Gold prices fell $6.58 an ounce on Wednesday as a stronger greenback offset safe-haven bids from escalating trade tensions between the U.S. and China. Federal Reserve Chairman Jerome Powell said “With unemployment low and expected to decline further, inflation close to our objective, and the risks to the outlook roughly balanced, the case for continued gradual increases in the federal funds rate is strong,” in a speech yesterday. U.S. economic data due for release Thursday is light and includes the Philadelphia Fed’s manufacturing index.

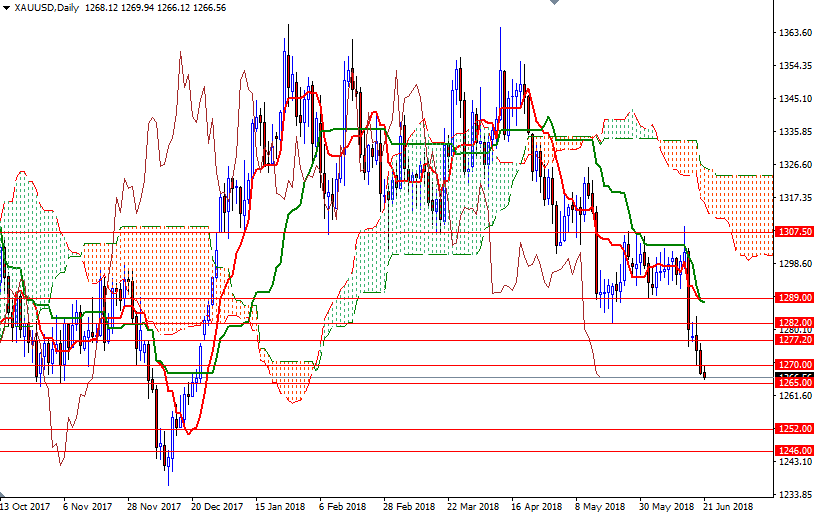

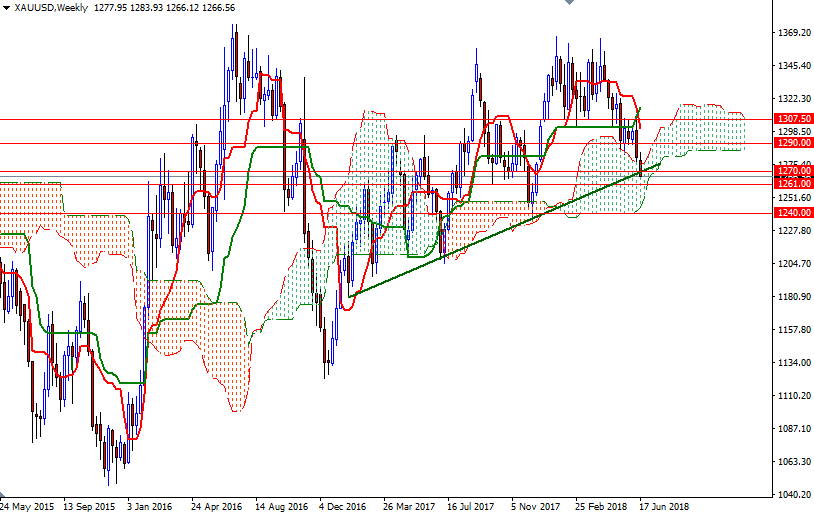

From a chart perspective, trading below the Ichimoku clouds (on the daily and the 4-hourly charts), along with the negatively aligned Tenkan-sen (nine-period moving average, red line) - Kijun-sen (twenty six-period moving average, green line), suggests that the bulls have the overall near-term technical advantage. It appears that the market will test the support at 1265 today. The bears will need to capture this camp to tackle 1261/0. If this strategic support fails to hold, look for further downside with 1257 and 1252/0 as targets.

To the upside, keep an eye on the 1270 level, which also happens to be the Tenkan-sen on the H4 chart. If XAU/USD can climb back above 1270, then the next target will be 1274/3. The bulls have to break through this barrier to make a run for 1277, the top of the hourly Ichimoku cloud.