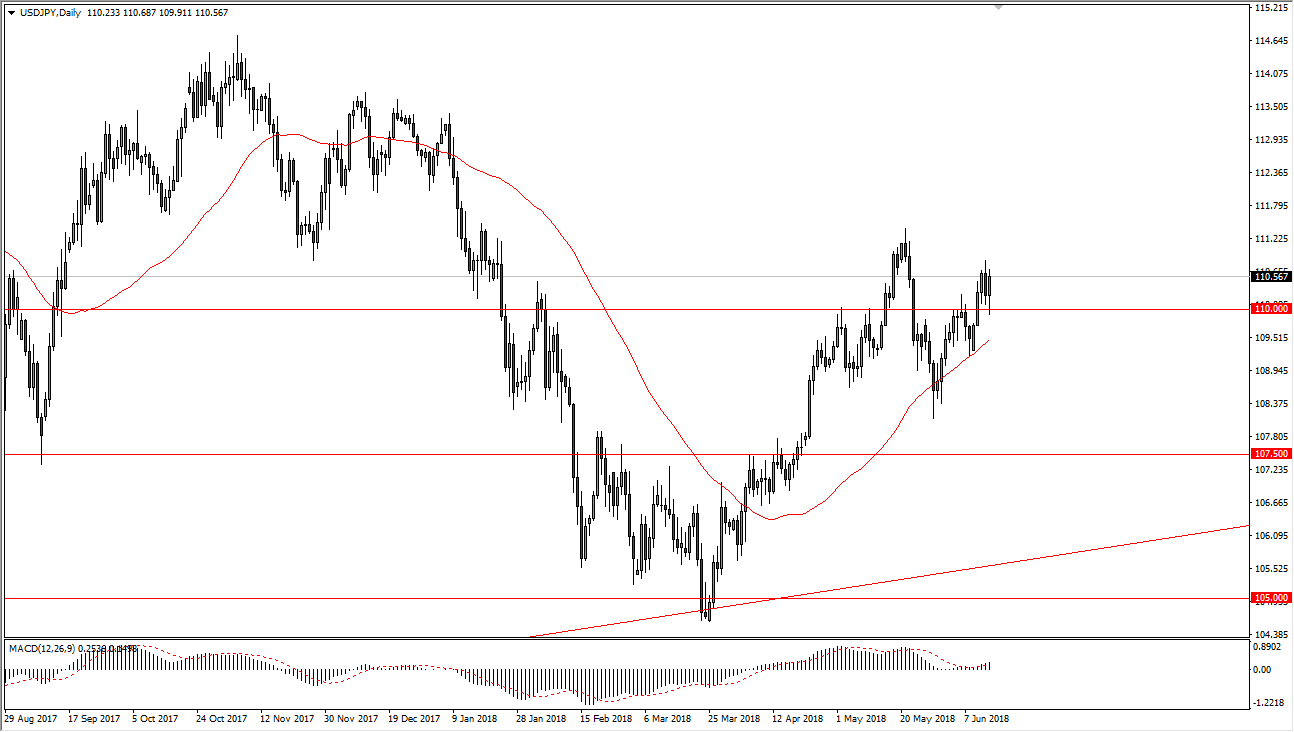

USD/JPY

The US dollar initially fell against the Japanese yen during trading on Thursday, pulling back to the ¥110 level. There is a previous resistance barrier there, and it now looks as if it should be supported. I think that the market will continue to be very noisy, but ultimately I anticipate that we go looking towards the ¥111 level next, and then perhaps even higher than that, maybe the ¥112.50 level. It appears to me that the ¥110 level is something that has proven itself to be resistance in the past several times, so at this point it would make sense that we should continue the upward momentum. Overall, this market is moving to a stronger US dollar in general, and I think that higher interest rates in America will continue to push to the upside. From a technical point of view, you can see that the red 50 day SMA on the chart has been reasonably reliable, therefore I think short-term pullbacks should be buying opportunities.

