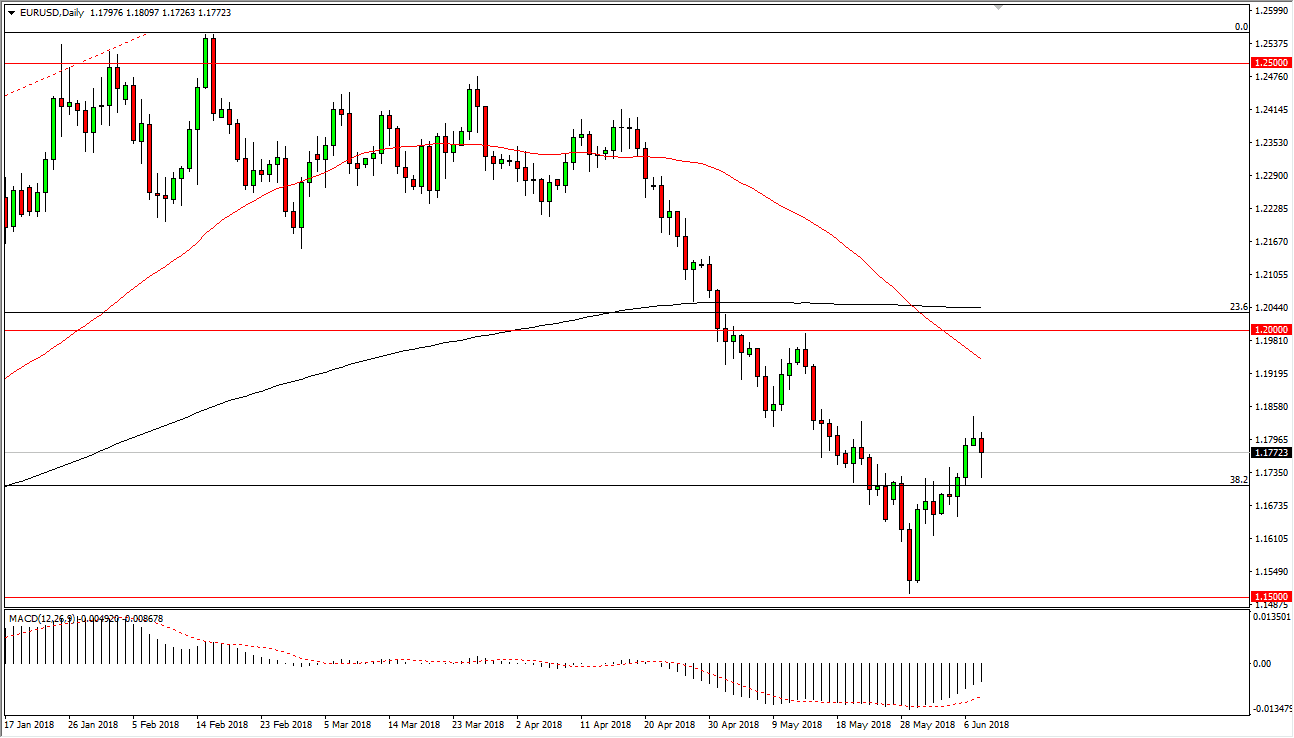

EUR/USD

The Euro fell initially during the trading session on Friday, reaching down towards the 1.1725 level before bouncing enough to form a hammer. The hammer is in direct competition with the shooting star that was formed on Thursday, and it looks as if the market did in fact rally at the very first opportunity that it had. Because of this, it’s likely that we will continue to try to go higher, and if we can break above the top of the shooting star from the Thursday session, that could open the door to the 1.20 level above. On longer-term charts, we have formed a perfect hammer at the 1.15 level, which is a longer-term “buy-and-hold” signal. This will be exacerbated by the ECB on the 14th, if they make mention of stepping away from quantitative easing which very well could happen.

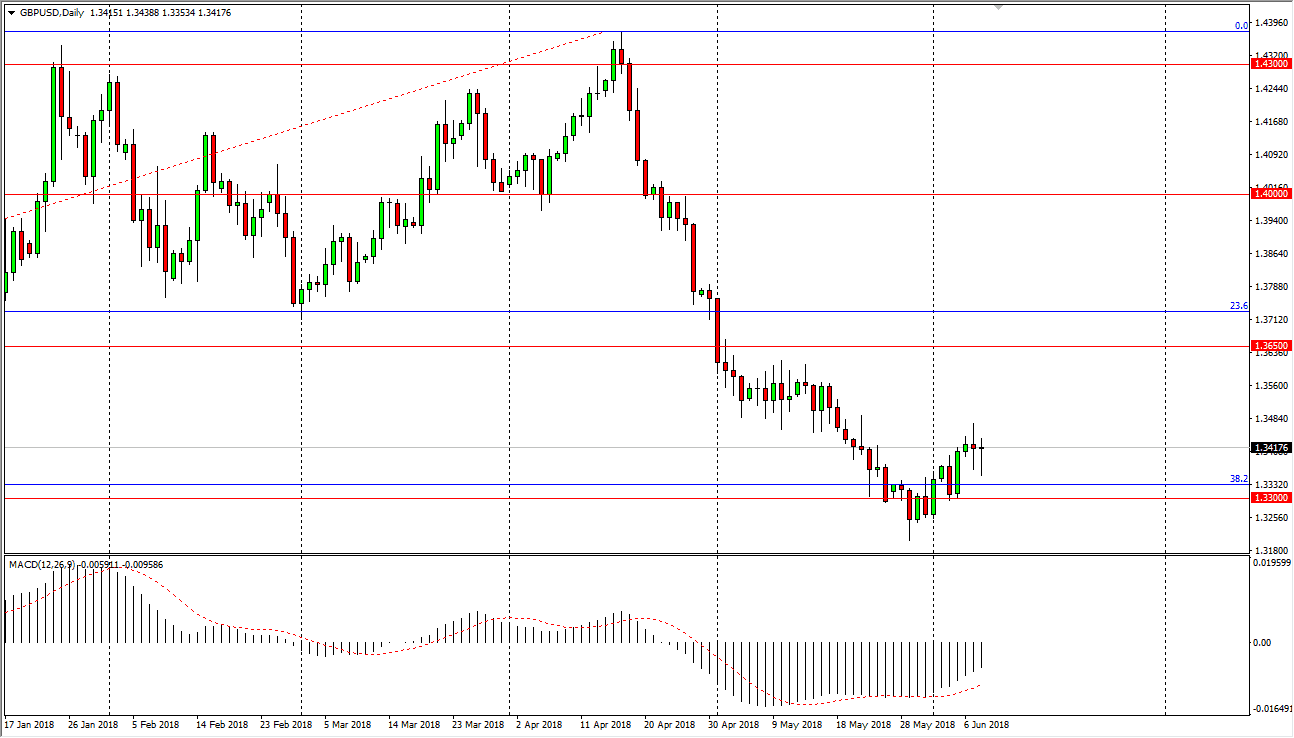

GBP/USD

The British pound went back and forth during the session but ended up forming a hammer. The hammer of course is a bullish sign, and it shows just how supportive the 1.33 region is going to be. While I think we do rally from here, I also recognize that there is a lot of noise above so it’s not necessarily going to be the easiest trade to take, nor will it be a sudden move under most circumstances. I like the idea of buying this pair, unless of course we make a fresh, new low, but that doesn’t look very likely right now. If we do rally from here, we could find ourselves pressing the 1.3650 level above, which should be rather resistive. If the world gets into more of a “risk on” type of attitude, that should help this pair as well.