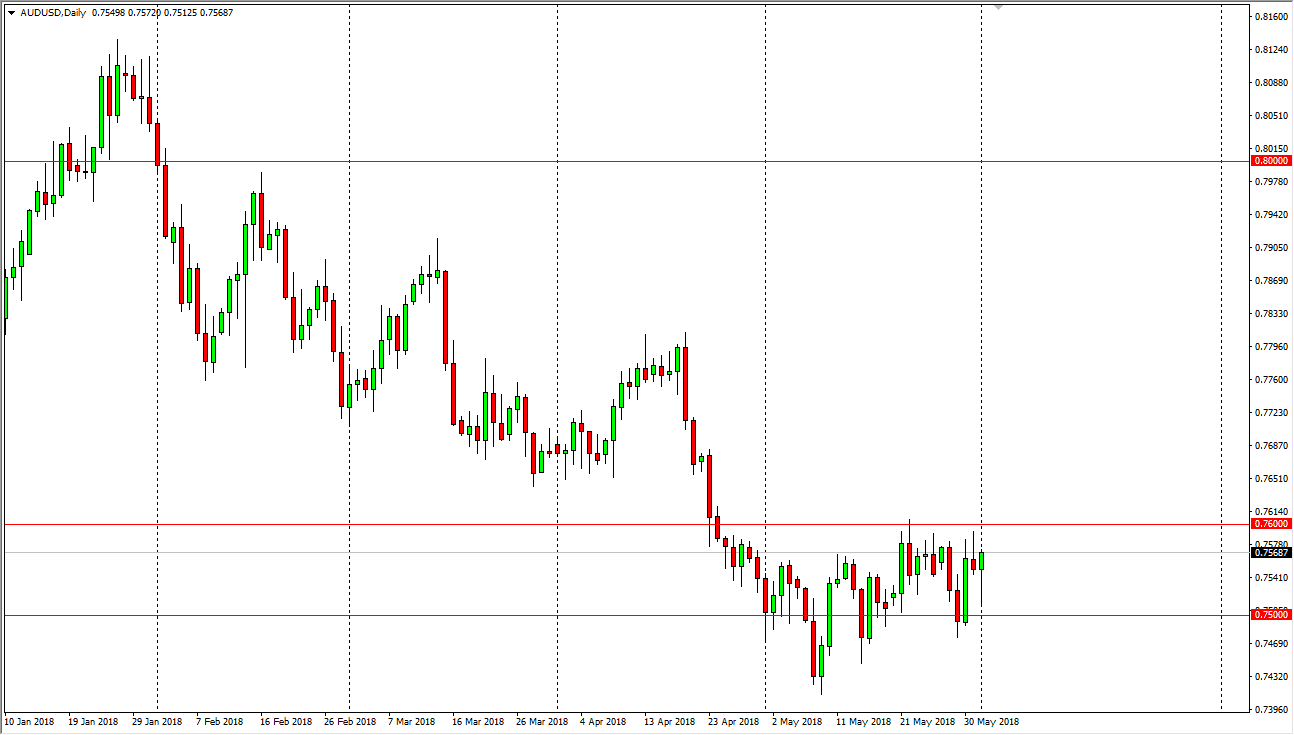

AUD/USD

The Australian dollar initially fell during the trading session on Friday but turned around to bounce from the 0.75 handle. By doing so, we did of forming a bit of a hammer, which of course is a bullish sign. We have a shooting star from the Thursday session working against that, so I think that the easiest trade to take is to buy this market if we can break above the 0.76 level just above. If we can break above that level, the market should continue to go much higher, perhaps reaching towards the 0.78 level. Ultimately, in the short term is likely that we will see a little bit of choppiness, but ultimately I think the hammer that form not only for the week, but also for the session on Friday suggests to me that we are going to see a move higher.