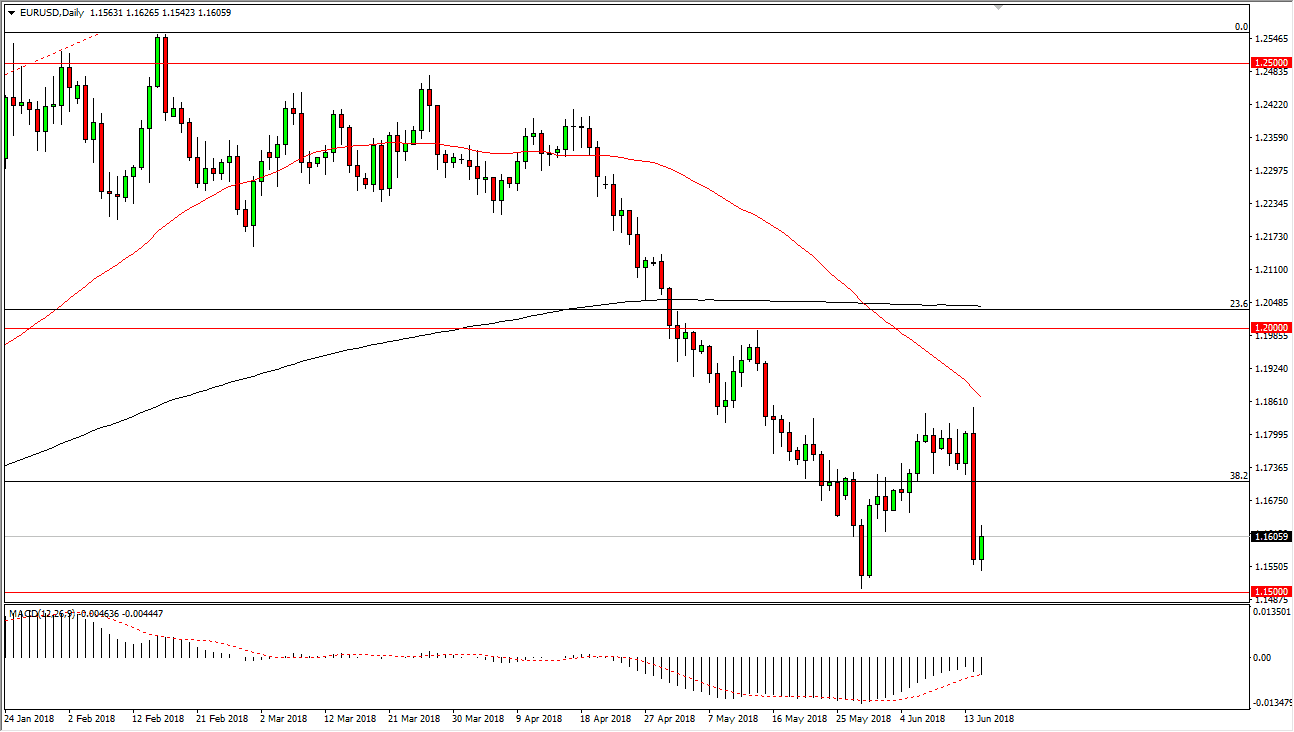

EUR/USD

The EUR/USD pair was a bit choppy during the trading session on Friday, as the market seems to be testing the 1.16 level above for resistance. The 1.15 level underneath is a major level on the charts, and I think it of course will cause a bit of natural support based upon structure. However, it’s hard to ignore the massive negative candle from the Thursday session, and how it dwarfs the action of the green candle on Friday. I suspect that this point it’s likely to be a market that is going to offer plenty of opportunities to the downside, but it may need to bounce a bit first. If we do break down below the 1.15 level, that could unwind this market rather significantly. Alternately, if we take out the massive red candle on Thursday, that would be a very bullish sign. Expect a lot of noise.

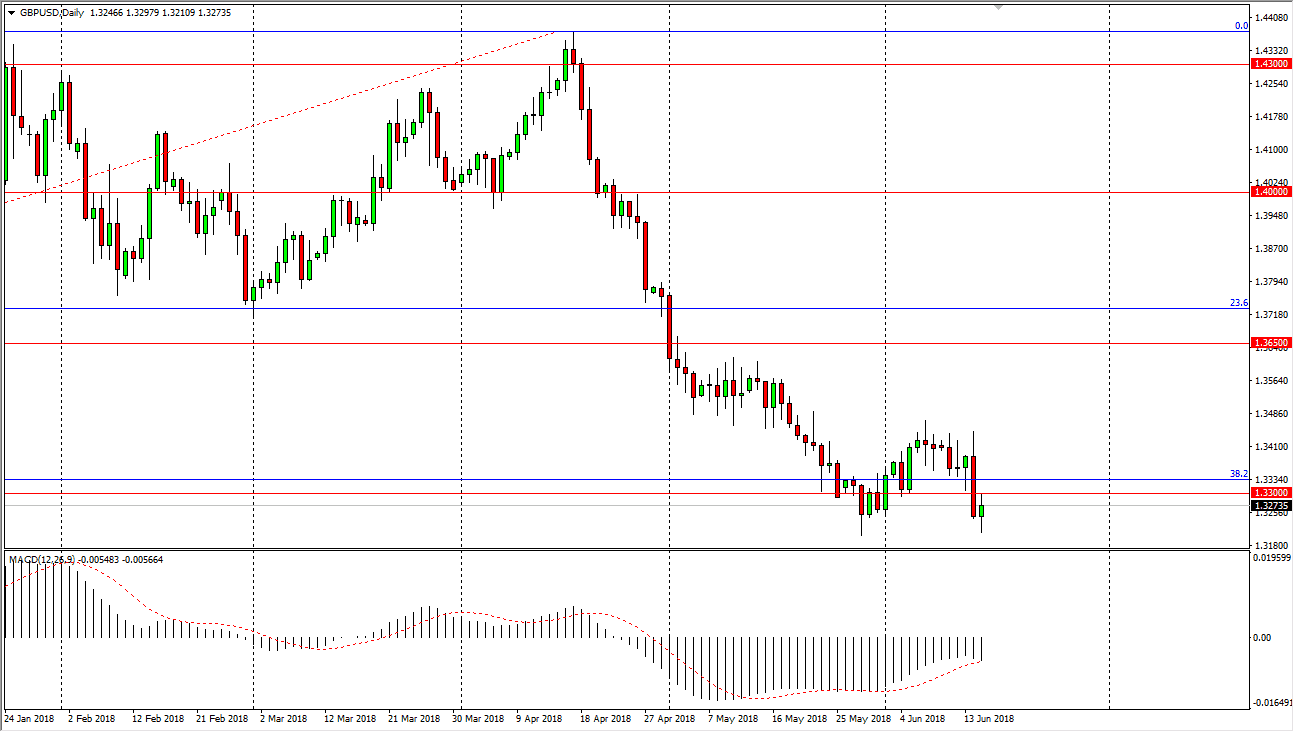

GBP/USD

The British pound went back and forth during the day as well, preceded by a similar candle to the EUR/USD pair on Thursday. I think at this point, the market is going to continue to find sellers, and a break down below the lows of the session on Friday should send this market down to the 1.30 level given enough time. It’s not until we take out the Thursday candle to the upside that I’m comfortable buying again, and it certainly looks as if the US dollar may continue to strengthen due to global fears of economic trade sanctions, and of course a higher interest rate coming out of the United States. I think that this market more than likely will favor the downside after the massive amount of destruction we have seen over the last couple of months.