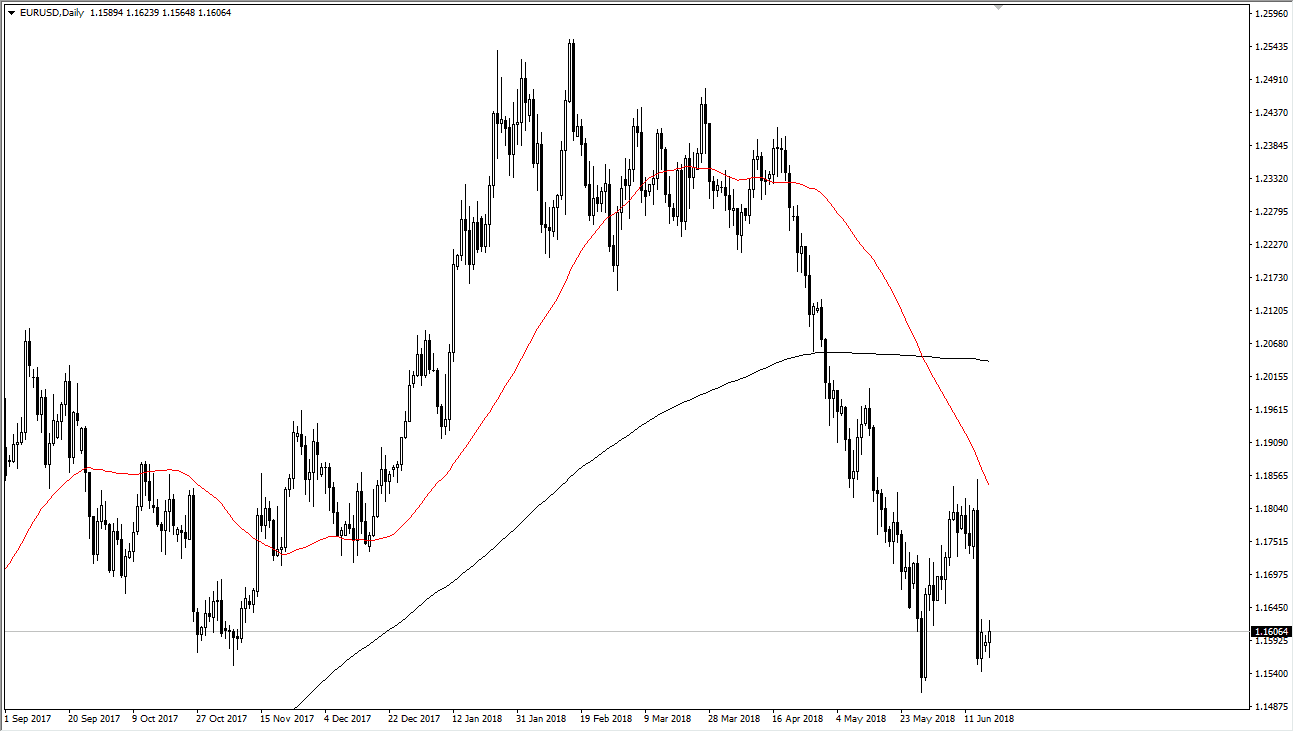

EUR/USD

The EUR/USD pair has been slightly positive during the trading session on Monday, as we continue to go back and forth around the 1.16 handle. The market sold off rather drastically last week, and now I think we are trying to catch her breath to see where we go next. The 1.15 level underneath is massive support, and I think it will continue to offer a lot of potential buying pressure. However, if we were to break down below that level it would be a complete collapse of the Euro. There are a lot of concerns out there right now, and we have most certainly sold off rather drastically. With concerns about Angela Merkel being around in just a few short weeks, it’s possible that the Euro will continue to struggle. I believe that the market is probably one that you can sell rallies in, picking up bits of “value” in the greenback.

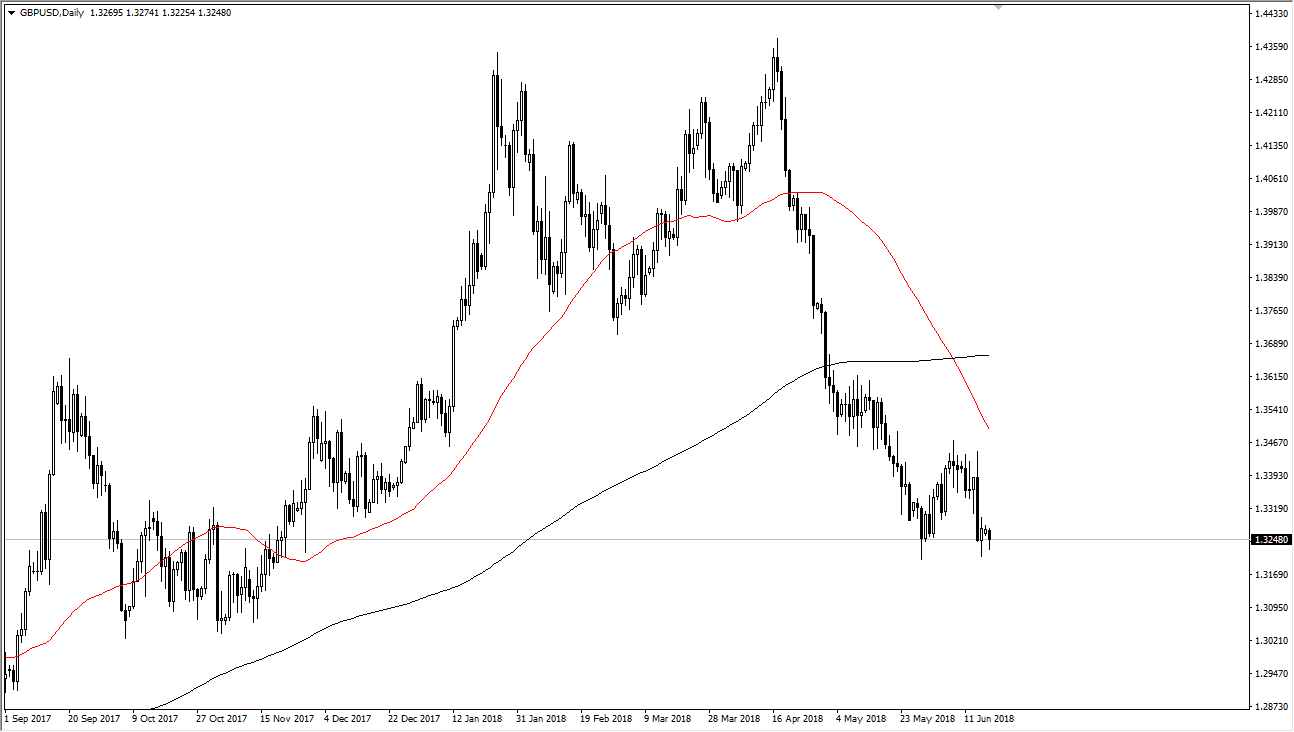

GBP/USD

The British pound fell a bit during the trading session but was also relatively quiet against the US dollar. The massive selloff of last week wasn’t as drastic in this market, but the 1.32 level looks to be targeted right now, and if we can break down below there I think that the market will probably go to the much more viable 1.30 level for support. Any time we rally from here, I will be looking for selling opportunities, and do so at the very first signs of exhaustion. Alternately, if we break down below the 1.32 handle, then I am willing to sell this market and towards 1.30 level after that. We have recently seen the “death cross” as the 50 EMA has crossed over the 200 EMA. This is a very negative turn of events and will certainly have longer-term traders looking to be short of the market as well.