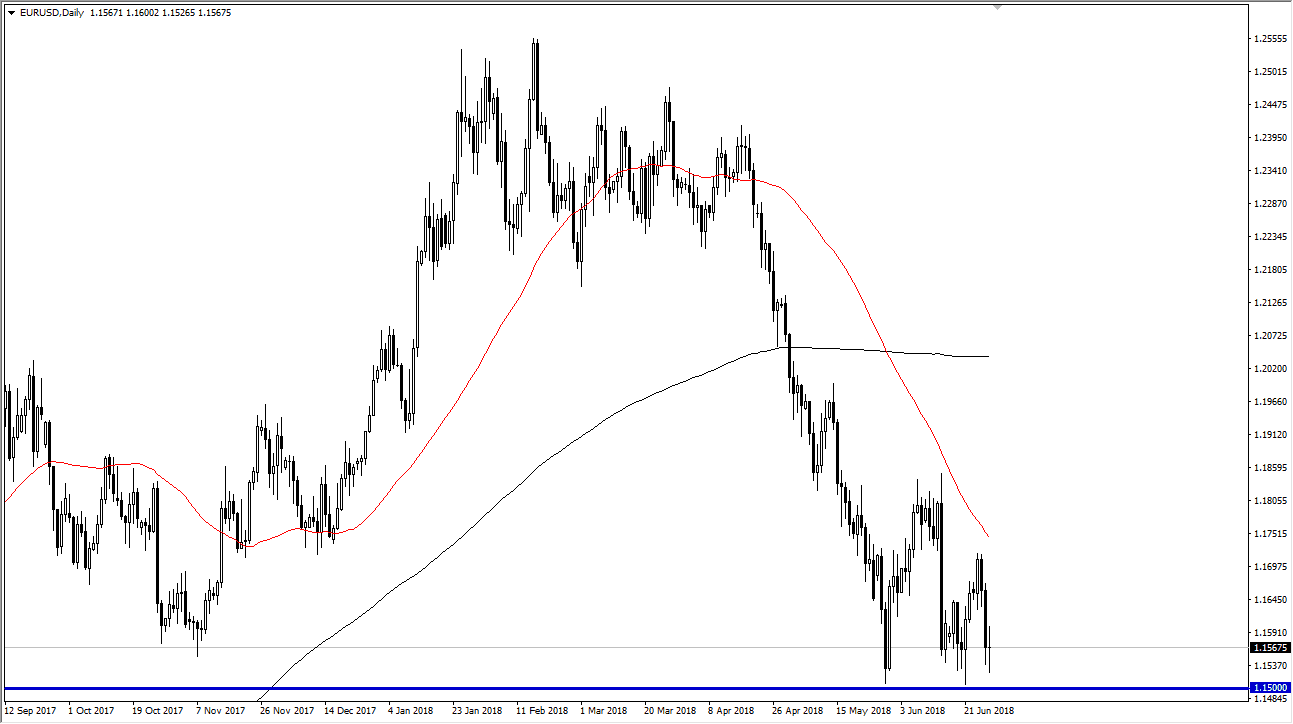

EUR/USD

The Euro has been extraordinarily noisy during the trading session on Thursday, as we dance around just above the psychologically and structurally important 1.15 handle. At this point, I anticipate that rallies will continue to run into trouble, because there are so many “risk off” scenarios out there. Trade tariffs are front and center, but we also need to worry about the longevity of Angela Merkel’s career. At this point, there are far too many questions about the EU to be comfortable owning the currency for the long term. However, I would also be the first to point out that the 1.15 level is massive support as it was massive resistance for a couple of years, so we are clearly trying to make a decision as to where we are going longer-term. In the meantime, it looks as if the sellers are becoming a bit more aggressive, but I would not look for major moves quite yet, as waiting for clarity is probably the best way to trade this market.

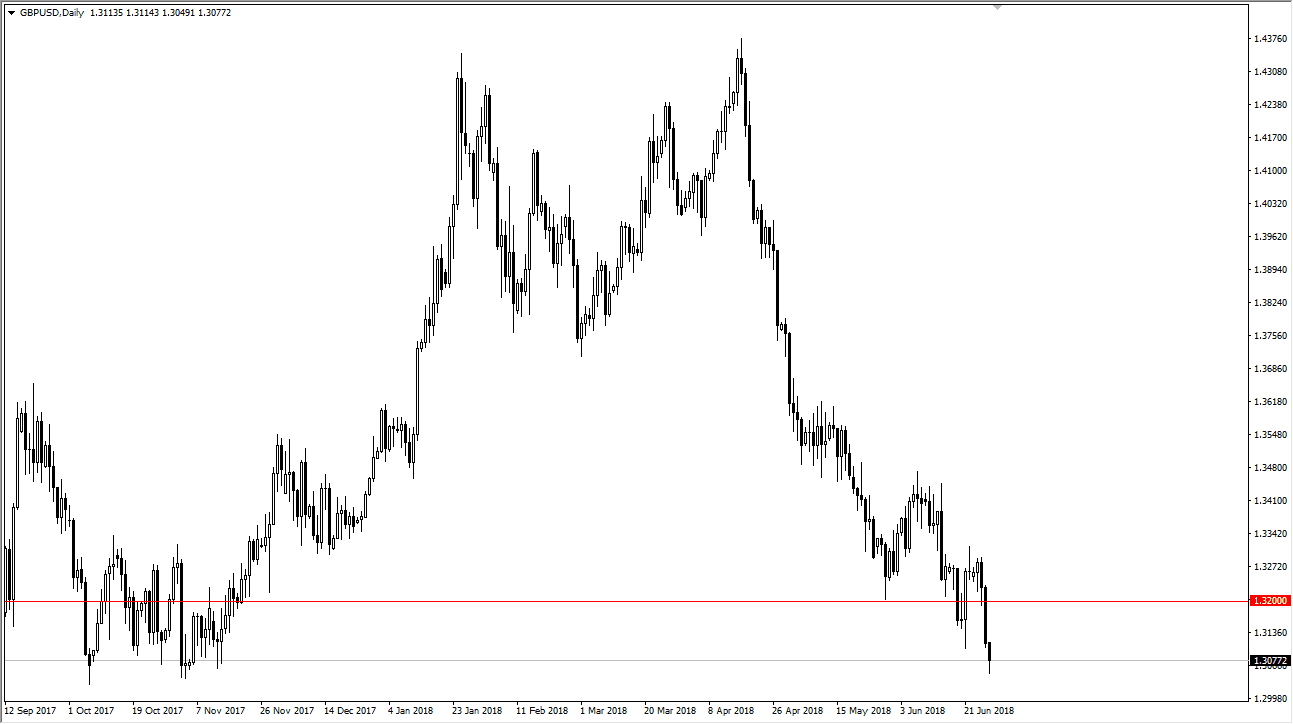

GBP/USD

The British pound has fallen a bit during the trading session again on Thursday, reaching down towards the 1.3050 level. I think there is a significant amount of support at the 1.30 level as well, and I think currently that any time this market rallies, it is likely to be an opportunity for people to start selling again. I believe that the 1.32 level should offer a significant amount of resistance, as it was psychologically important. In fact, I’m not comfortable buying this market until we break above the 1.35 level or form some type of longer-term “buy-and-hold” type of candle, perhaps on the weekly chart at the 1.30 level. Expect volatility, but clearly it looks as if the US dollar continues to strengthen.