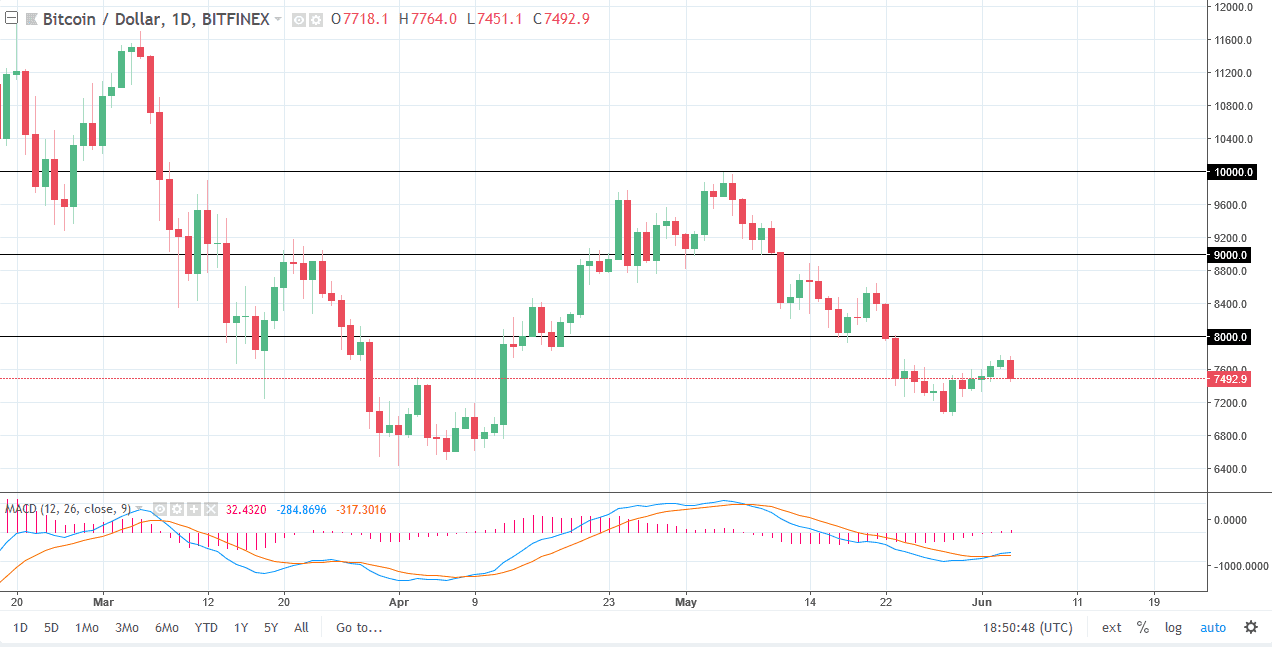

BTC/USD

The Bitcoin markets fell significantly on Monday again, losing 3%. The market has cracked the $7500 level, and it looks likely that we are ready to go a bit lower as we are closing at the bottom of the daily candle. I think that the market could go down to the $7000 level. This candle is a very negative, but we do have a little bit of support just below. I think that if we get some continuation today, we will more than likely go looking towards the lows again, especially near the $7000 level. Rallies at this point should continue to have plenty of resistance above, as the $8000 level should be a bit of a “ceiling” in the market. I think that it’s only a matter time before the sellers get involved even if we do rally. The US dollar has been strengthening quite a bit, but beyond that the crypto currency market continues to struggle in general.

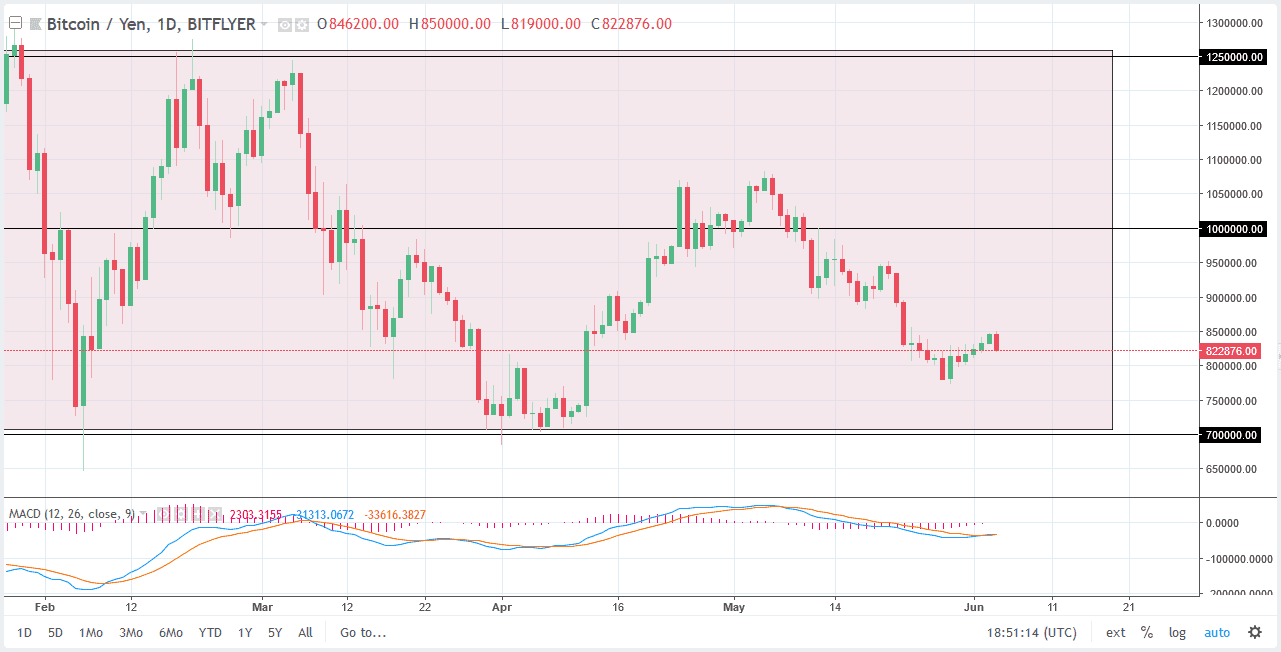

BTC/JPY

Bitcoin also fell against the Japanese yen as you can see, using the ¥850,000 level as resistance. The market looks likely to continue to go lower, perhaps reaching towards the ¥800,000 level, perhaps even reaching down to the ¥700,000 level. That is the bottom of this overall range, and I think it makes sense that we would test that area again. If we break down below the ¥700,000 level, that would be extremely negative as it would be yet another sign of weakness, and the fact that we could not reach the top of the consolidation area the last time we rally, gives me pause to think that we are in fact going to see a break down eventually. At that point, I suspect ¥600,000 would be the next target.