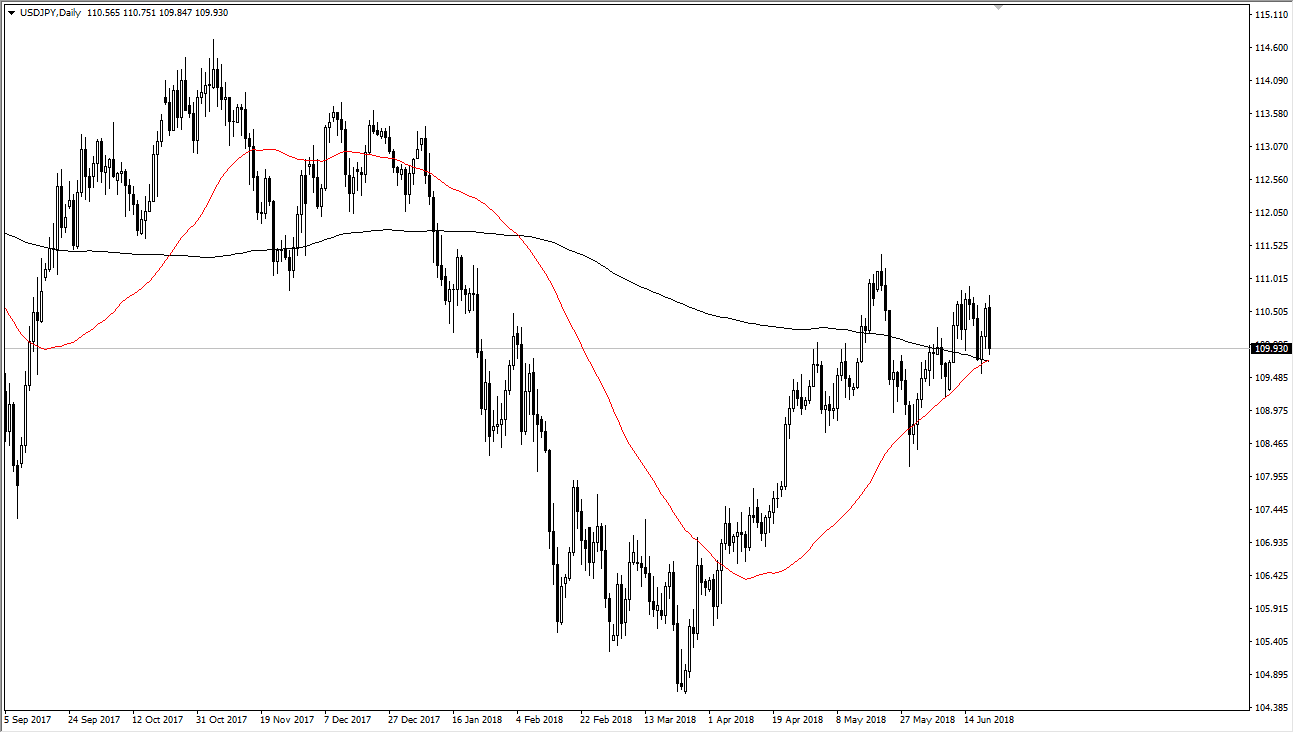

USD/JPY

The US dollar initially tried to rally during the day on Thursday but found enough resistance to turn things around and drive down towards the ¥110 level again. This is an area that features a lot of interest, and right now we are currently watching the 50 SMA and 200 SMA Cross on the daily chart. As we are crossing currently, it’s likely that we will see longer-term buyers get interested. I think that this market that is moving essentially based upon the whims and concerns of geopolitical trade. The interest rate differential between the United States and Japan certainly signifies that we should go higher. However, as we worry about tariffs being slapped on China from the Americans, and of course the other way around, it’s likely that the Japanese yen will continue to strengthen if things escalate.

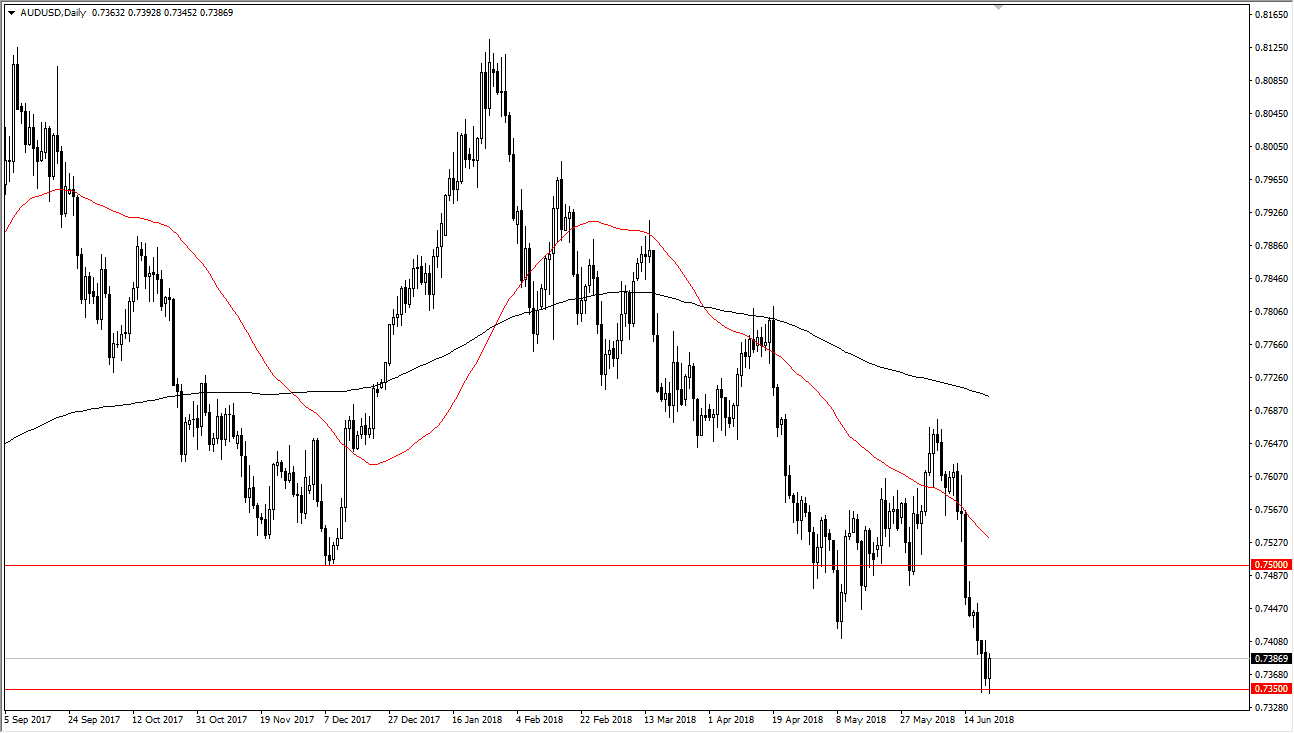

AUD/USD

The Australian dollar initially fell during the trading session on Thursday but found enough support at the 0.7350 level to turn things around. This is a very bullish sign, as it is an area that needs to hold to keep the Australian dollar afloat. However, if we were to break down below that level, it would be a very negative sign and I think that it would bring in fresh selling. In the short term, it looks as if we may try to rally towards the 0.74 level, possibly even the 0.75 level. That is an area where I would expect to see a lot of attention, so I think it will be difficult to break above 0.75 with any type of ease. Pay attention to the gold market, because it of course has the usual influence on the Australian dollar. It’s also important to pay attention to the trade spat, because as trade falls, that hurts exports coming out of Australia.