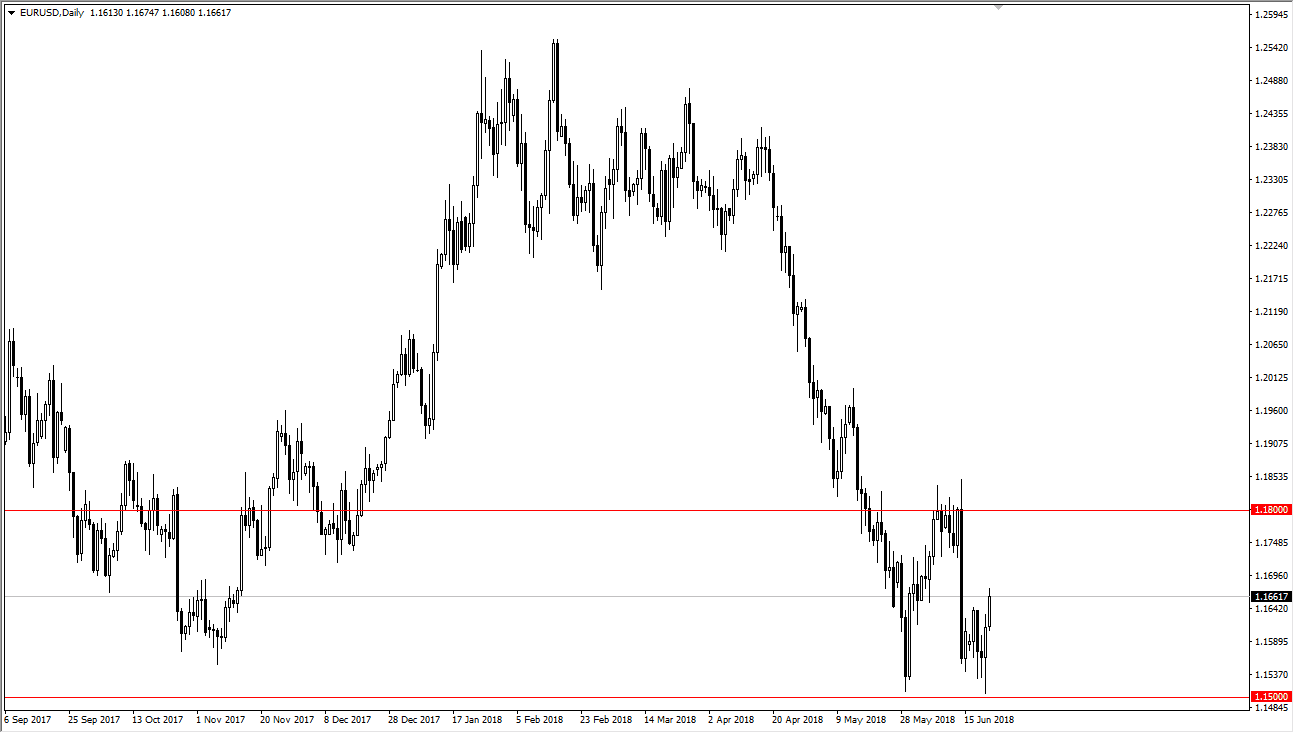

EUR/USD

The EUR/USD pair rallied a bit during the trading session on Monday, breaking above the 1.1650 level. It looks as if we are ready to continue to go higher, but at this point it also looks as if we are essentially in a larger consolidation area. The 1.18 level above offers a significant amount of resistance, based upon the massive selloff that we had seen last week. I think the bounce breaking a bit of resistance suggests that we are probably going to try to get back to the upside. The 1.15 level underneath offered the support that it needed to, based upon the longer-term weekly charts. The fact that we have bounced from the 1.15 handle, that tells me that we are not ready to break down and it’s very likely that we will continue to find buyers underneath. That being said, I believe the 1.18 level above is very resistive.

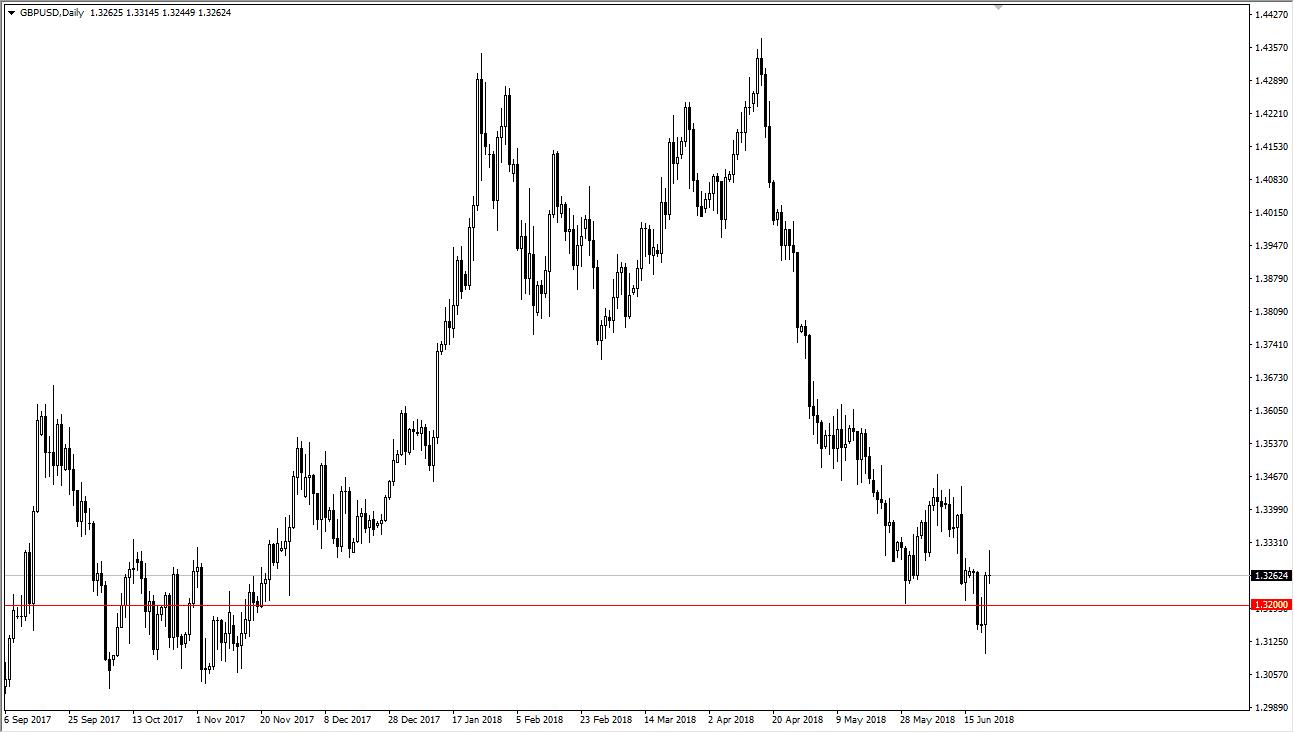

GBP/USD

The British pound initially tried to rally during the day on Friday but turned around to form a shooting star. However, at the same time we have a very strong hammer based upon the weekly chart, and that of course is a very bullish sign. I think if we can break above the top of the shooting star on the Friday session, we continue to go much higher, perhaps reaching towards the 1.35 handle. On the other hand, if we pull back from here and break down below the Thursday session, that would be very negative. I believe at this point, we are more than likely going to continue to see bullish pressure though, because the Bank of England was a bit more hawkish than anticipated on Thursday. I think that throws some questions into what we have seen lately.