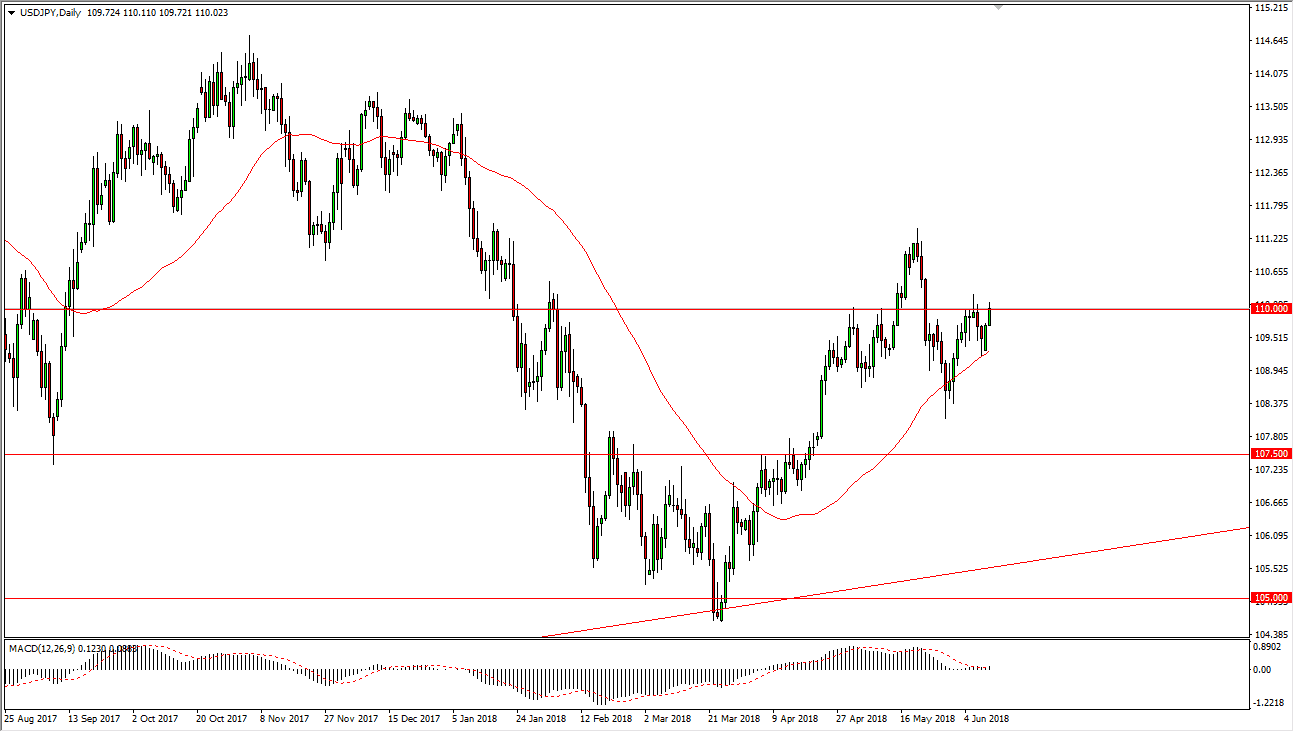

USD/JPY

The US dollar has rallied against the Japanese yen during the trading session on Monday, reaching towards the ¥110 level. I think if we can break above the shooting star from last week, the market should continue to go much higher. I think if we can break above the top of that candle, the market should continue to go higher, perhaps reaching towards the ¥111.50 level. The 50 SMA is underneath the market right now, offering a bit of dynamic support. I believe that the market is trying to price in the reaction of the summit between the United States and North Korea, and I think that if the meeting turns out to be reasonably productive, the pair will go higher based upon a “risk on” move. If we did break down below the 50 SMA, then I believe that the market will probably reach towards the ¥108 level.

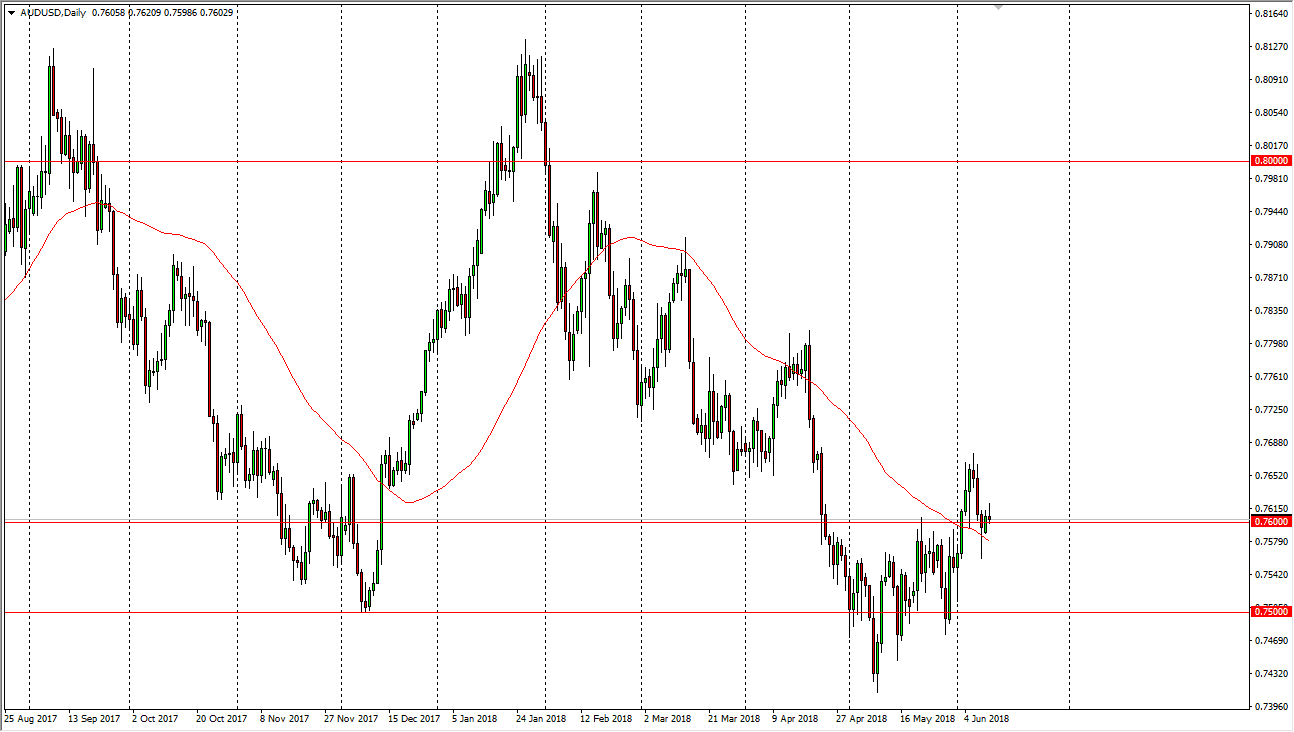

AUD/USD

The Australian dollar has tried to rally during the day on Monday but turned around and gave back most of the gains. I believe this is in reaction to a lot of confusion and concern right now as to how the meeting will go between the two countries today. I think that if we get good news, the market rallies in a “risk on” move as well, as the Australian dollar is certainly considered to be a “riskier currency.” If the meeting goes poorly, then I believe that the market will try to break down below the hammer on the Friday session, which would be rather negative.

The weekly chart shows several candles in a row near the 0.75 handle, and therefore I think that we have a massive amount of support underneath to keep this market alive. Longer-term, I think the market will probably continue to go looking towards the 0.78 level.