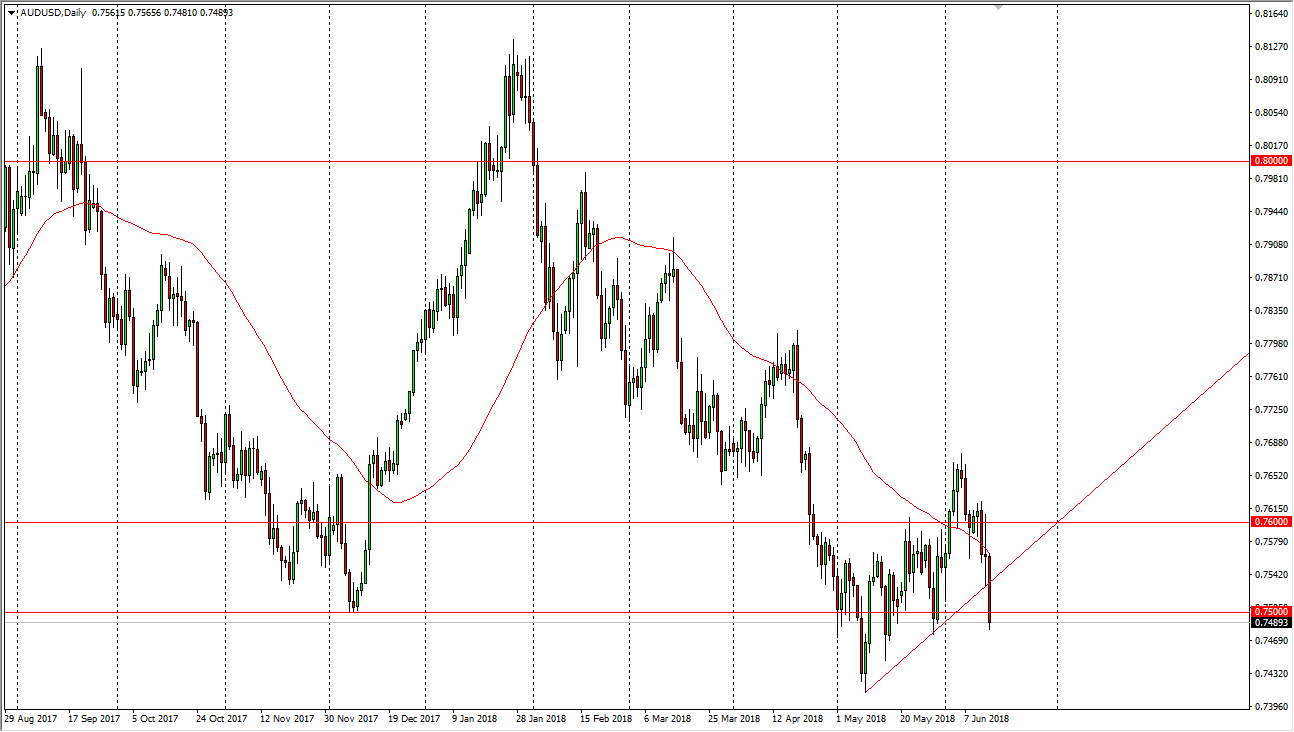

AUD/USD

The Australian dollar has broken down rather significantly during the day on Thursday, slicing through the short-term uptrend line that we had tried to confirm during the day on Wednesday, and then more importantly break down below the 0.75 handle. If we break down below the lows of the session for the day on Thursday, then the market probably goes down to the 0.7350 level. In general, I would look at this market with a bit of suspicion in either direction, because we had formed so many supportive hammers on the weekly chart previously, and for me I think that it’s going to be very difficult to get clarity in this region. Because of this, I anticipate that this market will continue to be difficult and therefore I would choose to stay away from it until we either get a fresh, new low and start selling, or if we break back above the uptrend line, and that I would be a buyer.