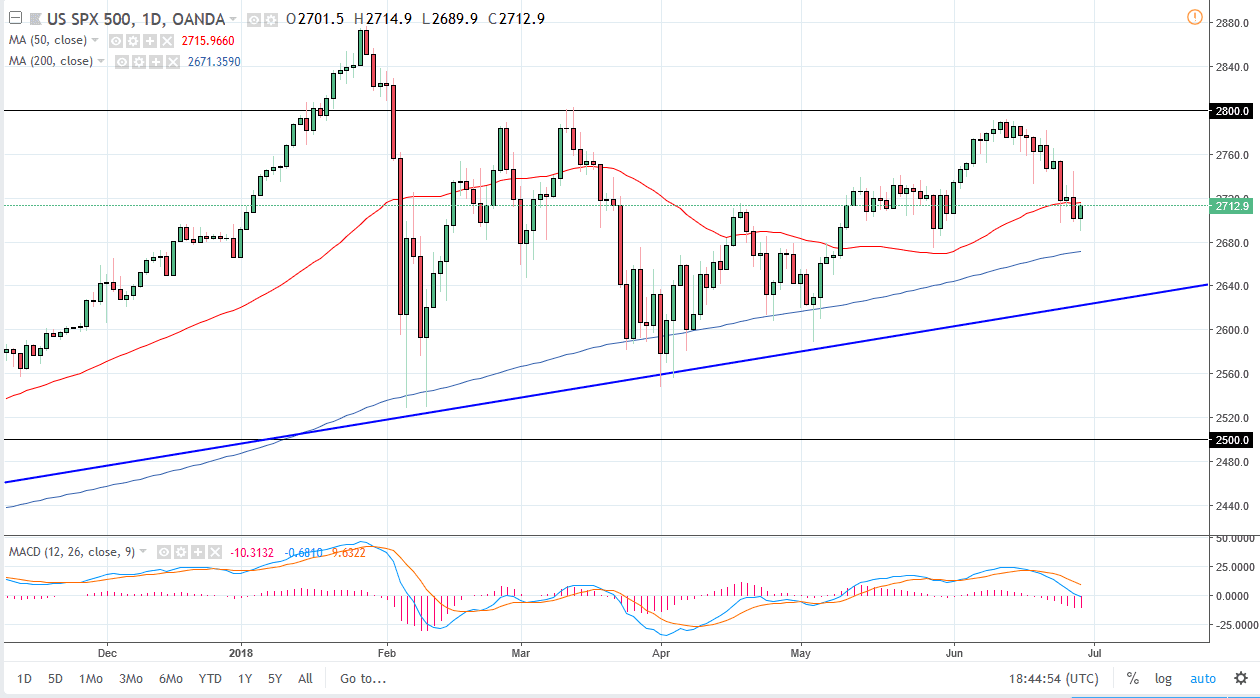

S&P 500

The S&P 500 initially dipped during trading on Thursday to continue with the selling pressure, but we turned right back around to break above the 2700 level as it appears there is a significant amount of support at the round figure. The 50 day DMA is just above, and I think at this point we will probably find some type of buying pressure. However, the 200 day DMA underneath should continue to keep the market somewhat supported, but obviously we are going to be very noisy as there is a significant amount of concern about trade wars and tariffs. The uptrend line underneath continues offer support as well, so I think that it’s only a matter time before we rally. If we do rally, the 2800 level is a major target, but if we can break above there then the longer-term market could continue to grind its way to the upside. Although things are a bit skittish, I’m not quite ready to start selling yet.

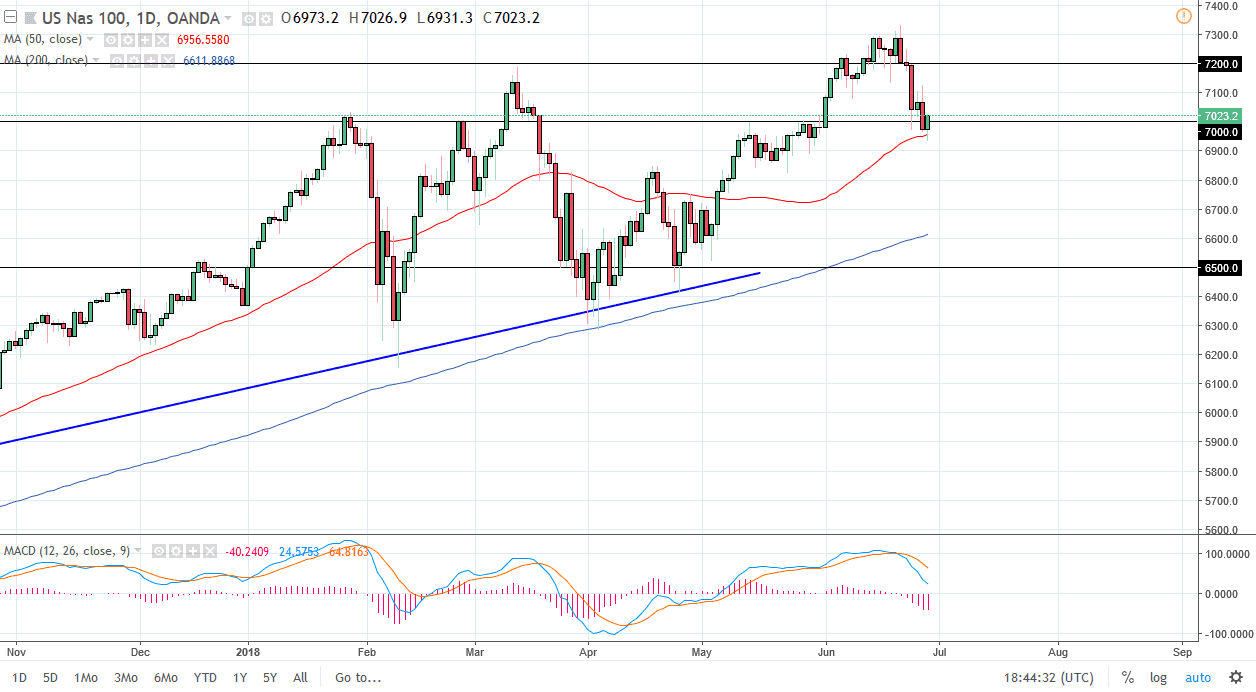

NASDAQ 100

The NASDAQ 100 initially dipped during the trading session on Thursday but found enough support at the 50 DMA to turn things around and break above the 7000 handle again. The 7000 level is not only psychologically important, but it is an area that we have seen a lot of order flow over the last several months. I believe that the market will probably try to make a move towards the 7200 level, but if we were to break down below the 6900 level, then we will unwind to the 6750 level again. Beyond that, there is an uptrend line and the 200 DMA underneath that should keep this market to the upside. I think that the market will continue to offer value for those who are patient enough to find it.