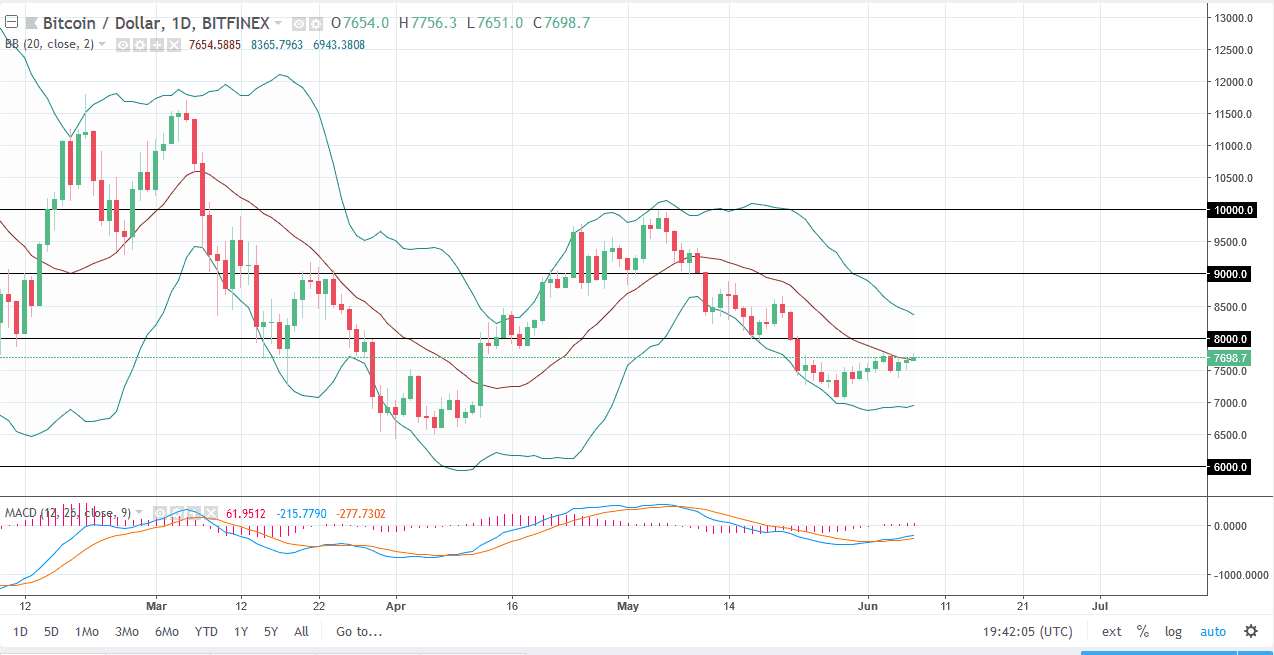

BTC/USD

Bitcoin rallied slightly against the United States dollar during the trading session on Thursday, turning around to form a bit of a shooting star. We had previously formed a hammer, and it now looks as if the 20 SMA is going to continue to cause a bit of a short-term reaction. I think that the $8000 level above offers a significant amount of resistance, and I would be a bit surprised if we managed to break above that level. I think that we will eventually roll over, and at this point I have no interest in buying bitcoin. It makes more sense that we will continue to go lower, perhaps reaching down towards the $6000 level over the longer-term. If we did break above the $8000 level, then we could go as high as $8500 in the short term. However, it should be said that the longer-term highs have been getting lower for some time.

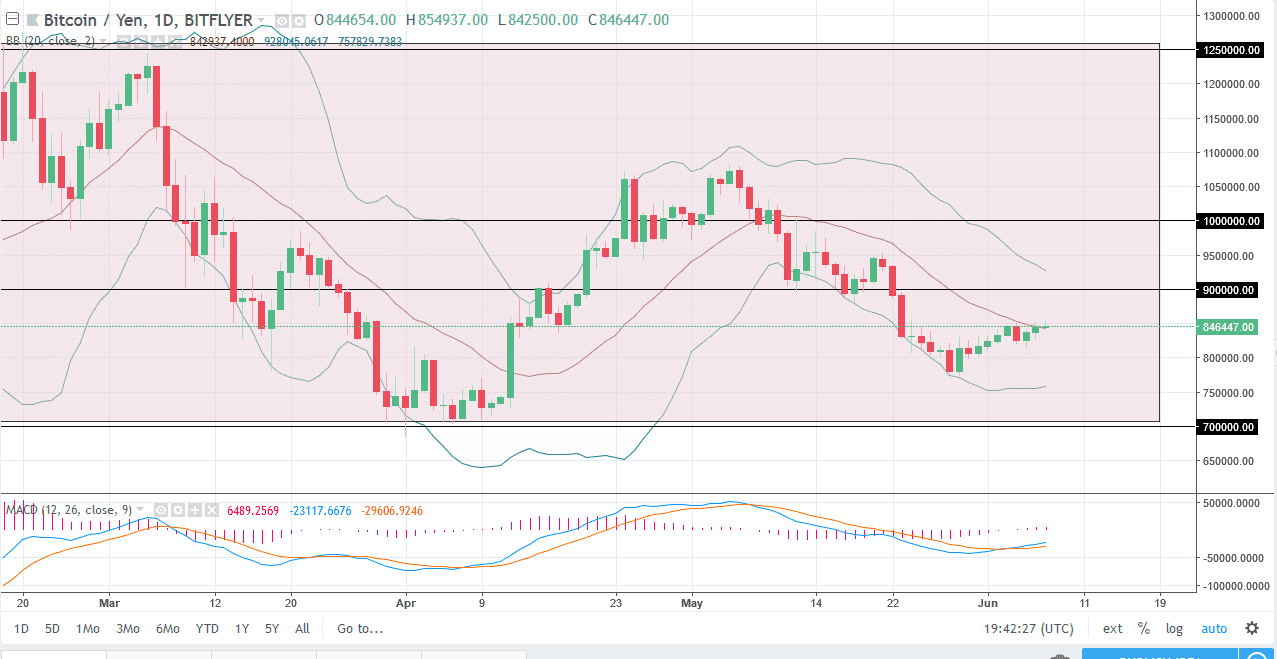

BTC/JPY

Bitcoin markets initially tried to rally against the Japanese yen as well but gave back most of the gains to form a short shooting star. The ¥850,000 level continues to be resistance, and I think if we can break above the top of the candle we could go looking towards the ¥900,000 level. That ¥900,000 level would continue to be important, and I think that we would struggle to break above there. The ¥800,000 level underneath would be a decent target, but I think if we break down below there we will probably go down to the ¥700,000 level which has been the bottom of the overall consolidation area. I believe that rallies that show signs of exhaustion will continue to be the best way to play this market. I have no interest in buying the pair as it continues to fail.