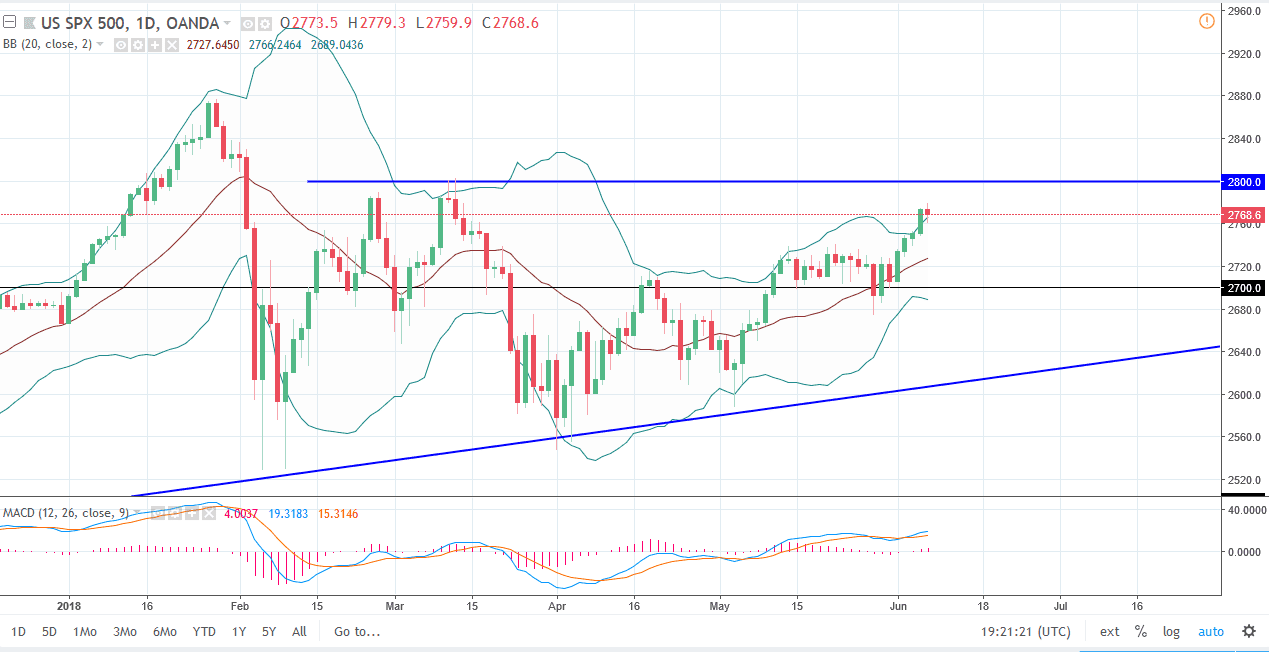

S&P 500

The S&P 500 initially fell during the trading session on Thursday, reaching down towards the 2760 level. We found enough support there to turn things around and form a bit of a hammer. If we can break above the top of the hammer, then I think the market goes towards the 2800 level above, which has been resistance previously. The 2800 level above should be massive resistance, and I think it will take a significant amount of momentum to finally break above there. Short-term pullbacks should be thought of as value, and I think there is a massive amount of support below at the 2750 handle. I believe that the market is trying to build up the necessary momentum to continue to go higher, and after that will go looking towards the 2880 handle.

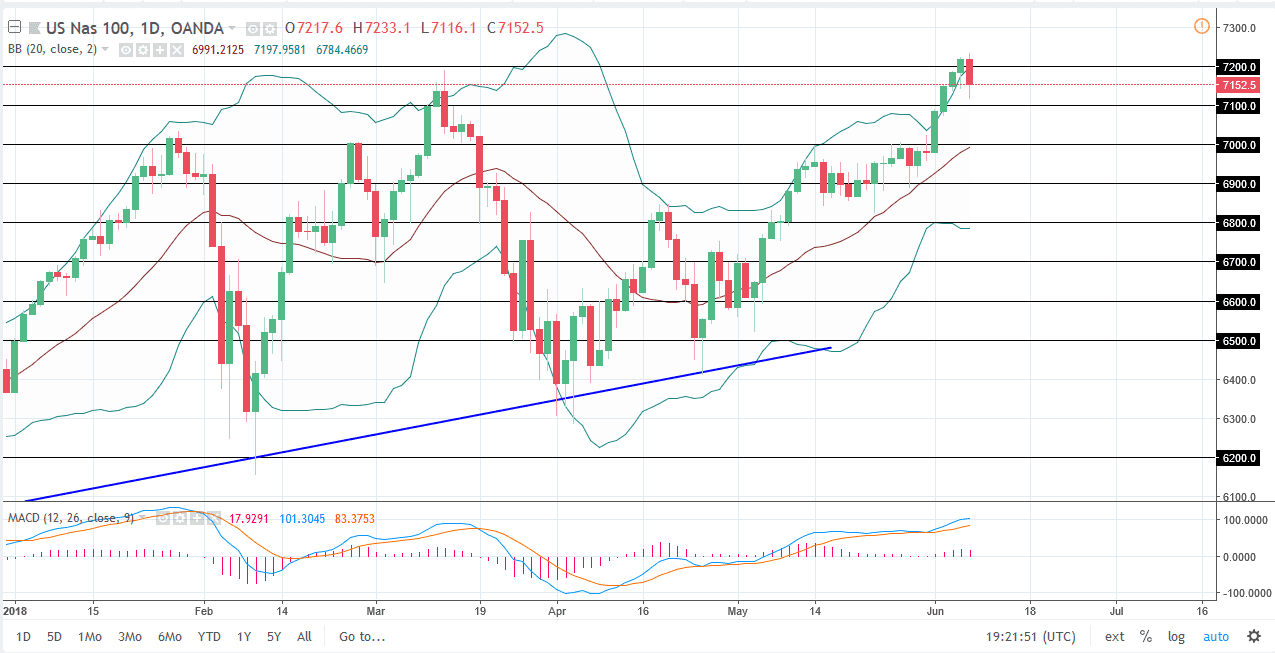

NASDAQ 100

The NASDAQ 100 fell a bit during the trading session on Thursday, reaching close to the 7100 level underneath. We did bounce from there though, and I think it’s only a matter time before the market will go looking towards the 7200 level. If we can break above the top of the range for the day on Thursday, then I think that the NASDAQ 100 goes higher. Technology stocks have been beaten down during the day, and I think that the markets will eventually play “catch up” with the other indices that I follow. The NASDAQ 100 will eventually break higher, but the question now is whether if we will find support now, or do we have to go a bit lower to find it? I do favor the upside, so shorting this market is something that I’m not going to do anytime soon. Stock markets in general should continue to favor buying, I believe that the NASDAQ 100 will certainly follow right along, eventually.