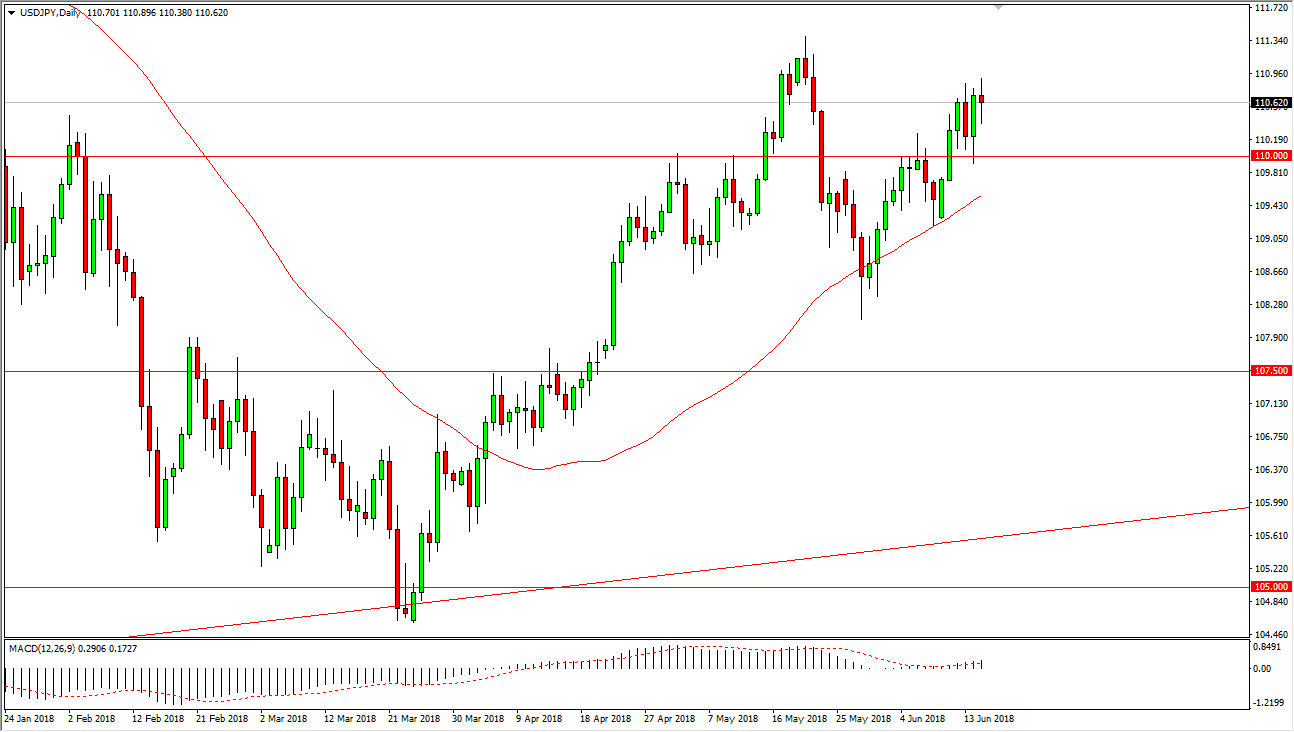

USD/JPY

The US dollar was very noisy against the Japanese yen on Friday, as we continue to see a lot of volatility in global markets. With the Americans slapping the Chinese with tariffs during the early part of the session, and then the Chinese responding in kind, that house a lot of concern creeping into the market. I think that the ¥110 level underneath is going to be support, so I think that when we do pull back, there should be a buyer somewhere underneath. However, if we break above the top of the candle, the market could then go looking towards the highs again. Overall, this market is going to be reacting to rhetoric between the Chinese and Americans more than anything else over the next several sessions from what I can see. The 50 SMA on the chart looks interesting as well, as it seems to be dynamic in its support.

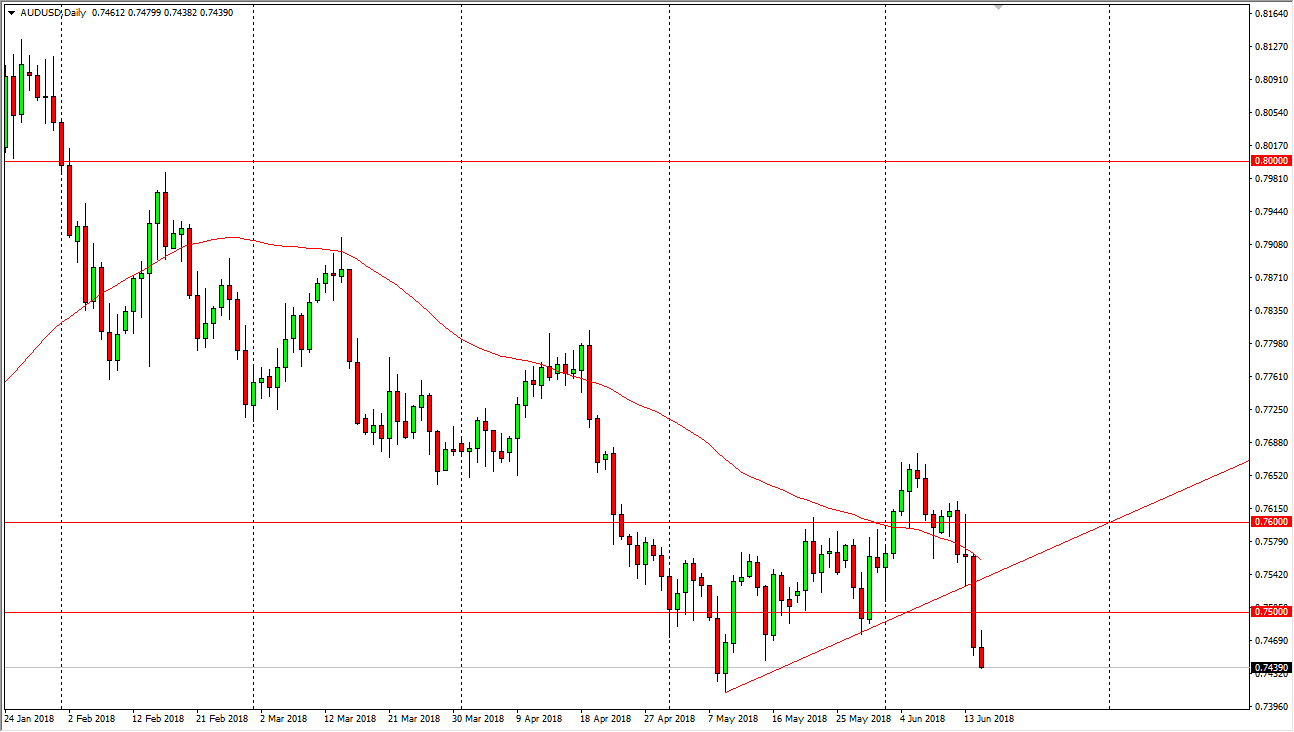

AUD/USD

The Australian dollar initially tried to rally during the day on Friday, but as those tariffs were announced the Australian dollar continue to fall. The market has broken through a short-term trendline, and of course a psychologically important level at the 0.75 handle. I think that the market will continue to be negative, and it now looks as if it is only a matter of time before we break down to the 0.7350 level, an area that was a major bottom previously. I think that we will target that area and could possibly even break down below there to reach towards the 0.70 level. The alternate scenario of course is that we rally, but I think that the 0.75 level and of course the previous uptrend line both could offer selling opportunities that signs of exhaustion.