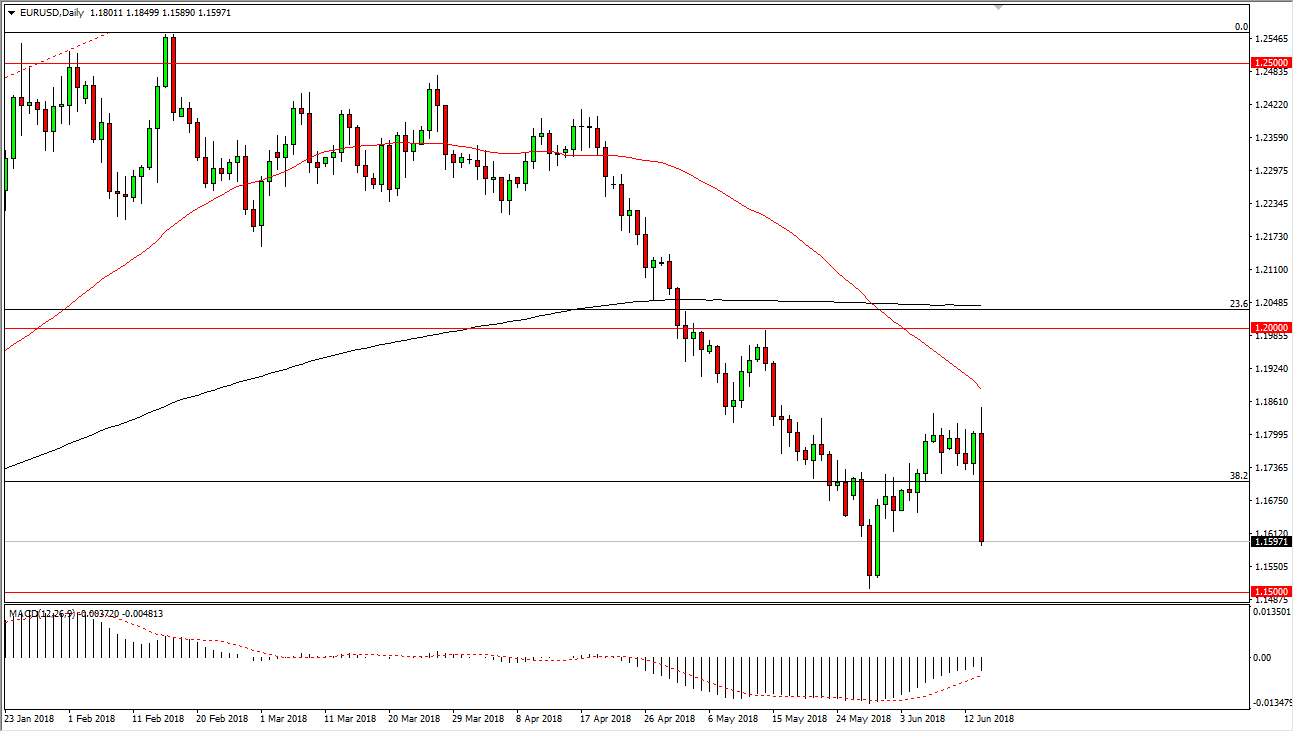

EUR/USD

The EUR/USD pair initially tried to rally during the day on Thursday but then collapsed to break down to the 1.16 region by the time the Americans went home. Ultimately, the European Central Bank cutting back on quantitative easing was not enough to pick up the Euro, as we had initially seen so much in the way of strength over the last couple of weeks, but got it completely wiped out in a few short hours. This was because the quantitative easing of €30 billion a month hasn’t been reversed, just simply been cut in half. This is a much more tepid approach to tightening then people had anticipated. If we can break down below the 1.16 level, it’s likely that we could go much lower. At this point, it looks as if this pair could very well continue lower, and if that’s the case I would anticipate more, not less volatility. At this point, I don’t trust buying this pair until we form another weekly hammer or something to that effect.

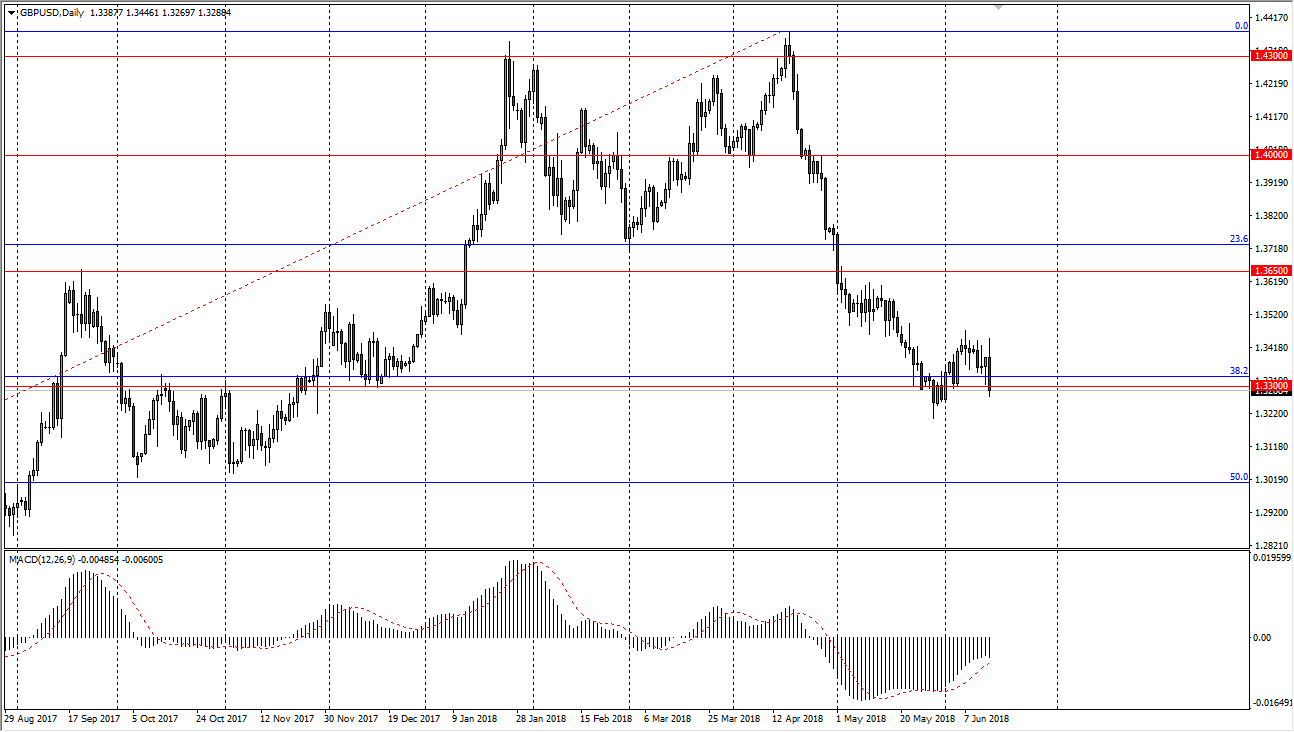

GBP/USD

The British pound was a victim against the US dollar as it strengthened around the world. By trying to rally, it looked as if it was ready to continue the upward momentum based upon the hammer from the Wednesday session. However, we have broken down significantly, and now it looks as if we could break down here as well. The 1.33 level has been very important in the past, but I think given enough time we will make a significant decision. If we can break down below to a fresh, new low, then the market continues to go even lower. At that point, it’s likely that we are going to go looking towards 1.30 level. If we broke above the highs from the Thursday session, then I think the buyers try to push this market towards 1.36 handle.