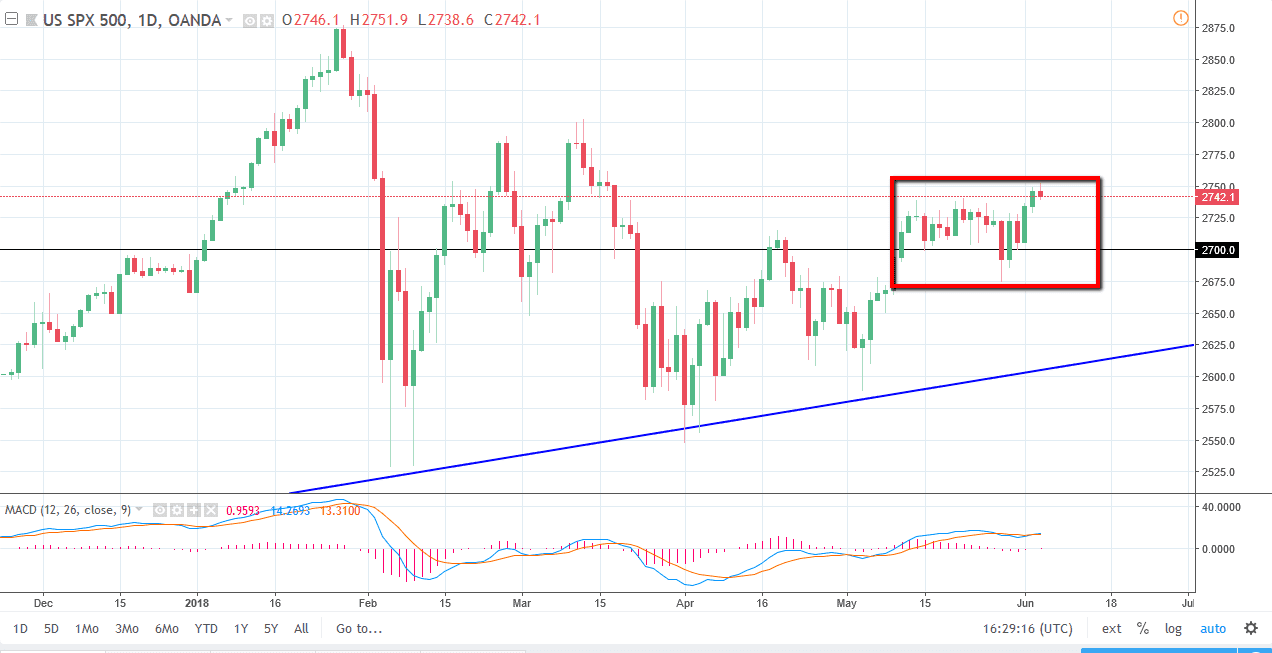

S&P 500

The S&P 500 initially tried to rally during the trading session on Tuesday but found enough resistance at the 2750 level to turn around. There is a significant amount of support underneath though, and I think it’s only a matter time before the buyers get involved. I believe that the 2700 level is psychologically important, and that it extends down to the 2675 level. Beyond that, there is a major uptrend line that should continue to keep the market afloat. I think that the alternate scenario is that we break above the top of the shooting star, which of course shows strength as well. I do believe that the S&P 500 continues to climb, but we may need to pullback to find a bit of value first. There are a lot of moving pieces around the world, not the least of which would be talks of trade wars, so expect volatility.

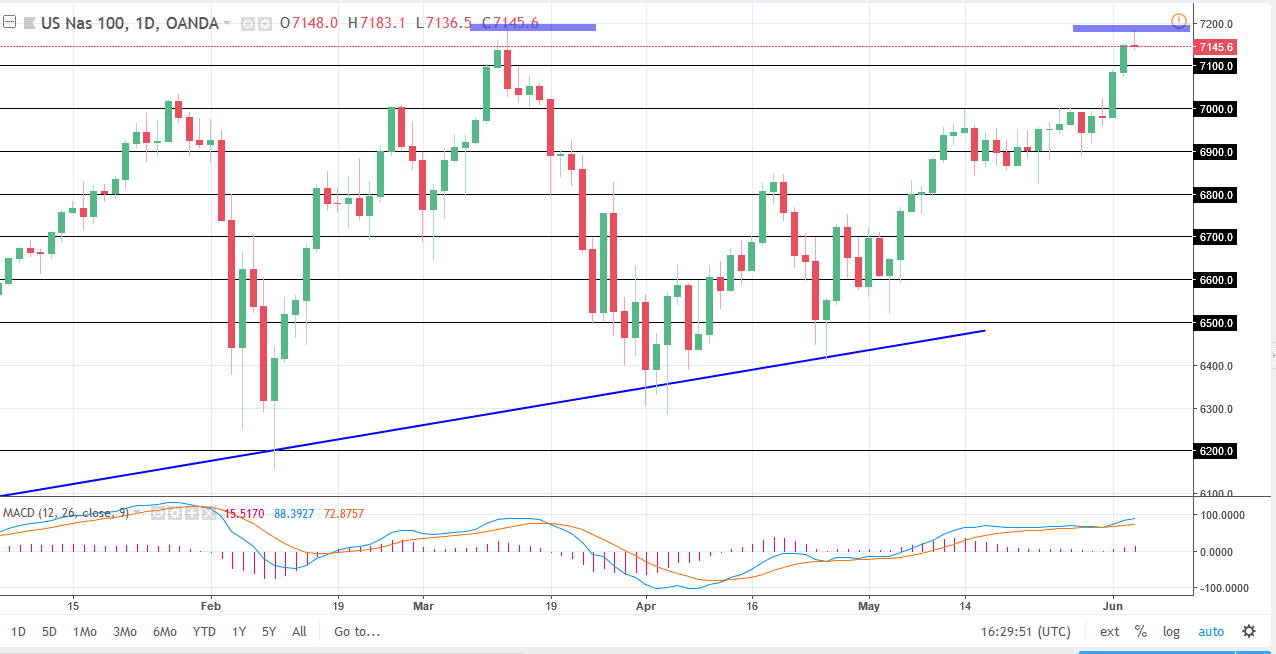

NASDAQ 100

The NASDAQ 100 rallied initially during the day but turned around of form a bit of a shooting star as I record this. However, one thing that I would be concerned about is that the 7200 level looks to be forming a bit of a “double top.” That doesn’t mean that we are going to turn around and fall apart, just that it’s likely that we may need to pullback to collect a bit of momentum to make that breakout. Obviously, a move above the 7200 level would be very strong, it should send this market much higher. I believe that the 7000 level below is a bit of a “floor”, and of course 7100 should also be supported. I think you should be looking at dips as value, not some type of melt down or negative sign.