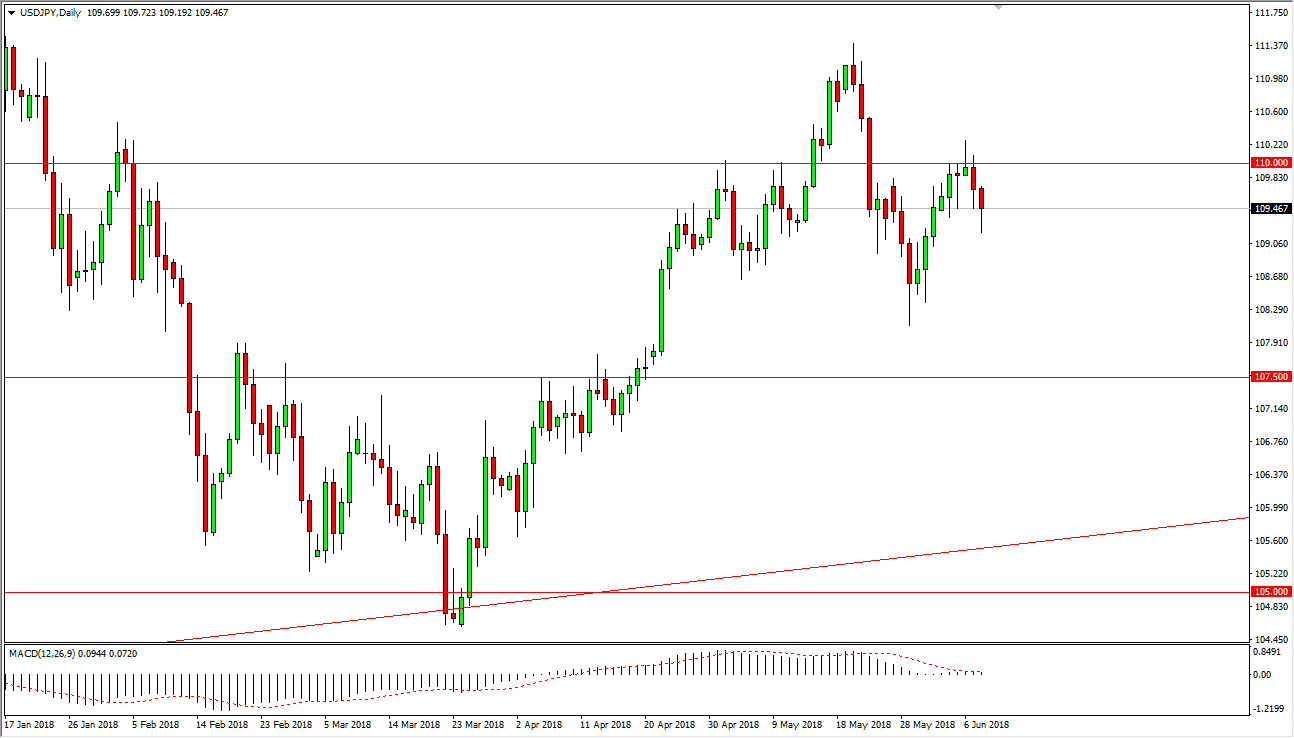

USD/JPY

The US dollar fell against the Japanese yen during a large portion of trading on Friday but did find a bit of support near the ¥109.20 level to bounce and form a hammer. I think that the market continues to meander around as we await the results of the G7 meeting, and of course the negotiations between the United States and North Korea. Ultimately, I do think that there is a buying opportunity that is trying to present itself, but it will obviously be very noisy in the meantime. With this in mind, I focus on this market from a longer-term standpoint and recognize that we are trying to build up enough pressure to finally get the ¥110 level in our rearview mirrors. I believe that there is massive support below near the ¥107.50 level.

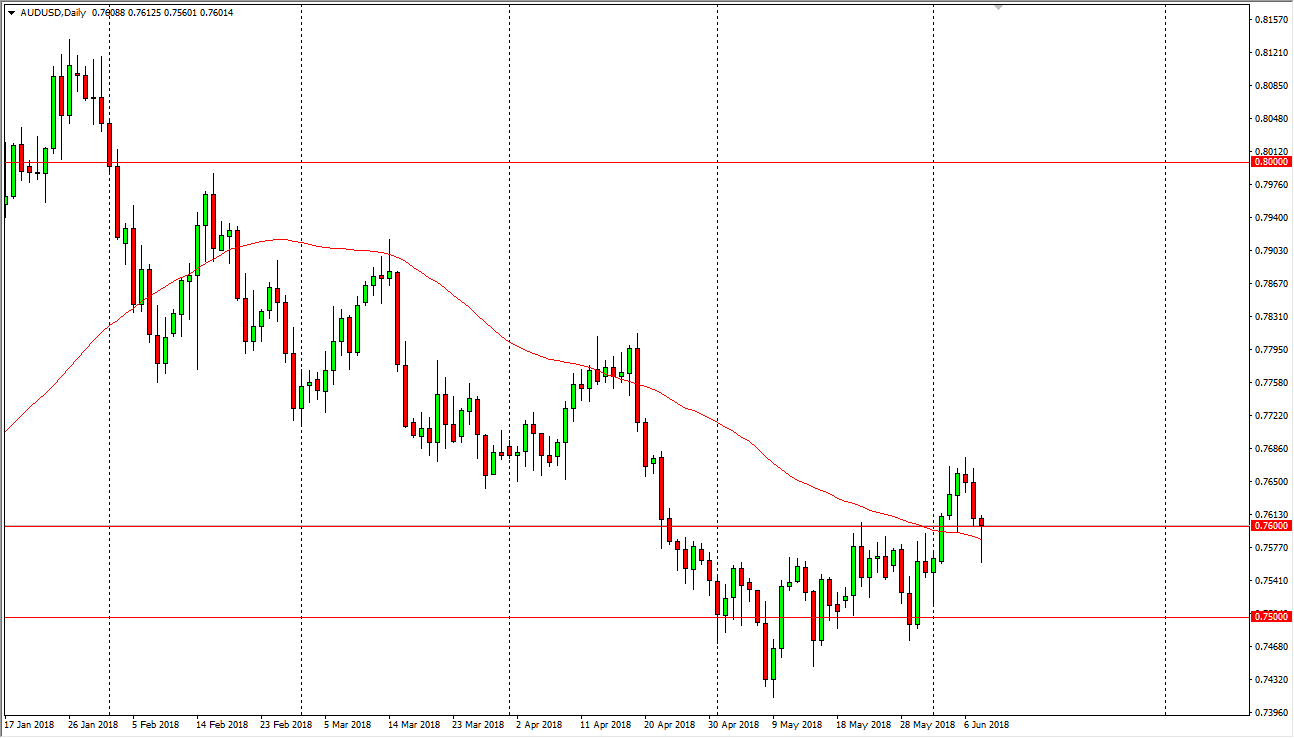

AUD/USD

The Australian dollar fell during the day as well but found enough support at the 50 day moving average in turn around and form a hammer. The hammer sits on top of a significant amount of noise, so that should continue to bring buyers into the marketplace. That’s not to say that is going to be easy to go higher, but certainly on the weekly charts we have formed several hammers around the 0.75 level, which of course is a very bullish sign. Pay attention to the Gold markets, they rally that could send this market higher as well.

The way we rallied and then pulled back to find support was perfect at the 0.76 level, so I believe that this could be one of the better trades going forward. If we break the top of the candle stick for the Friday session, I anticipate that the market will continue to grind its way higher.