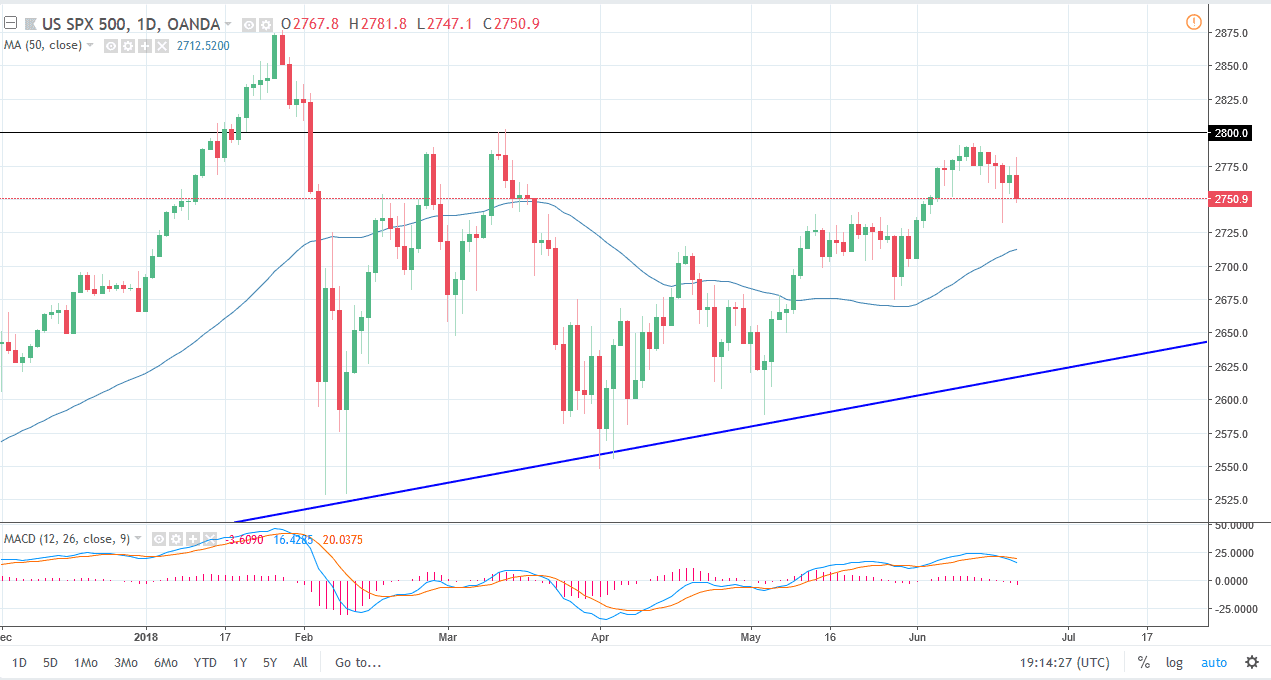

S&P 500

The S&P 500 has initially tried to rally during the day on Thursday but found enough selling pressure to turn around and reach towards the 2750 level. The candle looks very negative, and we had close towards the bottom of the range, which of course is a very negative sign. The 2725 level underneath looks to be supportive, and most certainly the round figure of 2700 should as well. Otherwise, we could turn back around and make a move towards 2800, but it’s not until we break above there that the market is free to go into the longer-term “buy-and-hold” attitude again. Essentially, I think that this market is continuing to move upon headlines about the potential trade war, and that of course is very unpredictable. Longer-term though, we are still very bullish though. That doesn’t mean it’s good to be easy, so if you are looking to buy, I would do so and very small bits and pieces.

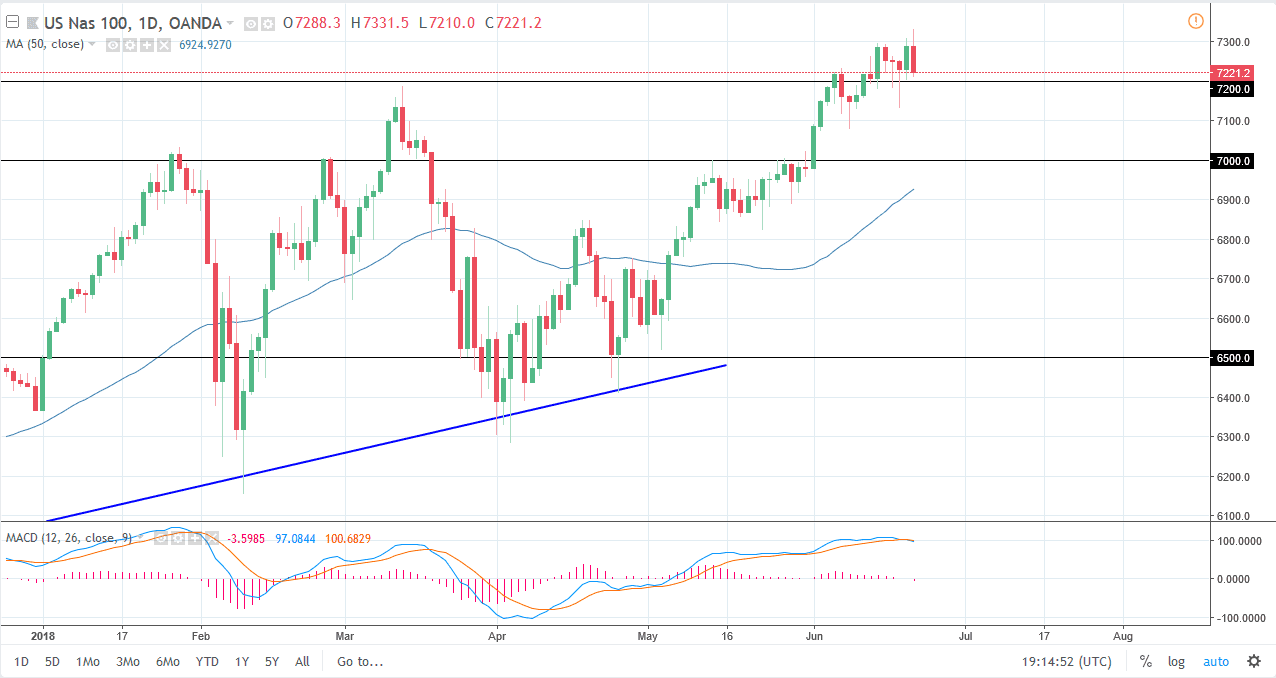

NASDAQ 100

The NASDAQ 100 also rallied to fresh, new highs again during the day on Thursday, but turned around to reach towards the 7200 level again. That’s an area that should offer a bit of support, and I think that support extends down to the 7100 level at the very least. I believe that the 7000 level is also a major support level, and essentially where the uptrend finds its “floor.” It’s likely that we will continue to see a lot of volatility, but the NASDAQ 100 has led the way higher for most of them, and I think that could continue to be the way forward. I think that the market here rallying could be a bit of a “canary in the coal mine” or bullish pressure in other indices. In the meantime, it looks like the market may pull back, but in the end that could only offer value from a technical standpoint.