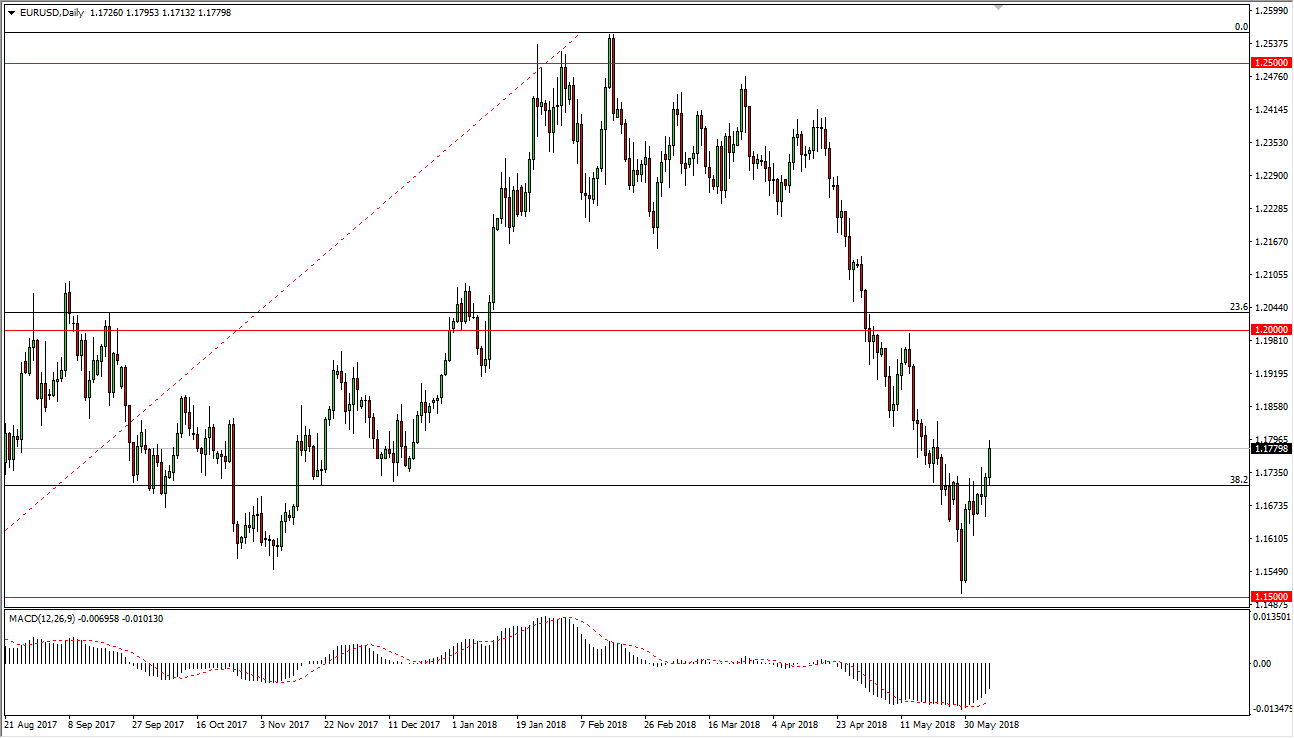

EUR/USD

The EUR/USD pair has rallied significantly during the trading session on Wednesday, reaching towards the 1.18 level. I suspect that we will continue to see bullish pressure, but a short-term pullback might be necessary to build up the momentum to break above the 1.18 handle. I think that the market should continue to be bullish in the short term and could get super charged if the Italians come to some type of consensus. Beyond that, there is talk of the ECB leaving quantitative easing sooner rather than later, so that could put upward pressure on the Euro as well. Even so, we are oversold, and the 1.15 level is massive support. I think that the bounce makes sense, and the hammer on the weekly chart was the first hint that we were ready to continue to go higher.

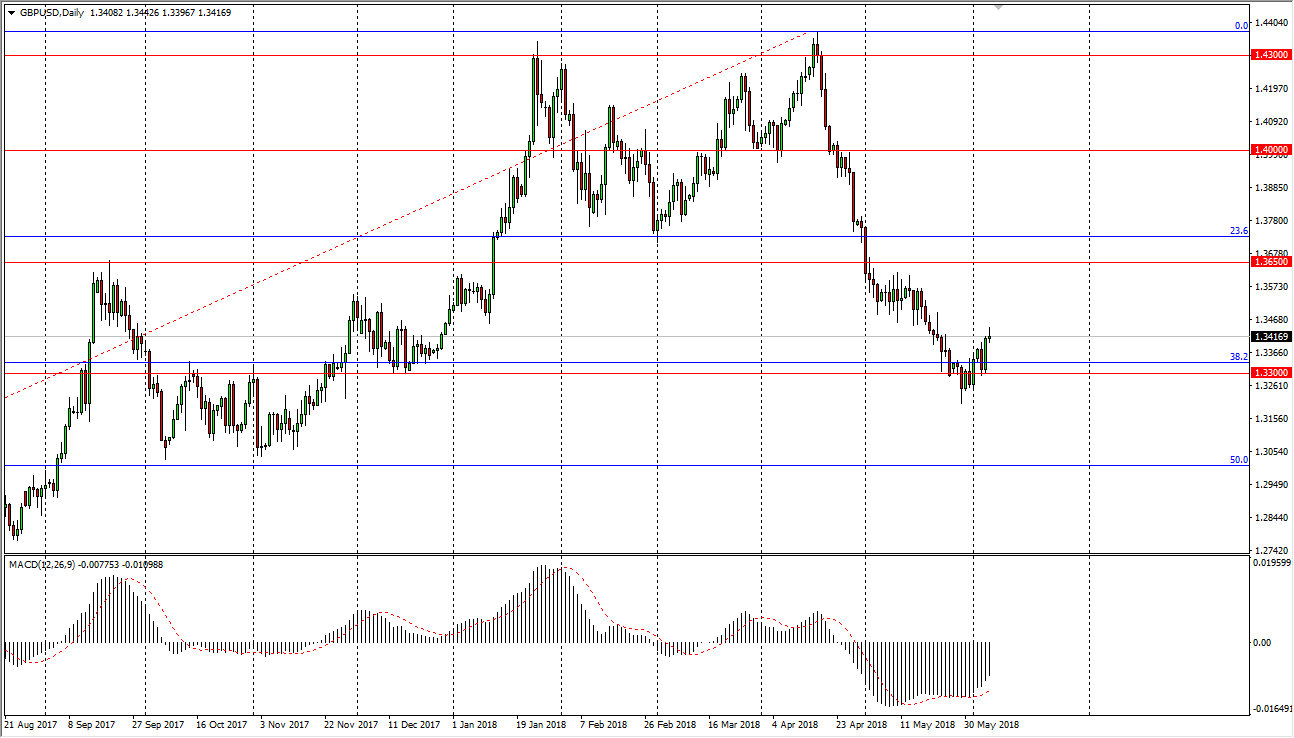

GBP/USD

The British pound rallied a bit during the trading session on Wednesday but did pull back to form a bit of a shooting star. I think that we may struggle to go a bit higher, and a bit of consolidation may be needed before we make our next move. I think that the 1.33 level will continue to be supportive, but if we can break above the top of the shooting star from the session, then the market could go to the 1.35 level next, and then possibly the 1.3650 level. That being said, I think that this is a necessary bounce, because we have broken down so drastically. We are most certainly in a downtrend, so I think that the overall attitude should continue to be negative, but certainly it’s been overdone. The next couple of days should continue to show an attempt to rally.