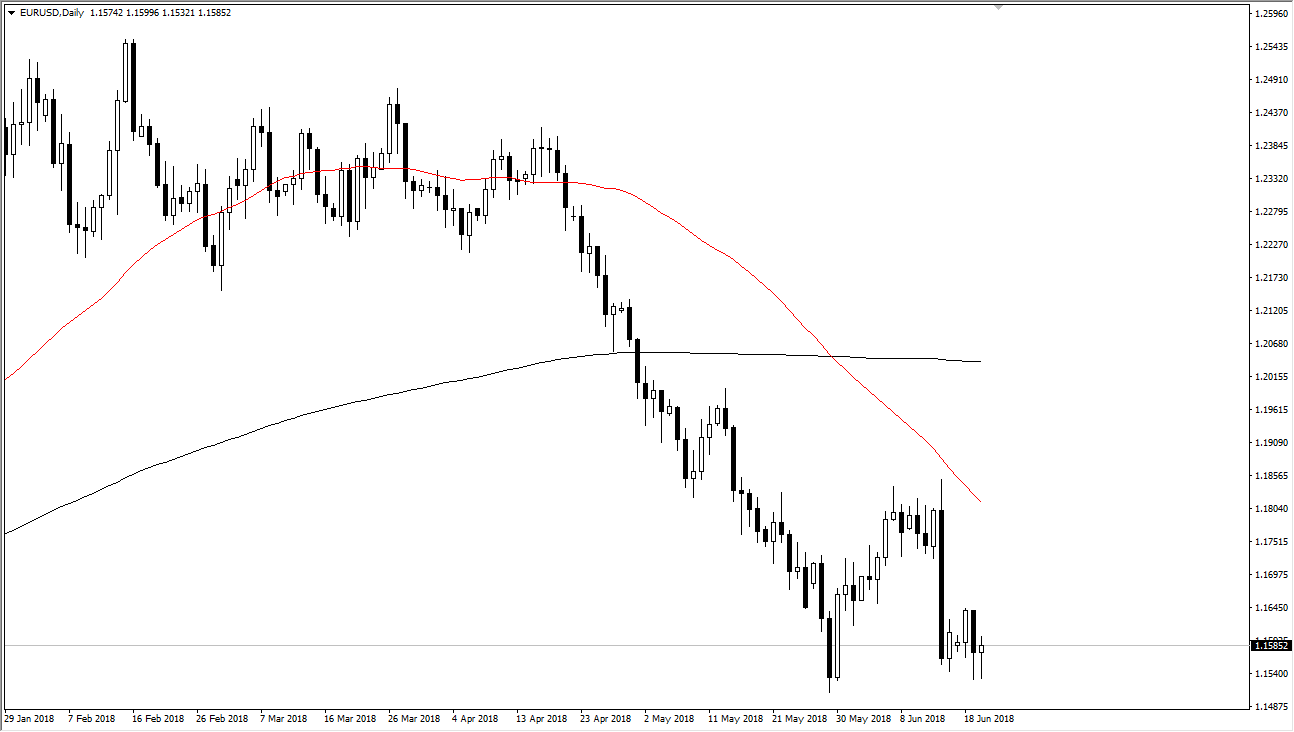

EUR/USD

The EUR/USD pair has been very choppy during the trading session on Wednesday as we continue to see a lot of interest near the 1.1550 level. I believe that the support extends down to the 1.15 level underneath, so therefore I think the fact that we could not break down isn’t much of a surprise. At this point, I anticipate that we should see some type of short-term bounce, and then start selling again on signs of exhaustion above. Ultimately, if we break down below the 1.15 handle, then it represents a significant break down in this pair. I believe that this market will continue to pay attention to the situation in Germany with Angela Merkel, and of course the overall lack of hawkish in this coming out of the ECB.

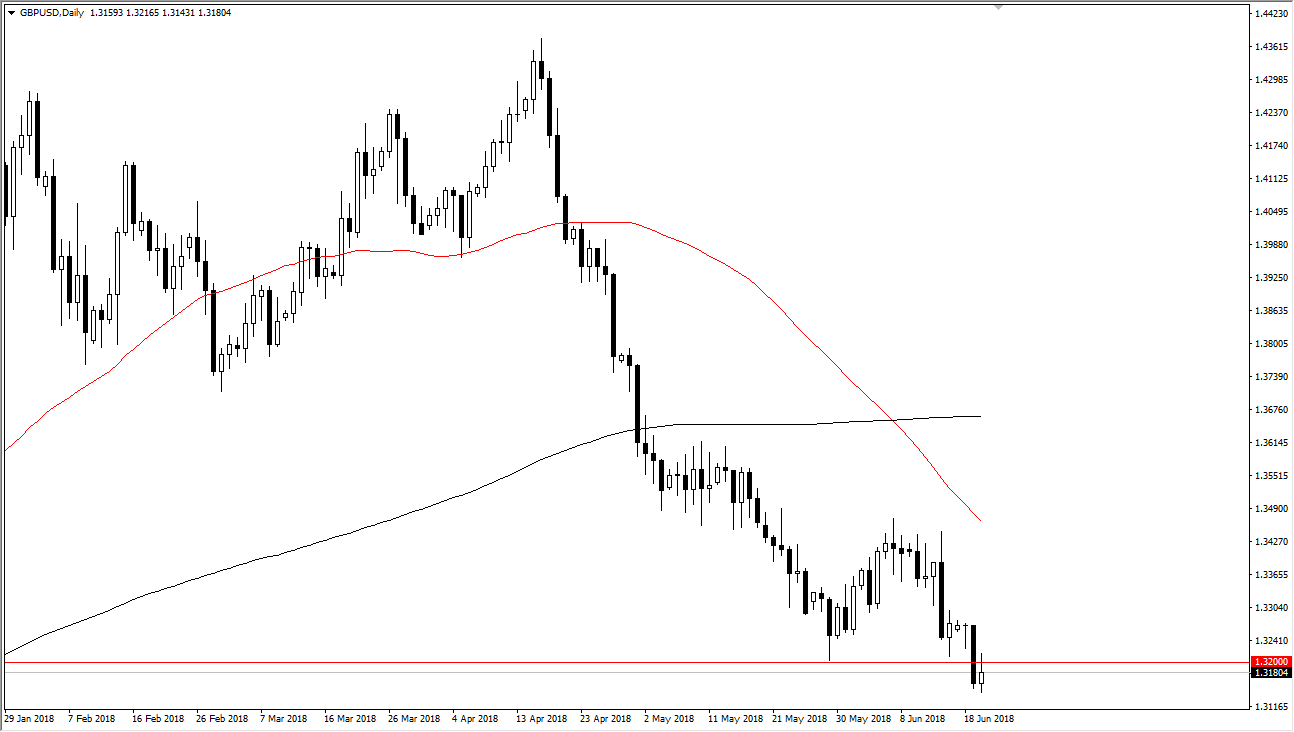

GBP/USD

The British pound initially tried to rally during the day, and even broke above the 1.32 handle. However, we ran into far too much in the way of resistance, and the market turned around to form a shooting star shaped candle, which could signify that we are going to continue to see selling pressure. Quite frankly, it now looks as if the 1.32 level has proven itself to be even more resistance than previously thought, so I think that the market could find the 1.30 level underneath as a target. Rallies are to be sold, as we are most certainly in a negative trend, but be patient and wait for those opportunities to present themselves. If we were to break down below the 1.30 level, that would be a very negative sign indeed. At that point, I think that we could be looking at 1.2750 over the longer-term. Softer than expected economic numbers certainly don’t help with the British pound.