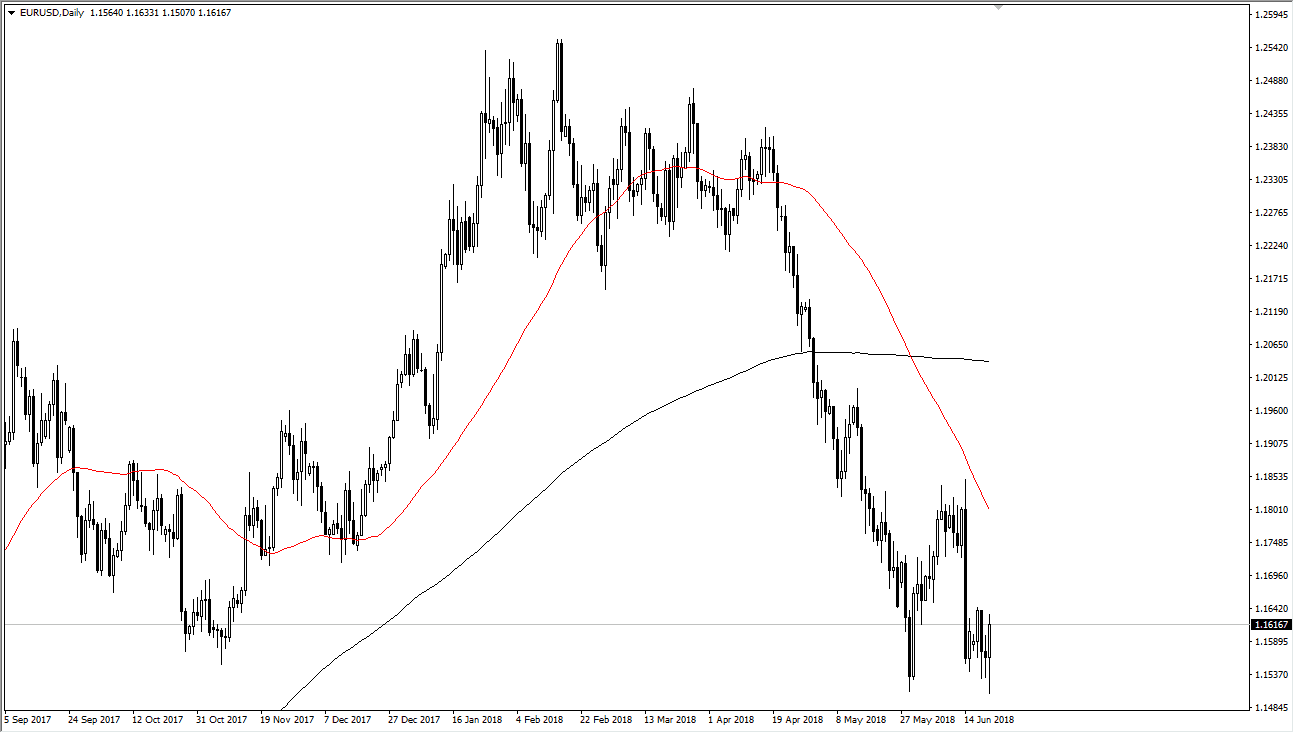

EUR/USD

The Euro initially fell during trading on Thursday, reaching down towards the 1.15 level. This is an area that I have been talking about for some time, and it has been crucial on longer-term charts. This was resistance that had been effective for a couple of years, so breaking above there is a very strong sign. We have rallied significantly from that point, and now find ourselves testing it again, but this time for support. It should continue to hold, based upon market memory, and if the candlestick on Thursday is any indication, it’s likely at the very least we are going to see a bit of consolidation in this area. If we were to break down below the 1.15 level, it would be a major turn of events. I think that the 1.15 level is an area where it makes sense that a lot of longer-term investors will be looking to value hunt.

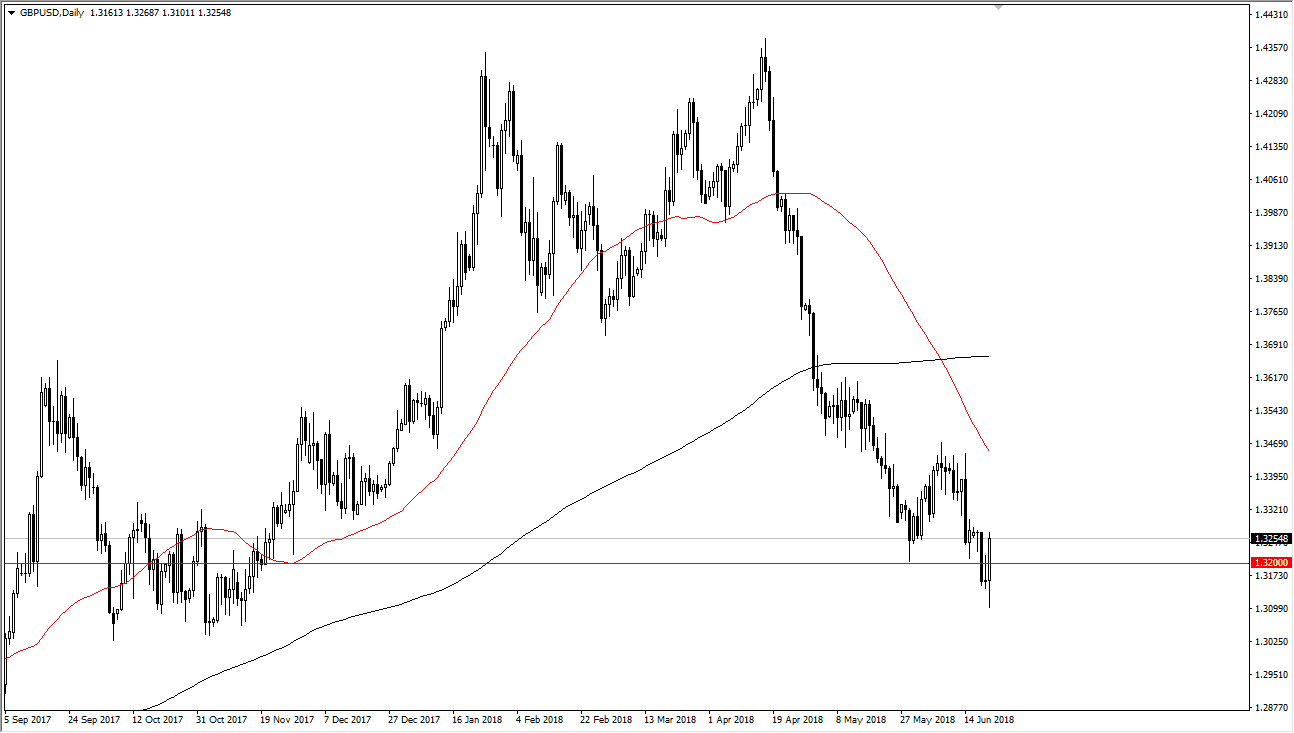

GBP/USD

The British pound has initially broken down during the day on Thursday but turned around to break above the 1.32 level. The market breaking above there is a very bullish sign, but I still think there is plenty of resistance above. The reaction was due to the Bank of England statement being much more hawkish than anticipated. This is a turn of events as far as attitude is concerned, but quite frankly there’s so much in the way of noise just above that I think it’s good to be difficult to continue to push. I believe it’s only a matter of time before the sellers come back, and it’s not until we cleared the 1.35 level that I would believe the rally to be one that is one we should follow.