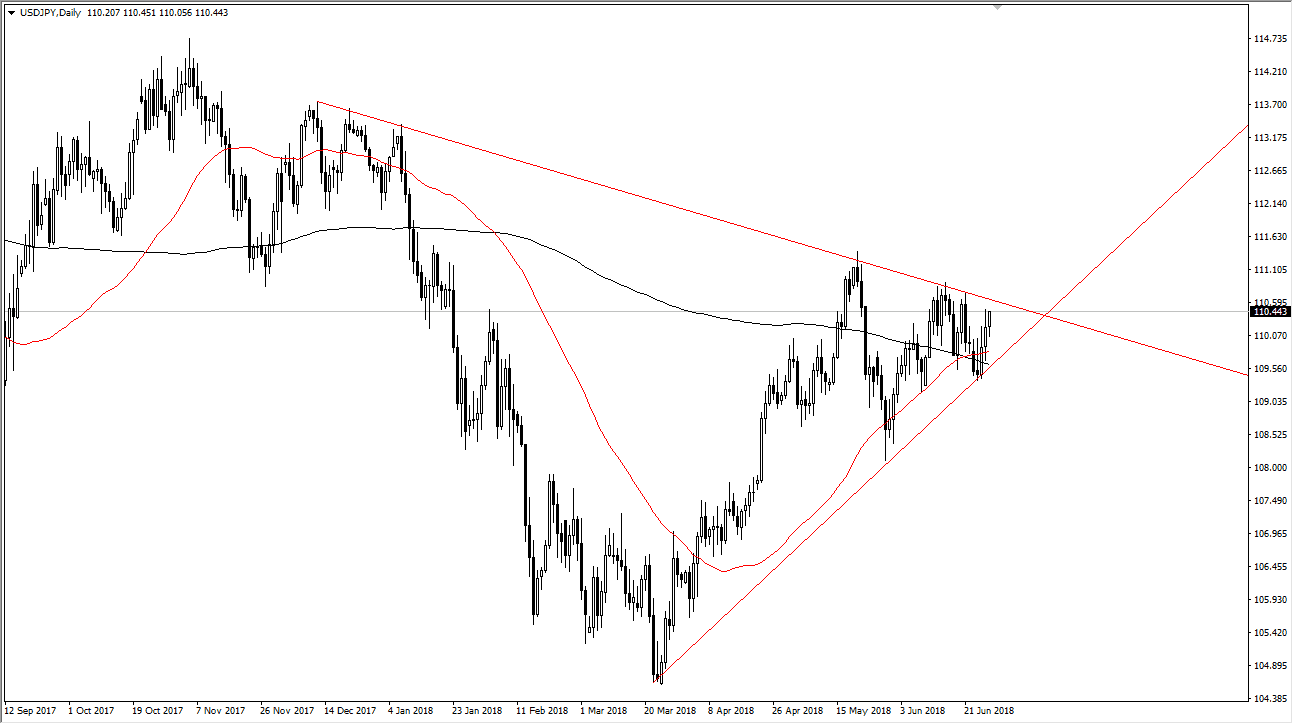

USD/JPY

The US dollar initially pulled back against the Japanese yen on Thursday but rallied towards the ¥110.50 level during the day. I have a couple of trendlines drawn on the chart, and it seems as if we are currently stuck between these two trendlines, and therefore I think that we continue to see a lot of noise. That makes a lot of sense, because there are a lot of headline risk out there, involving trade tariffs and trade wars. All things being equal though, if we can get that to calm down, I believe this pair goes higher as we should continue to look at higher interest rates coming out of the United States while the Japanese central bank isn’t anywhere near normalizing monetary policy. If we can break above the ¥111 level, I think this market can go higher.

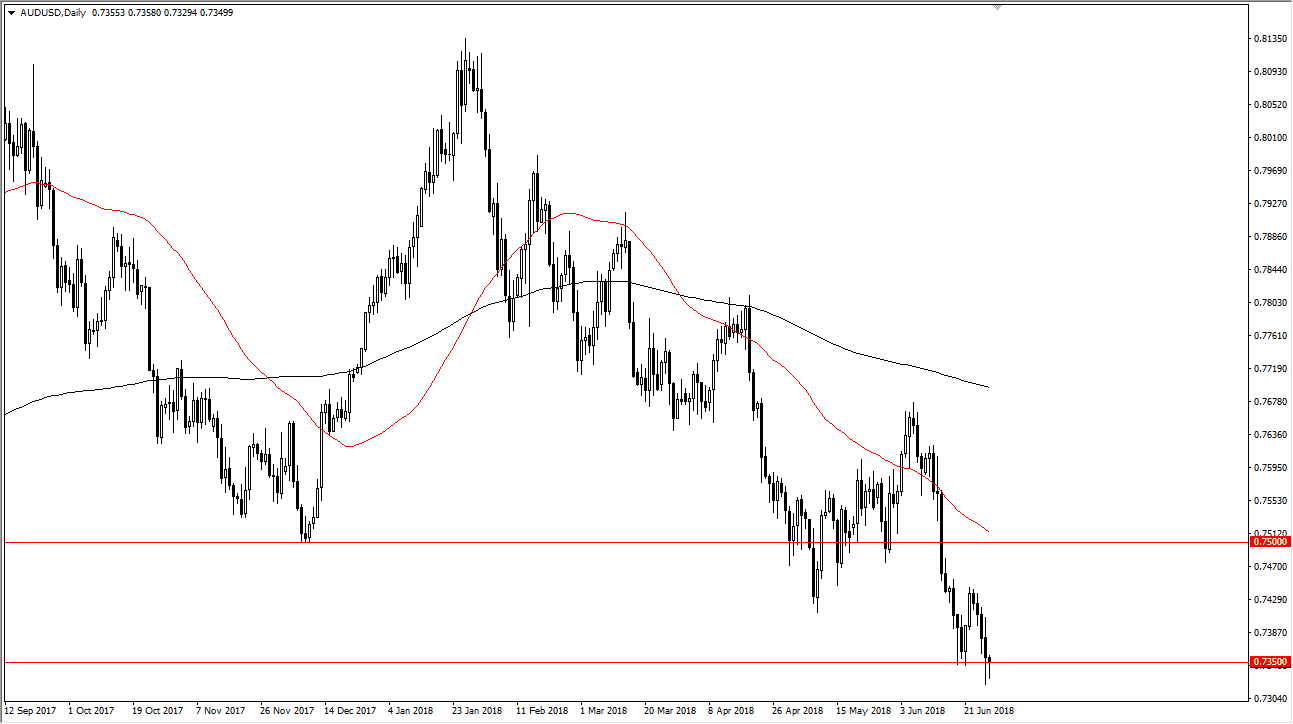

AUD/USD

The Australian dollar fell initially during the session on Thursday, breaking below the psychologically important 0.7350 level. This area has been supported several times, and the fact that we bounced again towards the end of the day does suggest just how hard it’s can it be to break this thing down. If we can, the market is very likely to go down to the 0.73 handle, and then the 0.72 level. Longer-term, we could be looking at a move to the 0.70. Rallies at this point should be thought of as selling opportunities, unless of course we can break above the psychologically significant 0.75 handle.

One thing that you should pay attention to is that we have made a fresh, new low, and that of course does bring in a certain amount of bearish pressure. I anticipate that rallies will probably be nice selling opportunities to pick up the US dollar “on the cheap.”