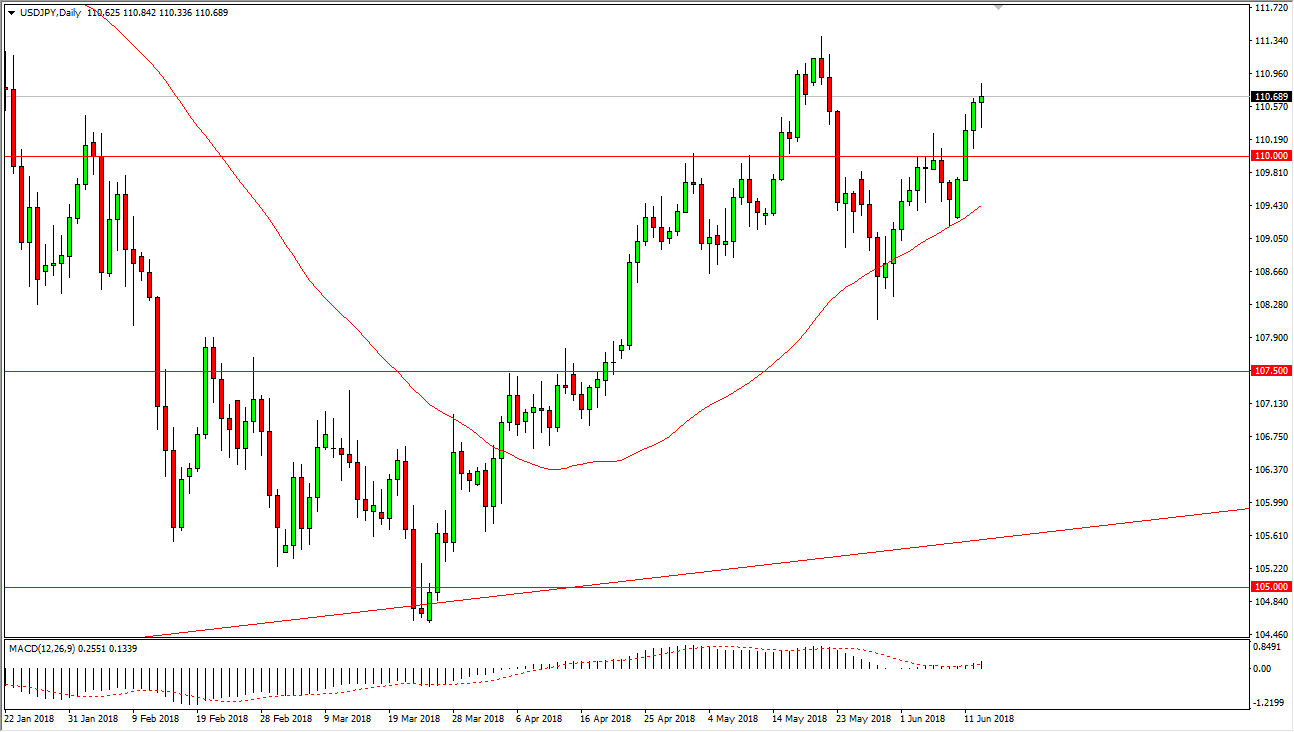

USD/JPY

The US dollar has been very noisy against the Japanese yen as you would expect during the day that the FOMC releases a statement. I believe that the market should continue to go back and forth, but ultimately should find buyers as the “risk on” trade should continue. I believe that the ¥110 level underneath is going to offer a bit of support, and I also recognize that the meeting getting out-of-the-way certainly helps. The market should continue to go towards the ¥112.50 level over the longer-term, and if the stock markets around the world continue to rally, I think that the USD/JPY pair should go right along with them. It looks as if we have several more hikes ahead, at least two more this year, so it makes sense that we continue to gain value.

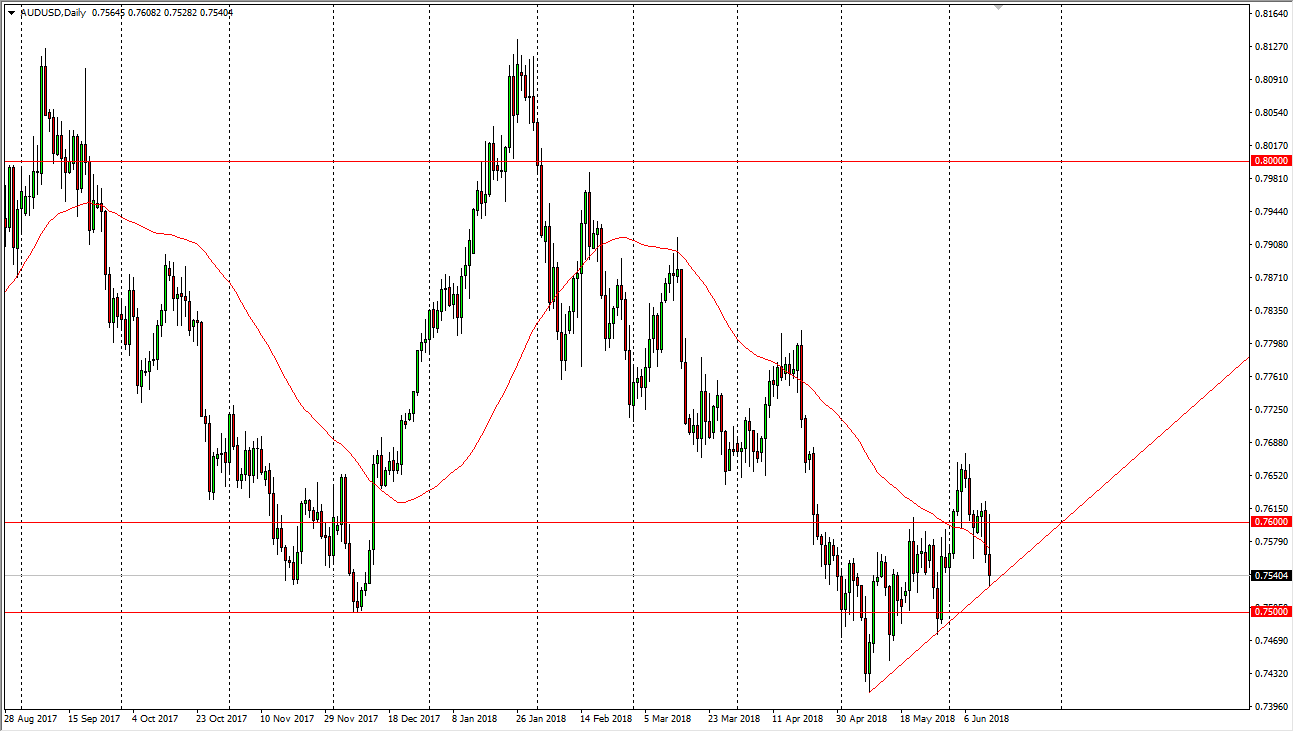

AUD/USD

The Australian dollar initially tried to rally during the day on Wednesday but found the area above the 0.76 level to be a bit too much. We pulled back after the FOC statement, as it suggested that we were going to get more interest rate hikes coming out of America, but I think in the end that will be thought of as a “known quantity.” When I look at this chart, I can also see that there is a short-term uptrend line just below, and more importantly there were several hammers on the weekly chart that were based around the 0.75 level. If we made a fresh, new low, that would be an extraordinarily bearish turn of events, but right now I think that it’s likely that we will see a bit of resiliency in this market, as these things take some time. A fresh new low would send this market down to the 0.7250 level. If we continue to rally, then it becomes a longer-term situation for the buyers.